FinVolution Group (NYSE:FINV) Valuation in Focus After Strong Q2 Earnings and Upbeat 2025 Outlook

Most Popular Narrative: 20.2% Undervalued

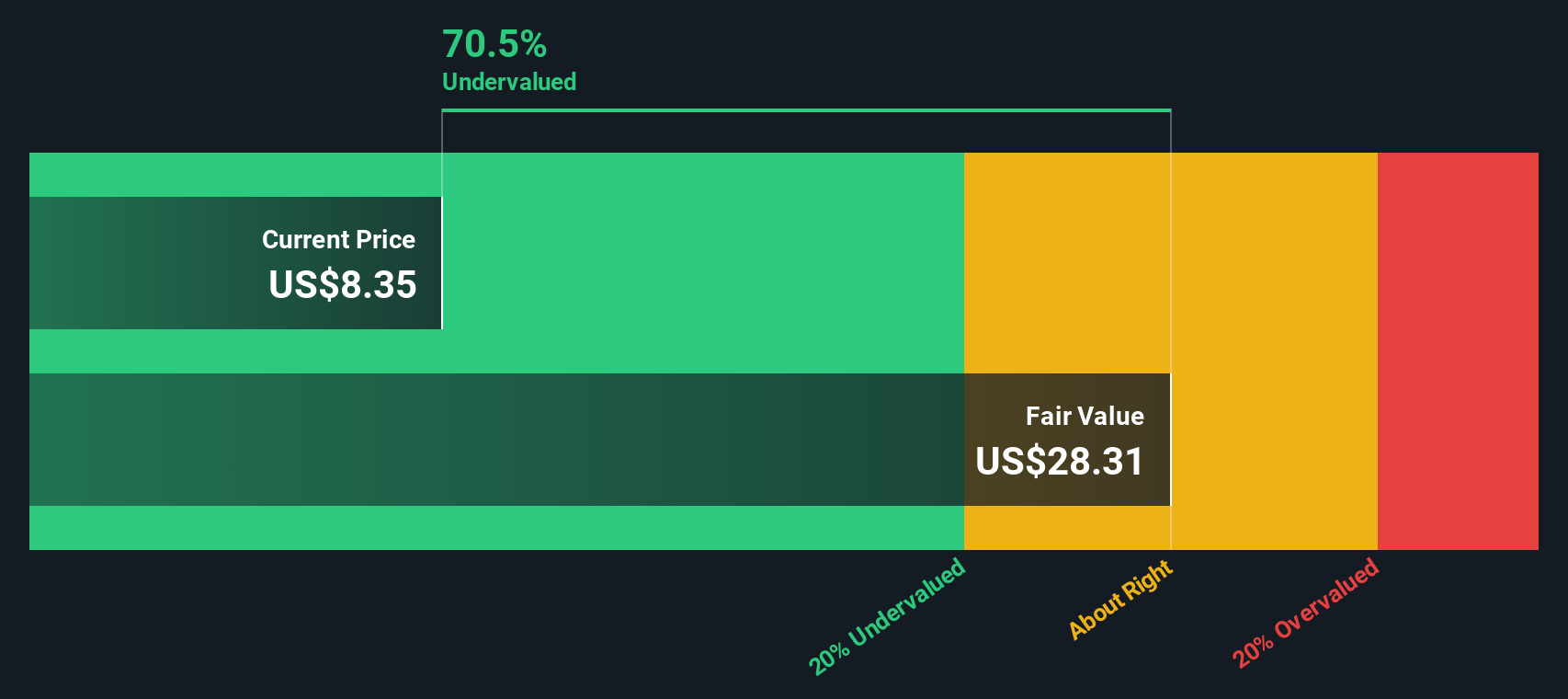

According to the community narrative, FinVolution Group is seen as trading below its fair value, with analysts forecasting considerable upside based on future earnings potential and margin expansion.

The company's international expansion strategy aims to achieve 50% of revenue from international markets by 2030. This may lead to increased operating costs and require significant initial investments, potentially impacting net margins due to the need for rapid expansion. While FinVolution's operations in Indonesia have started to achieve profitability, the focus on international expansion might delay substantial net earnings contributions from recently entered markets such as Pakistan, affecting overall profitability in the short term.

Curious about how bold global bets and strategic reinvestment could supercharge this fintech player? The narrative’s value hinges on ambitious revenue growth and a significant increase in margins. There is a surprising financial framework behind the projected upside. Wondering which expectations could really move the dial? Unpack the key logic driving this discounted valuation.

Result: Fair Value of $11.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory shifts or slower-than-expected international profit gains could challenge these growth forecasts and put current valuation assumptions to the test.

Find out about the key risks to this FinVolution Group narrative.Another View: What Does Our DCF Say?

Switching gears, the SWS DCF model takes a closer look at FinVolution Group based on future cash flows and business fundamentals. This approach also suggests the stock remains undervalued. The question remains: are growth drivers truly sustainable?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FinVolution Group Narrative

If you see things differently or want to test your own thesis, you can dive in and shape your view in just a couple of minutes. Simply do it your way.

A great starting point for your FinVolution Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar tuned to where opportunity is breaking out next. Don't sit on the sidelines as the market moves. Use these unique shortcuts to targeted investing strategies and keep your edge sharp.

- Tap into the stability of regular returns by running through dividend stocks with yields > 3%. This screener features companies with healthy dividend yields above 3% for those aiming for income and resilience.

- Expand your horizon and catch the next big leap in tech by zeroing in on AI penny stocks to find fast-moving innovators at the forefront of artificial intelligence advancements.

- Boost your growth playbook by targeting undervalued stocks based on cash flows to pinpoint stocks with stand-out potential based on attractive valuations and strong future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English