Should Mounting Quarterly Losses Require Action From Denali Therapeutics (DNLI) Investors?

- Denali Therapeutics recently reported financial results for the second quarter and first half of 2025, showing a net loss of US$124.12 million for the quarter and US$257.09 million for the six-month period, both wider than the losses reported a year ago.

- This marks a continuation of mounting losses for Denali, with basic loss per share from continuing operations increasing year-over-year in both reporting periods.

- We'll look at how the widening net loss, a critical factor in any biotech's story, impacts Denali's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Denali Therapeutics' Investment Narrative?

To remain invested in Denali Therapeutics, shareholders typically need to focus on the company’s ambitious biotech pipeline, particularly the prospect of FDA approval for tividenofusp alfa, which targets Hunter syndrome. The recent Q2 results, which revealed a widening net loss and a higher basic loss per share, do not directly alter this immediate catalyst. However, the deeper losses draw attention to Denali’s cash burn and reliance on future capital or successful product approvals. The critical catalyst remains the outcome of the FDA’s priority review expected by January 2026, though ongoing losses could increase pressure if timelines slip or further funding is needed. While the latest earnings tilt the risk profile slightly, the main story for most investors is still the upcoming BLA decision and how it will support or stress Denali’s financial position.

In spite of management’s optimism, increasing losses are something investors should keep a close eye on.

Exploring Other Perspectives

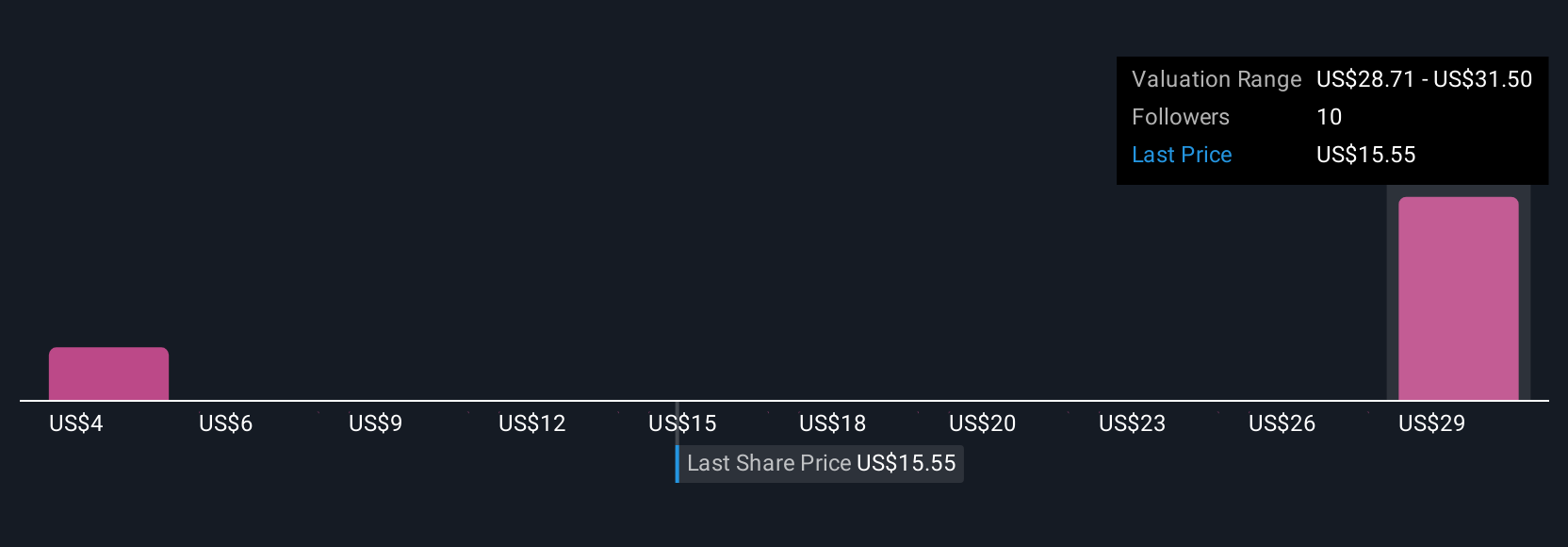

Explore 2 other fair value estimates on Denali Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Denali Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denali Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Denali Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denali Therapeutics' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English