How Investors May Respond To Clover Health (CLOV) Celebrating Nasdaq Bell and Improved Analyst Outlook

- In recent days, Clover Health Investments marked a significant milestone by ringing the Nasdaq Closing Bell, celebrating its transformation as a Medicare-focused healthcare technology innovator alongside positive analyst sentiment and improved earnings estimates.

- This dual recognition of the company’s fundamental progress and public achievements has highlighted the impact of its technology-driven physician enablement platform within the Medicare space.

- We’ll explore how rising analyst optimism, reflected in the Zacks Rank upgrade, may influence Clover Health’s forward-looking investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Clover Health Investments Investment Narrative Recap

To be a shareholder in Clover Health Investments, one must believe in the long-term potential of its technology-driven care model to transform Medicare delivery and drive profitability, despite near-term financial volatility. The recent positive shift in analyst sentiment, highlighted by the company's Zacks Rank upgrade, suggests growing confidence in Clover's operational turnaround, but it does not significantly alter the principal near-term catalyst, achieving and sustaining profitability, or the current risk of persistent net losses and margin pressure. Among the company's recent updates, the launch of a community-based pharmacy pilot program in New Jersey stands out, aiming to help seniors better manage medications and reduce hospital visits. While this aligns with Clover's mission to leverage technology for improved care, its broader impact on earnings and margins is likely to unfold gradually alongside ongoing efforts to control benefit expenses and achieve scale. Yet despite encouraging analyst upgrades, investors should be aware that continued net losses may still limit near-term...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments' narrative projects $3.0 billion in revenue and $160.1 million in earnings by 2028. This requires 22.8% annual revenue growth and an increase in earnings of $202.2 million from the current level of -$42.1 million.

Uncover how Clover Health Investments' forecasts yield a $3.65 fair value, a 34% upside to its current price.

Exploring Other Perspectives

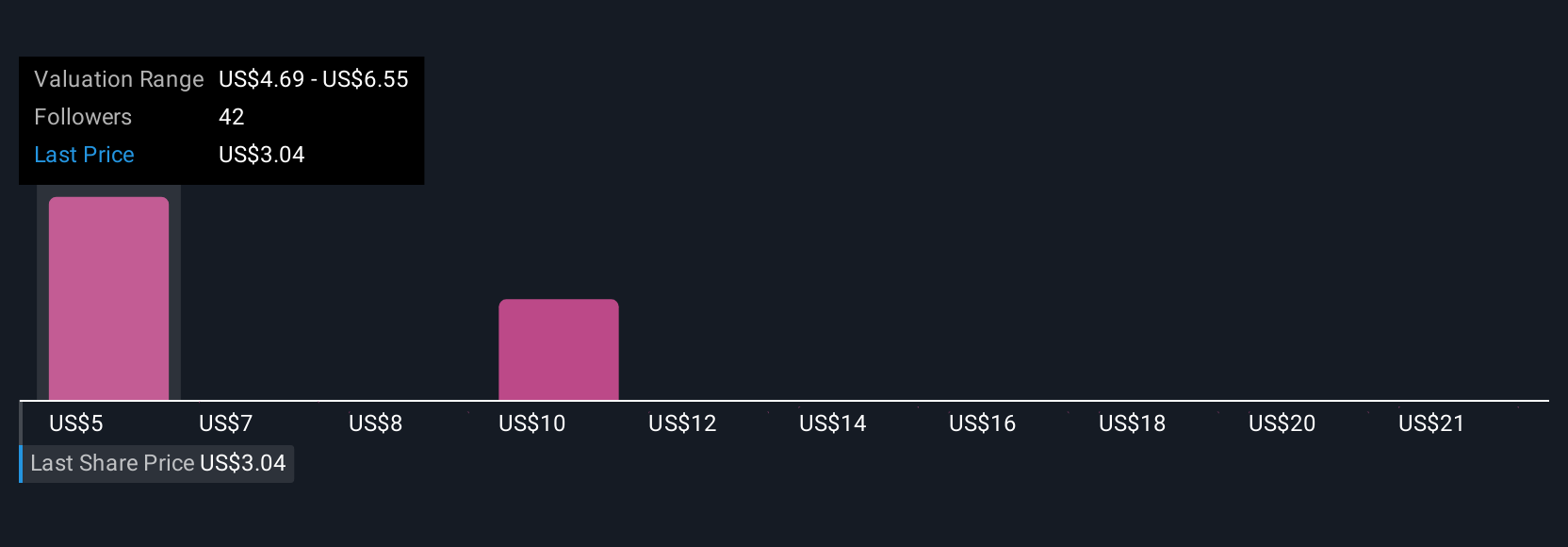

Simply Wall St Community members provided 12 fair value estimates for Clover Health, ranging from US$3.65 to US$23.32 per share. While some see substantial upside, persistent net losses and uncertain profitability remain key factors that could impact the company's ability to meet high expectations, so consider multiple viewpoints before making any decisions.

Explore 12 other fair value estimates on Clover Health Investments - why the stock might be worth just $3.65!

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English