Should Jefferies' (JEF) Latest Bond Offerings Prompt Investors to Reassess Its Capital Allocation Strategy?

- Jefferies Financial Group recently completed and announced several fixed-income offerings, including senior unsecured notes with fixed coupons ranging from 5.50% to 6.25% and maturities between 2035 and 2045, raising millions in new capital.

- The mix of callable, global medium-term notes with varying maturities may reshape Jefferies' funding flexibility and have meaningful implications for its capital allocation strategies.

- We'll explore how the company's expanded funding through multiple bond issuances may influence its investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Jefferies Financial Group's Investment Narrative?

If you are looking at Jefferies Financial Group as a potential investment, the core story to buy into is one of a capital markets firm trying to balance measured growth with prudent funding. The recent fixed-income offerings, totaling nearly US$21.4 million across several senior unsecured notes, may not immediately shift the company's trajectory but could give Jefferies greater agility in managing its capital and debt over time. This is relevant as earnings and revenues have recently trended lower compared to last year, and no shares have been repurchased in the last two quarters. On the positive side, dividends have increased, and board experience remains a strength. The key catalysts to watch in the short term are earnings resilience and cost controls, while the biggest risk remains the pace of earnings declines outpacing Jefferies' ability to deploy this new capital effectively. The bond issuances could mitigate some short-term refinancing risks, but the overall impact may be more modest unless used to fund significant strategic moves or support higher growth. Recent price gains suggest some optimism, but investors should keep an eye on how quickly the new capital translates into improved results.

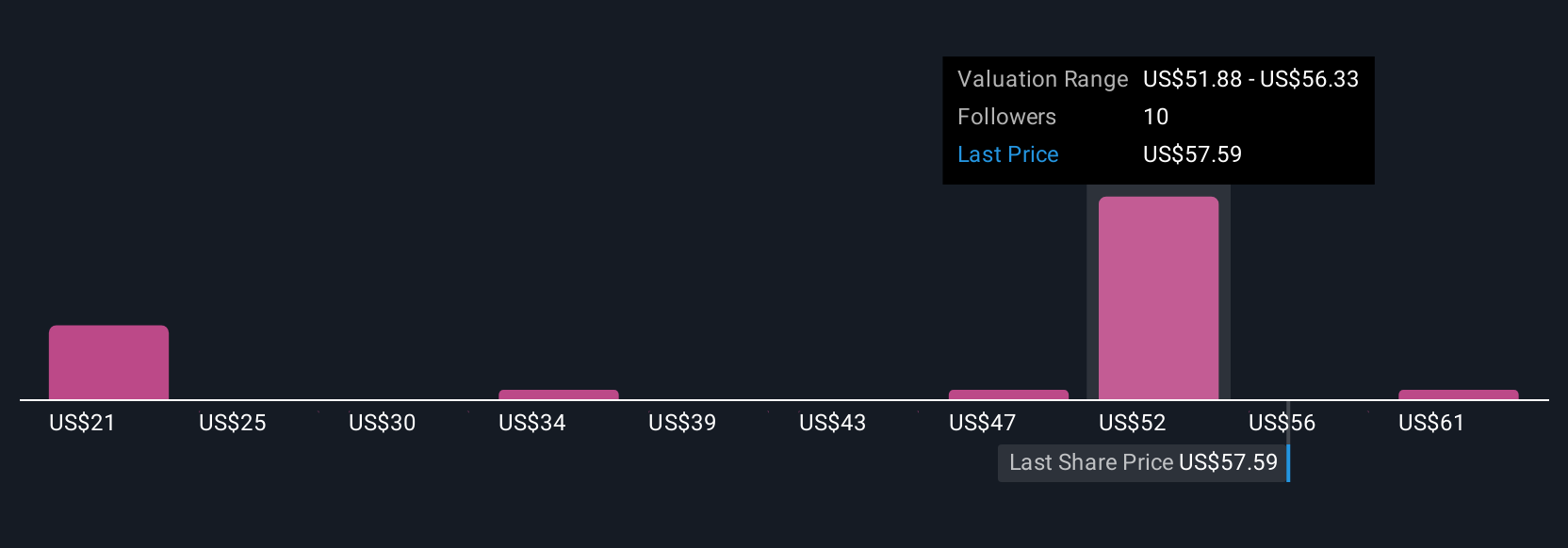

Yet even with new capital, Jefferies' earnings trajectory remains a key risk investors should watch. Jefferies Financial Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Jefferies Financial Group - why the stock might be worth less than half the current price!

Build Your Own Jefferies Financial Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Jefferies Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jefferies Financial Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English