Icahn Enterprises (IEP) Valuation in Focus After $500 Million Debt Refinancing

Price-to-Sales of 0.5x: Is it justified?

Based on the price-to-sales ratio, Icahn Enterprises appears undervalued relative to both its industry peers and the broader global sector. The stock is trading at a significant discount compared with the Industrials industry average, which may attract investors seeking value opportunities.

The price-to-sales ratio measures a company's stock price relative to its revenues. For asset-heavy conglomerates like IEP, where profits may be irregular or negative, this multiple can provide a clearer comparison than metrics such as price-to-earnings.

IEP’s below-average price-to-sales valuation suggests that investors might be underpricing its revenue potential in light of short-term challenges. Whether this discount is justified depends on future profitability and the company's ability to reverse recent negative trends.

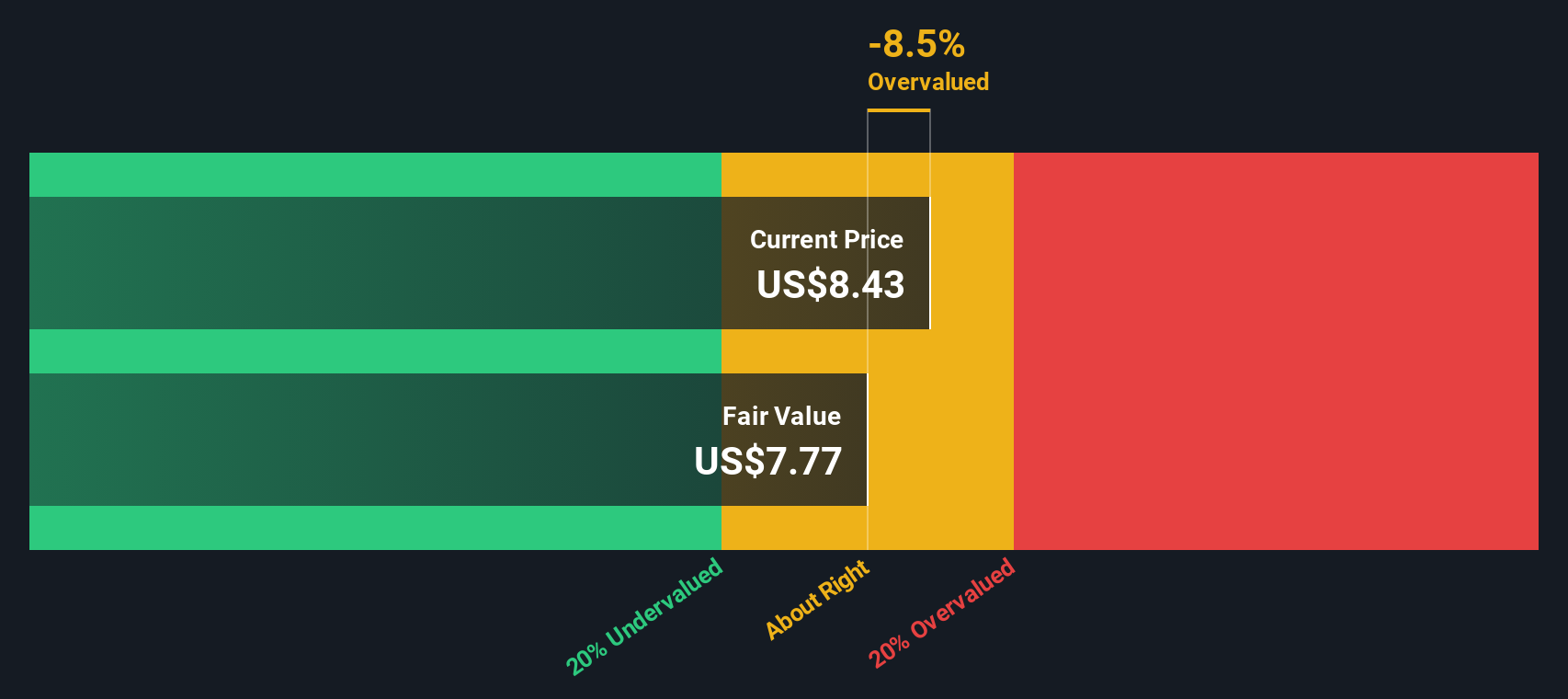

Result: Fair Value of $7.75 (OVERVALUED)

See our latest analysis for Icahn Enterprises.However, persistent revenue declines and sustained negative total returns could challenge the optimism around IEP’s recent refinancing efforts. This may keep investor sentiment cautious.

Find out about the key risks to this Icahn Enterprises narrative.Another View: What Does the SWS DCF Model Say?

While the stock may look appealing based on sales, our DCF model takes a deeper dive into future cash flows and arrives at a different conclusion. This suggests the shares may not be as cheap as they first appear. Which approach should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Icahn Enterprises Narrative

If you would like to form your own perspective or check the data firsthand, you have the freedom to craft your own analysis in just a few minutes. So why not do it your way?

A great starting point for your Icahn Enterprises research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Don't let your search stop here. Explore a world of opportunity by scanning proven stocks that match your goals and risk profile. Take charge of your next investing move with some of the market’s best-kept secrets, all accessible through the Simply Wall Street Screener.

- Amplify your income potential by targeting leading dividend stocks with yields > 3% and benefit from resilient dividend yields above 3%.

- Seize new trends and growth with a curated list of AI penny stocks that are pioneering advances in artificial intelligence and reshaping tomorrow’s industries.

- Build a defensive portfolio and stay ahead with healthcare AI stocks, which combines healthcare and AI innovations for long-term strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English