Spotlight On AppLovin And Two Other Top Insider-Owned Growth Stocks

As the U.S. stock market experiences a surge following Federal Reserve Chair Jerome Powell's indication of potential rate cuts, investors are keenly watching for opportunities in growth companies with high insider ownership. In this context, stocks like AppLovin and others stand out as they often reflect strong confidence from those closest to the business, potentially aligning well with current market optimism driven by lower borrowing costs.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Prairie Operating (PROP) | 30.9% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 12.9% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 37.1% |

Let's take a closer look at a couple of our picks from the screened companies.

AppLovin (APP)

Simply Wall St Growth Rating: ★★★★★☆

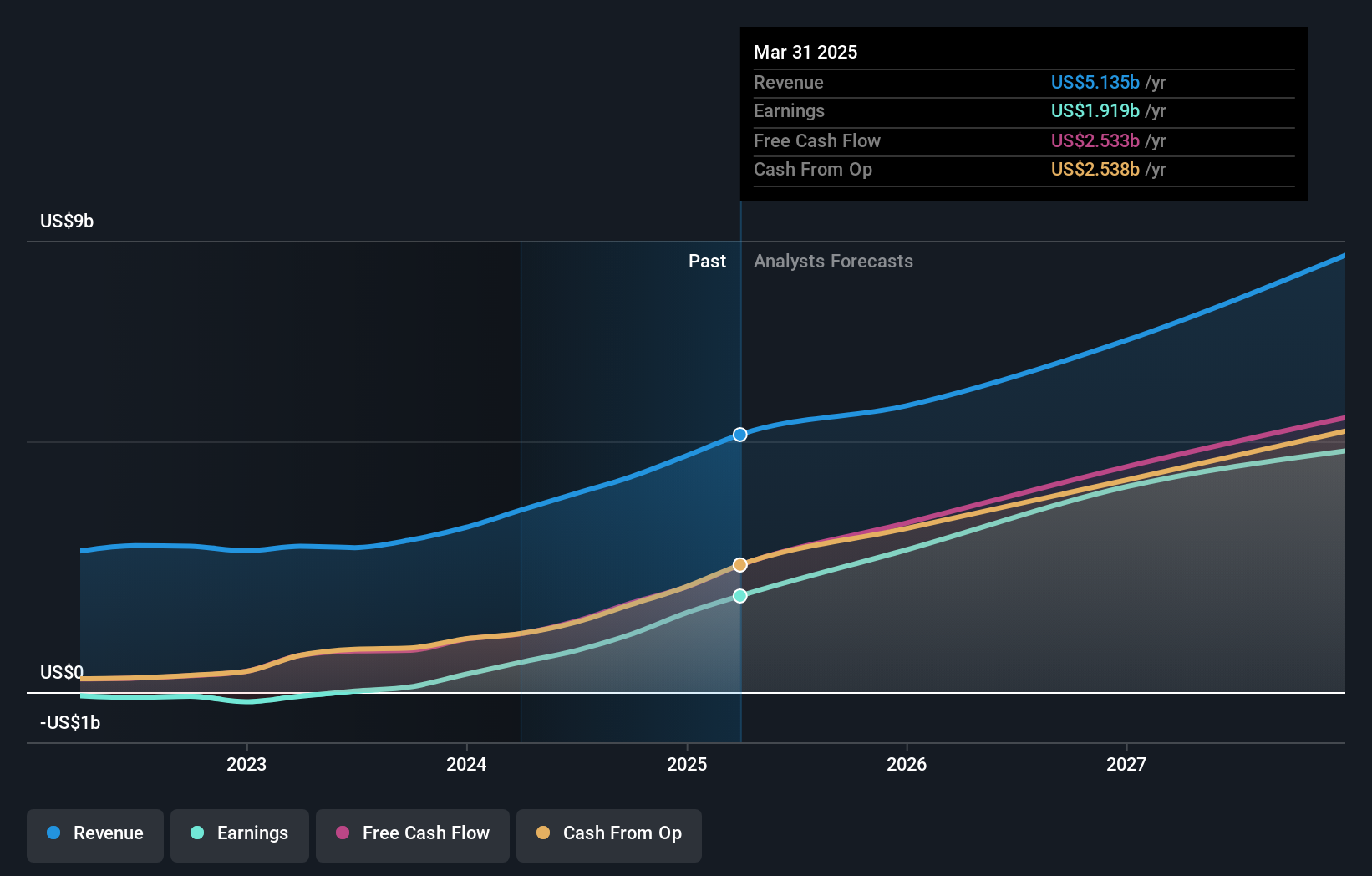

Overview: AppLovin Corporation develops a software-based platform designed to improve marketing and monetization for advertisers both in the United States and globally, with a market cap of $149.40 billion.

Operations: The company's revenue is primarily derived from its advertising segment, which generated $4.25 billion.

Insider Ownership: 30.8%

AppLovin has demonstrated strong earnings growth, with net income rising to US$819.53 million in Q2 2025 from US$309.97 million a year ago. Despite high debt levels, the company forecasts significant annual profit growth of over 20%, outpacing the broader market. Insider activity shows more buying than selling recently, indicating confidence among stakeholders. However, revenue is expected to grow slower than 20% annually but still surpasses market averages at 18.4%.

- Navigate through the intricacies of AppLovin with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that AppLovin is trading beyond its estimated value.

Upstart Holdings (UPST)

Simply Wall St Growth Rating: ★★★★★★

Overview: Upstart Holdings, Inc. operates a cloud-based AI lending platform in the United States and has a market cap of approximately $6.62 billion.

Operations: The company's revenue is primarily derived from its personal lending segment, which generated $781.23 million.

Insider Ownership: 12.5%

Upstart Holdings is experiencing rapid revenue growth, forecasted at 23.6% annually, surpassing market averages. The company reported a Q2 2025 revenue of US$257.29 million, significantly up from the previous year. Recent partnerships with credit unions like ABNB and Cabrillo enhance its consumer loan offerings through the Upstart Referral Network. Although insider selling was significant recently, Upstart's profitability outlook remains positive with expected net income of US$35 million for 2025 and high future return on equity forecasts.

- Get an in-depth perspective on Upstart Holdings' performance by reading our analyst estimates report here.

- The analysis detailed in our Upstart Holdings valuation report hints at an inflated share price compared to its estimated value.

Toast (TOST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Toast, Inc. operates a cloud-based digital technology platform for the restaurant industry across various countries and has a market cap of $25.65 billion.

Operations: Toast generates revenue primarily from its data processing segment, which amounts to $5.53 billion.

Insider Ownership: 18.8%

Toast has shown robust growth, with Q2 2025 revenue reaching US$1.55 billion, up from US$1.24 billion the previous year. Its earnings are expected to grow significantly at 30% annually, surpassing market averages. Despite being dropped from the Russell 2500 Index and experiencing significant insider selling recently, Toast continues to innovate with products like Toast Go®? 3 and strategic partnerships, such as its collaboration with American Express to enhance restaurant experiences through technology integration.

- Click here and access our complete growth analysis report to understand the dynamics of Toast.

- Our valuation report unveils the possibility Toast's shares may be trading at a premium.

Turning Ideas Into Actions

- Unlock our comprehensive list of 195 Fast Growing US Companies With High Insider Ownership by clicking here.

- Curious About Other Options? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English