What Marten Transport (MRTN)'s CEO Transition Means for Shareholders

- Marten Transport announced that CEO Timothy Kohl will retire effective September 30, 2025, with former longtime CEO and current Executive Chairman Randolph Marten set to return as Chief Executive Officer and Chairman on October 1, 2025.

- This marks another leadership transition for Marten Transport, as Mr. Marten previously held the CEO role for over 15 years and has maintained a longstanding influence within the company.

- We'll look at how Randolph Marten's return as CEO could shape Marten Transport's investment narrative and future direction.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

What Is Marten Transport's Investment Narrative?

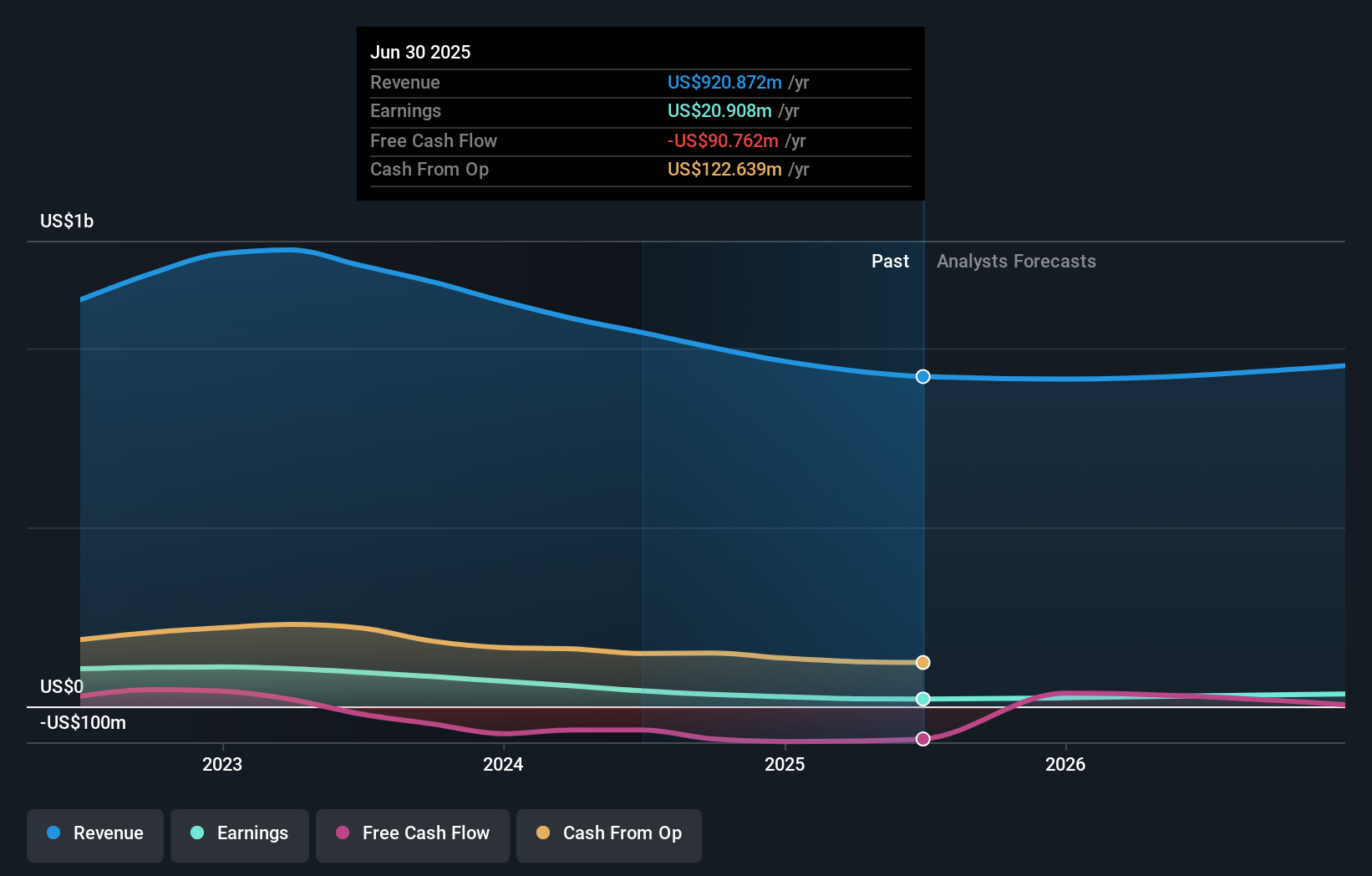

For shareholders considering Marten Transport, the big picture often comes down to whether you believe the company can rebound from recent weak earnings, assert its market position, and deliver sustainable growth, even as its revenue and margin trends have moved lower and the broader transportation sector slows. The announcement that longtime leader Randolph Marten will take over as CEO and Chairman in October 2025 adds an interesting twist: he brings decades of experience and deep company roots, but also represents a return to very familiar management at a time when many investors may be hoping for new approaches given recent underperformance and Marten’s expensive valuation. Short-term catalysts like a rebound in earnings or operational improvements now hinge in part on how leadership transition is handled, though with a full year before it takes effect, near-term momentum is unlikely to shift drastically. Key risks, particularly around slow revenue growth, modest profit expectations, and index exclusion, remain top of mind as this transition unfolds.

But challenges around slow revenue growth and cost pressures remain just as pressing for investors. Marten Transport's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Marten Transport - why the stock might be worth just $15.00!

Build Your Own Marten Transport Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marten Transport research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Marten Transport research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marten Transport's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English