A Look at Valley National Bancorp’s (VLY) Valuation Following Fed’s Shift Toward Softer Monetary Policy

Valley National Bancorp (VLY) grabbed the spotlight after Fed Chair Jerome Powell’s comments at the Jackson Hole symposium hinted at a softer monetary policy ahead. By raising the possibility of interest rate cuts instead of more hikes, Powell has given regional banks, including Valley National Bancorp, a welcome boost. The event has investors considering whether this shift could mark a turning point for bank stocks, just as worries about higher-for-longer rates were beginning to weigh heavily on outlooks.

Since the Fed’s tone shifted, Valley National Bancorp stock has surged, up nearly 9% this month and 16% over the past 3 months, handily outpacing the banking sector. Over the past year, the stock has delivered a total return of nearly 24%, even as performance over three years has been flat by comparison. The company’s improving financial trends, with annual revenue and net income growth both in the double digits, are starting to gain attention at a time when momentum appears to be building again for the stock.

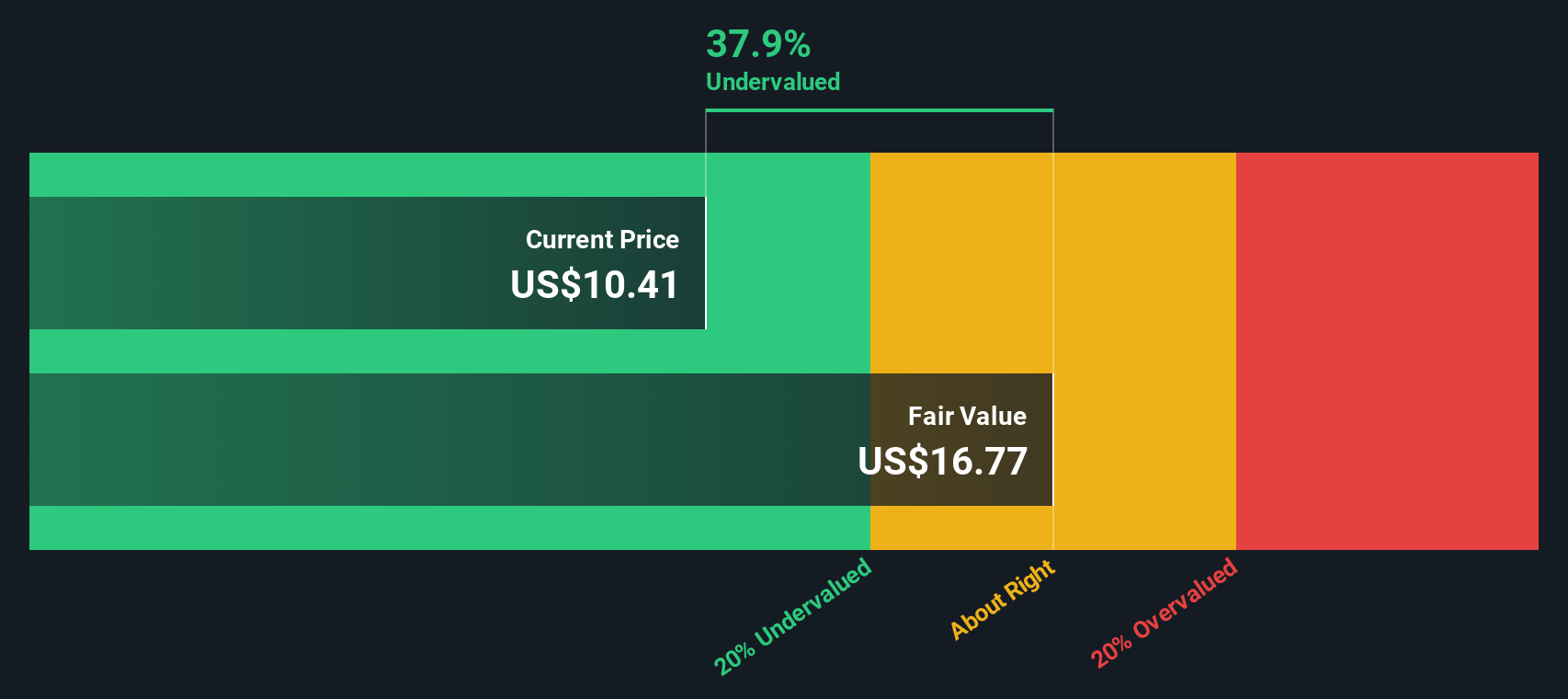

With the recent rally and a friendlier macro backdrop, is Valley National Bancorp now trading at a bargain, or is the market already pricing in the next phase of growth?

Most Popular Narrative: 4.1% Undervalued

According to community narrative, Valley National Bancorp is currently undervalued, with a fair value estimate sitting slightly above its latest trading price. This assessment is based on optimistic projections for earnings and revenue growth, as well as profit margin expansion over the next few years.

"Valley's accelerating growth in commercial and specialty deposit accounts, driven by technology investments and targeted market penetration, is likely to yield structurally lower funding costs and enhanced net interest margin. As legacy brokered deposits are replaced with lower-cost core deposits, this directly supports revenue and margin expansion."

Ready to discover what powers the analyst pricing model? The story behind this valuation features aggressive expansion, digital banking upgrades, and high-stakes projections for the coming years. Want to know which bold numbers could make or break the next price target? Take a closer look to see the forecasts that set this company’s estimated fair value apart.

Result: Fair Value of $10.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, long-term regional economic shifts or renewed challenges in commercial real estate could quickly reverse optimism around Valley National Bancorp’s growth story.

Find out about the key risks to this Valley National Bancorp narrative.Another View: Discounted Cash Flow Perspective

While earnings-based analysis suggests Valley National Bancorp is undervalued, our DCF model tells a similar story based on projected future cash flows. Could both methods be right? Or is the real answer somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valley National Bancorp Narrative

If you have a different perspective, or simply want to uncover your own insights, it takes just a few minutes to shape your own view. do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Valley National Bancorp.

Looking for More Winning Investment Ideas?

Take action and unlock your next opportunity. Sharpen your research with powerful tools that help you spot hidden gems and future leaders. If you miss these chances, you risk letting the market’s best ideas pass you by.

- Hunt for reliable income by reviewing handpicked dividend stocks with yields > 3%, which offer consistent returns and protection against volatility.

- Tap into tomorrow’s breakthroughs by scoping out AI penny stocks, positioned to help shape the AI-driven future with strong innovation and growth potential.

- Supercharge your portfolio with undervalued stocks based on cash flows to identify stocks trading well below their intrinsic value, giving you a head start on the competition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English