AeroVironment (AVAV) Valuation in Focus After P550 sUAS Delivery Milestone and New Defense Partnerships

AeroVironment (AVAV) just hit a major milestone that has investors taking notice. The company successfully delivered its advanced P550 small Unmanned Aircraft Systems to the U.S. Army under the Long-Range Reconnaissance program. This initial shipment is a significant development for AeroVironment’s latest product line and signals real-world progress instead of just pipeline hype. The P550’s modular architecture, quick field integration, and future-proof design are notable features that enhance AeroVironment’s position in the evolving defense technology sector.

This key event comes after a year marked by both skepticism and renewed optimism for AeroVironment. Following some hesitation due to reduced revenue from Ukraine-related work, shares have recovered, gaining over 29% in the past year and more than doubling over three years. Momentum has increased recently through high-profile partnerships, major contract wins, and deals such as supplying Italy with Jump 20 UAVs and collaborating on advanced air and missile defense projects. Revenue and net income growth rates of 22% and 33%, respectively, also reflect the changing views on risk as defense spending priorities evolve.

With the P550 deliveries now achieved and broader momentum behind it, the key question remains whether AeroVironment’s current valuation offers further potential or if the market has already accounted for its future growth. What do you think—is there an opportunity in this situation?

Most Popular Narrative: 15% Undervalued

According to community narrative, AeroVironment is currently trading at a discount to analysts’ fair value estimates, pointing to a potential upside for investors.

The successful and transformative acquisition of BlueHalo significantly broadens AeroVironment's product portfolio into high-priority areas such as space communication, directed energy, electronic warfare, and cybersecurity. This move enhances customer lock-in and provides opportunities for cross-segment revenue synergies, increasing visibility for long-term earnings.

Interested in the math behind this valuation call? The story centers on bold multi-year growth projections and some ambitious profit margin assumptions. Which specific targets are driving the fair value above today’s price? Explore the details that could reshape this stock’s trajectory.

Result: Fair Value of $282.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reliance on U.S. government contracts and potential integration challenges following the BlueHalo acquisition could threaten AeroVironment’s bullish outlook.

Find out about the key risks to this AeroVironment narrative.Another View: Discounted Cash Flow Model

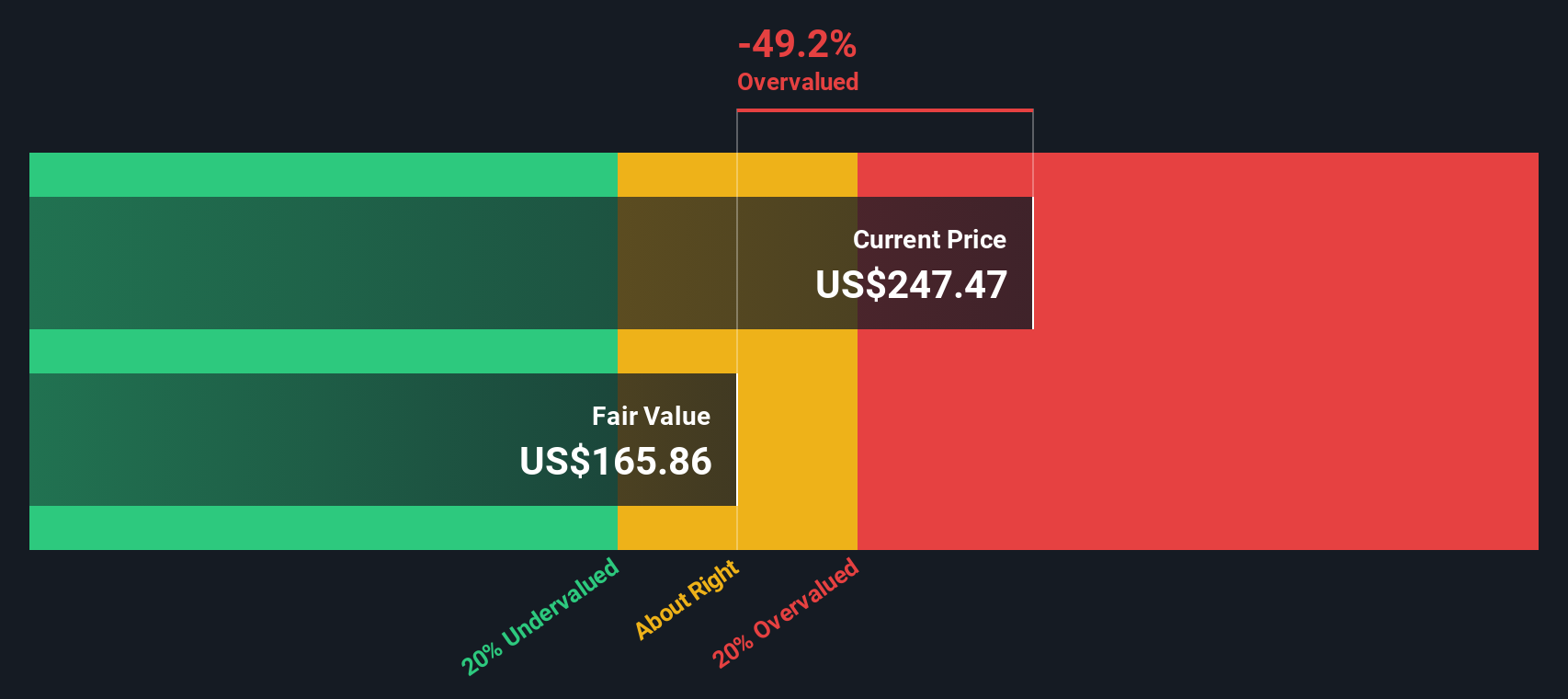

While the community sees AeroVironment as undervalued, our SWS DCF model presents a more cautious perspective. It suggests the market may be assigning a higher value to future growth than what underlying cash flows support. Is the optimism fully justified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AeroVironment Narrative

If you see things differently or want to dig into the numbers yourself, you can create your own personalized narrative in just a few minutes. do it your way.

A great starting point for your AeroVironment research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to expand your opportunities beyond AeroVironment, now is the time to scan the market for unique and promising stocks. These tailored picks are designed to inspire smart, forward-thinking decisions. Do not let these potential standouts slip past your radar.

- Maximize your income potential with steady-earners by heading straight to dividend stocks with yields > 3% and uncovering companies paying attractive yields above 3%.

- Jump on the rise of artificial intelligence and see which innovators are making waves with robust financials through AI penny stocks.

- Spot the hidden gems trading below their true worth by checking out undervalued stocks based on cash flows for stocks undervalued on pure cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English