A Look at On Holding (NYSE:ONON) Valuation Following Raised 2025 Earnings Guidance and Strong Revenue Growth

If you’ve been watching On Holding (NYSE:ONON), you know that not all stock moves are created equal. The recent announcement that the company is raising its full-year 2025 earnings guidance—a step up in both expected net sales and profit margin—has turned even more heads than usual in the active wear space. Management’s confidence comes at a time when many peers are hedging their bets due to macro uncertainty, signaling that On Holding sees real traction behind its growth story.

This event lands on top of a rapid revenue climb, with quarterly sales up 44% compared to a year ago, comfortably beating market expectations. While the company did report a net loss for the quarter, investors seem willing to look through it to focus on the growth trajectory and improving profitability outlook. Despite a sluggish start to the year and shares down about 16% year-to-date, On Holding still sports a slight gain over the past year and an impressive cumulative return over three years, showing that momentum might just be re-accelerating as confidence builds.

So, after a year marked by cautious optimism and a recent kick from stronger guidance, could this be a spot where the market is underrating On’s potential, or is all the future growth already baked into the price?

--- **Rewritten with requested corrections (replacing em dashes)**:If you’ve been watching On Holding (NYSE:ONON), you know that not all stock moves are created equal. The recent announcement that the company is raising its full-year 2025 earnings guidance, with increases in both expected net sales and profit margin, has turned even more heads than usual in the active wear space. Management’s confidence comes at a time when many peers are hedging their bets due to macro uncertainty. This signals that On Holding sees real traction behind its growth story.

This event adds to a rapid revenue climb, with quarterly sales up 44% compared to a year ago and comfortably beating market expectations. While the company did report a net loss for the quarter, investors seem willing to look past this to focus on the company's growth trajectory and improving profitability outlook. Despite a sluggish start to the year and shares down about 16% year-to-date, On Holding still shows a slight gain over the past year and an impressive cumulative return over three years. This suggests that momentum may be re-accelerating as confidence builds.

After a year marked by cautious optimism and a recent boost from stronger guidance, investors may be wondering if the market is underrating On’s potential, or if all future growth is already reflected in the current price.

Most Popular Narrative: 29% Undervalued

According to community narrative, On Holding is currently viewed as undervalued, with analysts estimating substantial upside based on ambitious growth projections and improved profitability over the next several years.

The acceleration in DTC (Direct-to-Consumer) and e-commerce channels, with DTC reaching new highs (41.1% of sales in Q2 and up 54% YoY), gives On more control over brand, pricing, and customer data while increasing gross and EBITDA margins. This operational catalyst is likely to further expand profitability as DTC continues its mix shift.

Want to know what is fueling this bold price target? Hint: It goes beyond headline sales growth and taps into a future margin expansion narrative that could surpass peers in the sector. These analysts are betting on a leap in profitability and a significant change in how investors value On Holding. Discover the major assumptions driving this valuation and what it could mean for long-term investors.

Result: Fair Value of $65.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on premium pricing and aggressive expansion could limit margins if consumer trends shift or if investments fail to deliver expected returns.

Find out about the key risks to this On Holding narrative.Another View: What Does Our DCF Say?

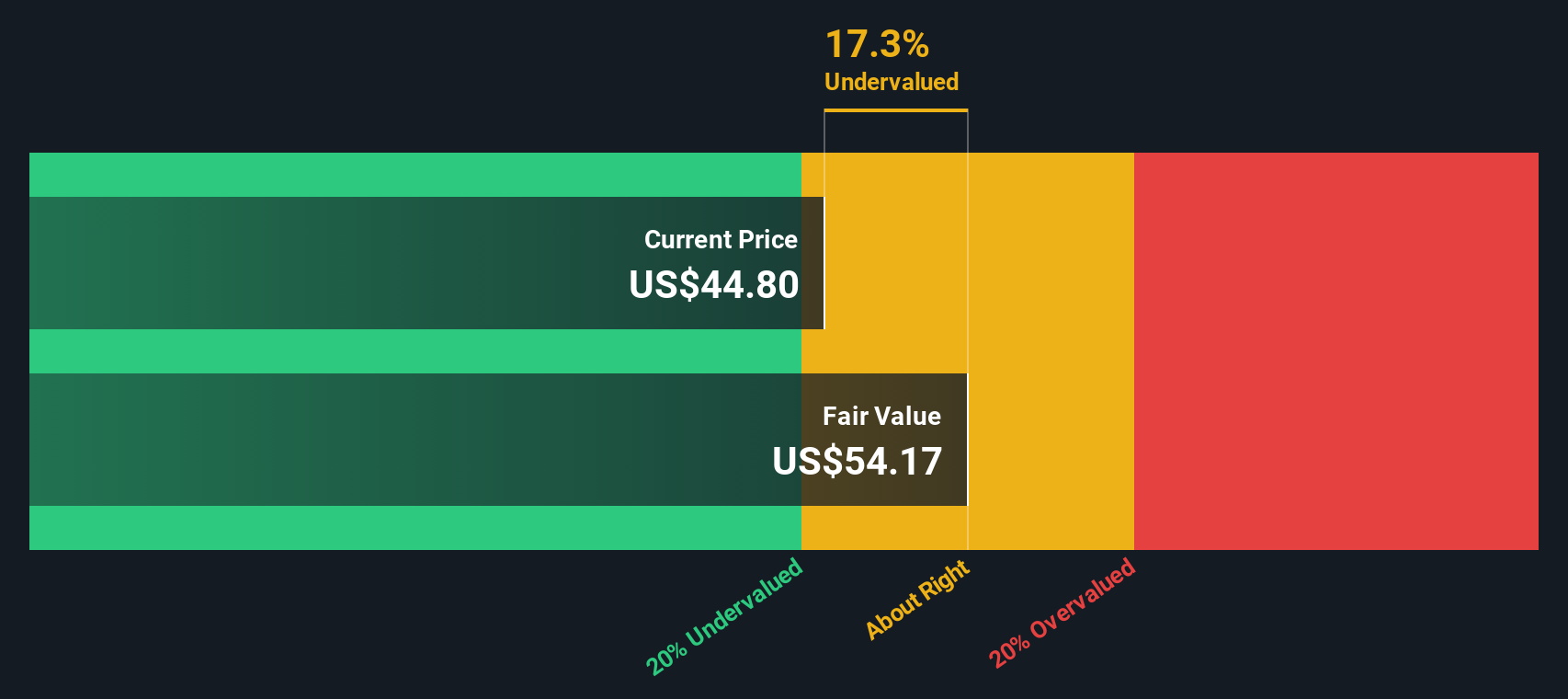

While the market often focuses on high growth and industry comparisons, our DCF model offers a different perspective. According to this method, On Holding appears undervalued. Could this grounded approach be capturing something that others might overlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own On Holding Narrative

If you see things differently or want to dig into the numbers firsthand, you can build your own narrative in just a few minutes. So why not do it your way.

A great starting point for your On Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Broaden your investment horizon with promising themes that could set your portfolio apart. Whether you’re looking to secure steady yields, get ahead in breakthrough industries, or spot value before the crowd does, these curated ideas are ready for you to act on:

- Tap into reliable income by evaluating companies that offer dividend stocks with yields > 3%. This gives your portfolio the stability of strong dividend payouts in any market conditions.

- Jump on the AI trend early with instantly accessible insights into AI penny stocks. These insights connect you to the innovators driving artificial intelligence forward.

- Unlock rare bargains with up-to-date picks for undervalued stocks based on cash flows. These suggestions spotlight stocks whose potential the market may be missing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English