Can Shifting Interest Rate Expectations Reshape Procore Technologies' (PCOR) Long-Term Growth Narrative?

- Following recent comments from Federal Reserve Chair Jerome Powell indicating possible interest rate cuts, technology and growth-oriented sectors including Procore Technologies experienced renewed investor optimism.

- This market rally was largely attributed to shifting macroeconomic expectations and reduced trade uncertainty rather than any company-specific developments by Procore.

- We'll look at how these changing interest rate expectations could influence the growth outlook and risk factors for Procore Technologies.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Procore Technologies Investment Narrative Recap

To be a shareholder in Procore Technologies, you need to believe in the potential for construction digitization to drive steady revenue growth, as well as Procore’s ability to expand globally and defend its market share in a competitive environment. While recent optimism around potential interest rate cuts gave Procore's stock a short-term boost, this market-wide rally does not materially change the company's biggest catalyst, the adoption of its AI-powered platform, or its key risk, which is ongoing macroeconomic uncertainty that may limit construction activity and revenue visibility. The company’s most recent announcement of Q2 2025 earnings is especially relevant, as it highlights continued double-digit year-over-year revenue growth but also a rising net loss. This underscores that while Procore is growing, the path to profitability remains a concern and ties directly to the catalyst of increased AI adoption, which could drive margin improvement and long-term earnings potential if customer uptake accelerates. But looking ahead, there is an extra layer of risk that investors should be aware of, especially as global construction activity remains tightly linked to shifting macroeconomic conditions...

Read the full narrative on Procore Technologies (it's free!)

Procore Technologies’ outlook anticipates $1.8 billion in revenue and $246.3 million in earnings by 2028. This is based on analysts forecasting a 14.3% annual revenue growth and an earnings increase of $389.1 million from current earnings of -$142.8 million.

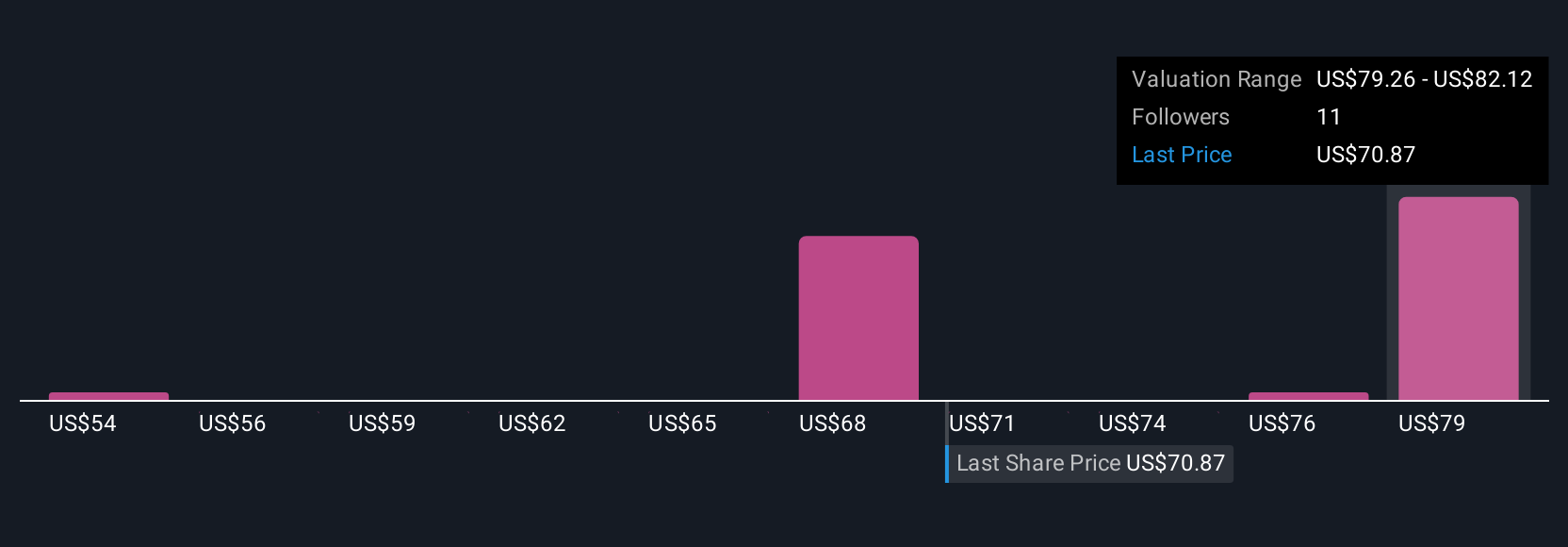

Uncover how Procore Technologies' forecasts yield a $82.12 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members estimate fair value for Procore shares ranging from US$53.58 to US$82.12. While forecasts for AI-powered product adoption offer upside, ongoing macroeconomic headwinds could constrain the growth these investors are anticipating.

Explore 4 other fair value estimates on Procore Technologies - why the stock might be worth 21% less than the current price!

Build Your Own Procore Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Procore Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Procore Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Procore Technologies' overall financial health at a glance.

No Opportunity In Procore Technologies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English