Is Cathay General Bancorp’s (CATY) Dividend Strategy a Sign of Resilient Sector Confidence?

- Cathay General Bancorp recently announced that its Board of Directors declared a cash dividend of US$0.34 per common share, payable on September 8, 2025, to shareholders of record as of August 28, 2025.

- While the dividend announcement highlights Cathay General Bancorp’s steady track record of distributions, broader sector momentum from Federal Reserve policy commentary has been a more influential force in recent market activity.

- We’ll explore how renewed confidence in the regional banking sector supports Cathay General Bancorp’s investment narrative amid continued dividend reliability.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cathay General Bancorp Investment Narrative Recap

Shareholders in Cathay General Bancorp are likely focused on the company's ability to deliver steady earnings and reliable dividends, backed by its core customer base and disciplined management. The recently announced US$0.34 per share dividend reinforces this narrative, yet the more influential short-term catalyst remains market sentiment on regional banks following Federal Reserve policy signals; by itself, the dividend news has limited material impact on these broader sector trends, while the key risk continues to be the bank’s concentrated exposure to commercial real estate.

Of the bank's recent announcements, the July 2025 share repurchase stands out alongside the dividend declaration, signaling ongoing capital return to shareholders. Combined with robust second quarter earnings, these moves support the investment case tied to sustained capital discipline, but they do not offset continued concerns regarding asset quality and exposure to volatile property sectors.

On the other hand, investors should remain aware of potential challenges linked to Cathay General Bancorp’s significant concentration in commercial real estate, especially as...

Read the full narrative on Cathay General Bancorp (it's free!)

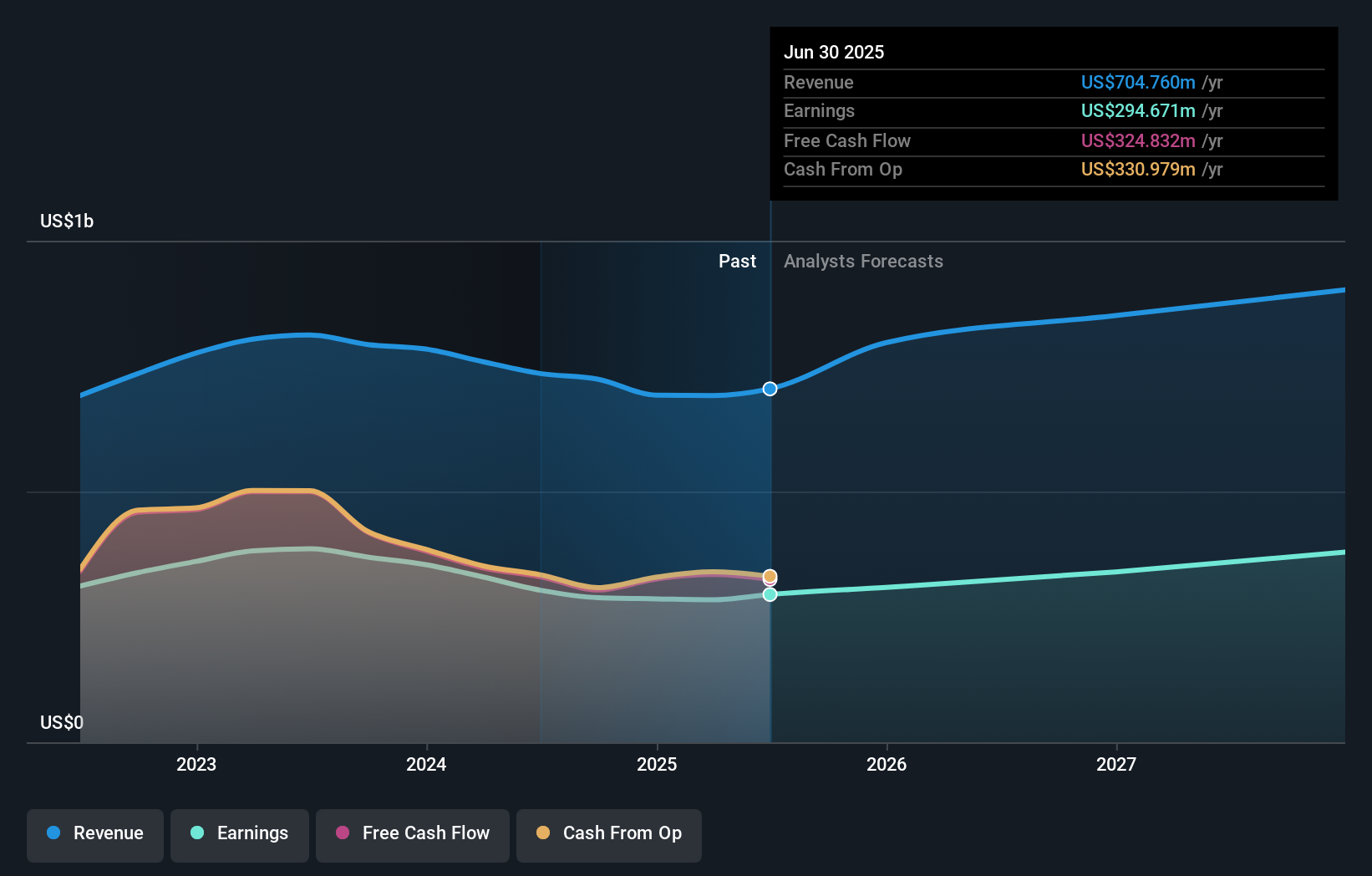

Cathay General Bancorp is projected to reach $964.1 million in revenue and $393.8 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 11.0% and an increase in earnings of about $99 million from the current earnings of $294.7 million.

Uncover how Cathay General Bancorp's forecasts yield a $50.60 fair value, in line with its current price.

Exploring Other Perspectives

According to the Simply Wall St Community, all fair value estimates for Cathay General Bancorp cluster at US$50.60 based on one view. While community opinions are uniform, persistent risks in the commercial real estate loan book could have wider effects on future returns, so explore multiple viewpoints before making conclusions.

Explore another fair value estimate on Cathay General Bancorp - why the stock might be worth just $50.60!

Build Your Own Cathay General Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cathay General Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cathay General Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cathay General Bancorp's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English