e.l.f. Beauty (ELF): Revisiting Valuation After Rhode Deal and Mixed Analyst Sentiment

When e.l.f. Beauty (ELF) wrapped up its $1 billion acquisition of Rhode earlier this month, it signaled a bold play for the premium skincare segment. Investors have been quick to weigh the risks. Recent analyst commentary has introduced both optimism and caution. While e.l.f. Beauty’s international revenue surge offers growth potential, concerns persist around softening US demand, ongoing tariff risks from Chinese manufacturing, and the strain a sizable deal like Rhode could place on the company’s finances, especially with a choppy market background and macro pressures such as rising inflation.

These factors have contributed to a turbulent period for e.l.f. Beauty’s stock price. Shares dipped over the past month, reflecting renewed anxiety about margins and broader market volatility, but their three-year climb remains notable. Momentum has faded somewhat this year as domestic sales showed only slight gains, even though market share and international distribution have improved. A combination of mixed fundamentals and cautious sentiment seems to have investors wondering about the true upside from this point.

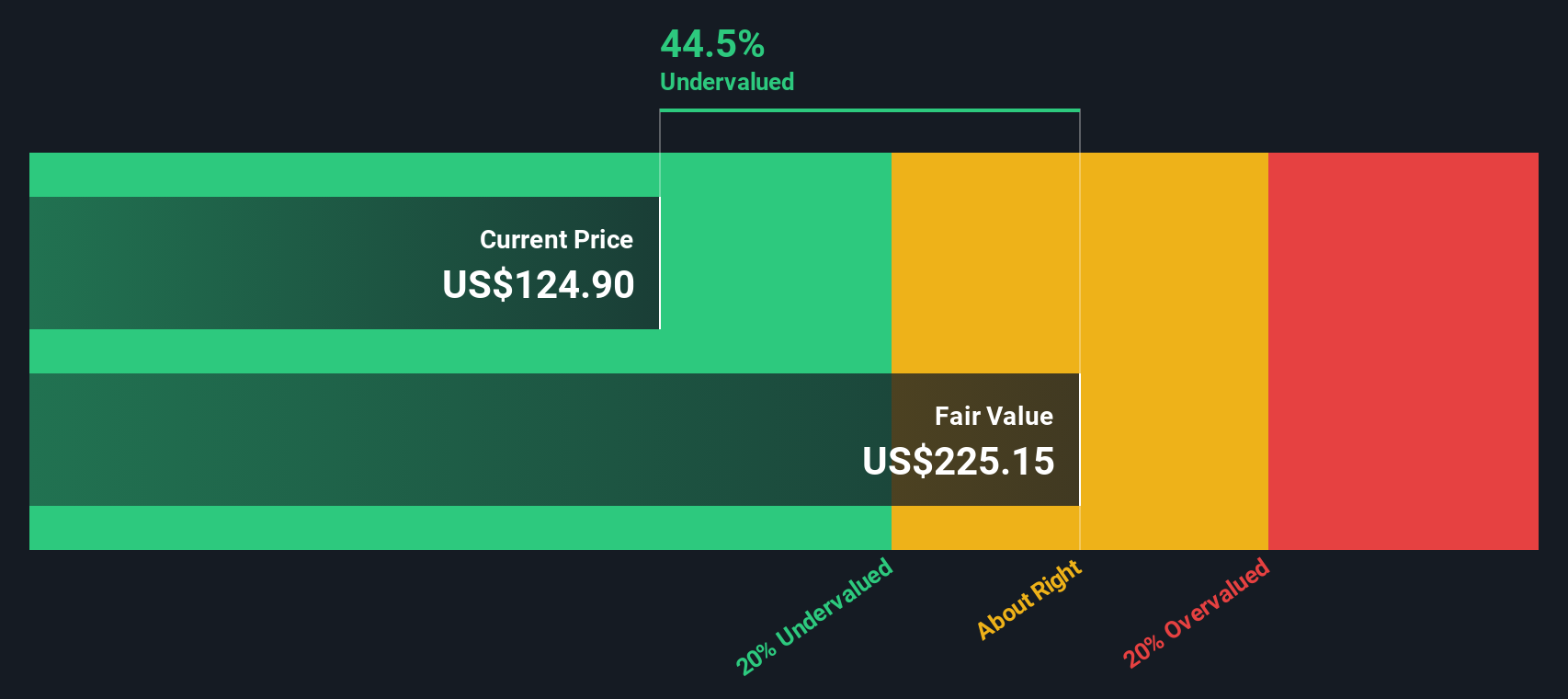

As the dust settles from the Rhode deal and new risks take center stage, the question remains whether e.l.f. Beauty is trading at an attractive discount, or if the market has already priced in all the future growth.

Most Popular Narrative: 11.6% Undervalued

According to community narrative, analysts believe e.l.f. Beauty is trading below its estimated fair value. This view is based on robust growth projections and brand expansion efforts. Their assessment suggests investors may be underappreciating the company’s future earnings potential at current market prices.

The company is highly effective at leveraging influencer marketing, social media virality, and community-driven innovation. These strategies enable lower customer acquisition costs and highly efficient brand-building, supporting both top-line growth and sustainable net margin expansion.

Interested in what sets e.l.f. Beauty apart? The narrative’s bold forecast is powered by strategic expansion, rising margins, and a brand story that challenges industry norms. Want to see which future milestones could influence the stock price? Read further to explore the figures and assumptions behind this valuation perspective.

Result: Fair Value of $133.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tariff pressures or delays in diversifying manufacturing could threaten margins and challenge the optimism that supports e.l.f. Beauty’s current valuation narrative.

Find out about the key risks to this e.l.f. Beauty narrative.Another View: DCF Offers a Sharply Different Take

Looking through the lens of our DCF model, the story changes. Instead of focusing on earnings ratios, this approach estimates what e.l.f. Beauty’s future cash flows might be worth today and paints a far more optimistic picture. Which narrative will prove closer to reality as the market moves forward?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own e.l.f. Beauty Narrative

If the narrative above does not match your perspective or you would rather dig into the data yourself, why not create your own view in just a few minutes and do it your way?

A great starting point for your e.l.f. Beauty research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not limit yourself to just one story when the market is full of opportunities. Take control of your strategy and uncover winning stocks across different themes with the power of the Simply Wall Street Screener. Miss this, and you might miss your next big idea.

- Maximize your income potential and spot companies offering strong yields by checking out dividend stocks with yields above 3% using dividend stocks with yields > 3%.

- Harness the accelerating trends in healthcare innovation and find leading-edge medical companies using AI with healthcare AI stocks.

- Take advantage of undervalued opportunities and refine your search for stocks priced attractively based on cash flow insights through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English