Clover Health (CLOV): Assessing Valuation After Analyst Upgrades and Technical Signals Suggest a Shift

Clover Health Investments (CLOV) is back on investors’ radar as a wave of optimism sweeps in from both the analyst community and technical chart watchers. Just this past week, several Wall Street analysts raised their earnings forecasts for Clover Health and assigned the company a more favorable ranking. At the same time, chart technicians have spotted a hammer pattern, which is often an early sign that selling pressure is easing and sentiment might be shifting. These developments are encouraging for shareholders who have watched the stock languish and are now wondering if a turning point is at hand.

Over the past year, Clover Health Investments has faced headwinds, with shares sliding about 18%. In the past month, the stock has dropped about 10%, but the recent analyst upgrades and chart signals have provided a spark of renewed interest. Despite ongoing struggles, the company’s annual revenue and earnings have both improved, suggesting fundamentals may be catching up with sentiment. The big question now is whether this early momentum can be sustained, or if it will fizzle out as quickly as it arrived.

After a tough year and a sudden surge in coverage along with bullish technicals, does the stock still have room to run, or has the market already priced in a turnaround?

Most Popular Narrative: 25.2% Undervalued

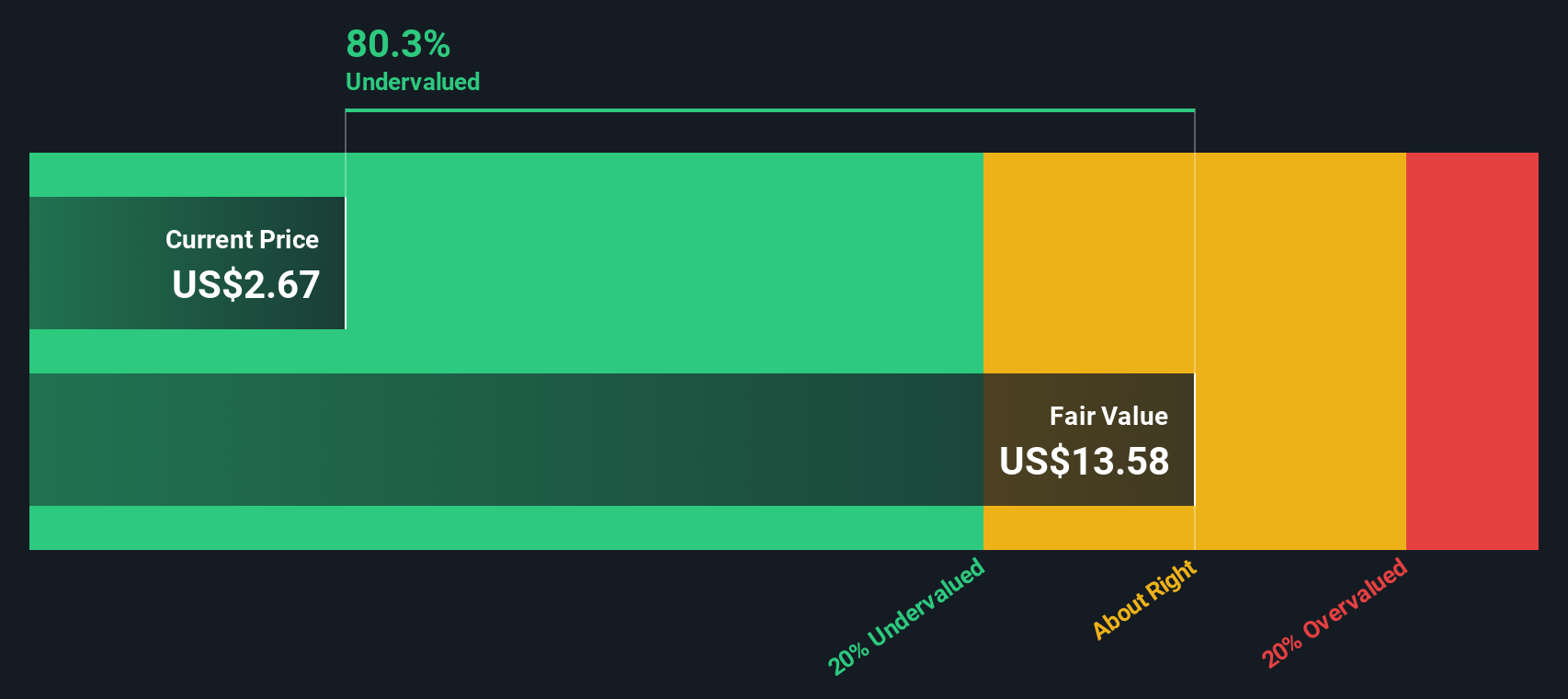

According to community narrative, Clover Health Investments is viewed as considerably undervalued, with analysts projecting substantial upside based on future earnings growth and profit margin potential.

The company's differentiated technology-driven care model, particularly the Clover Assistant platform, positions it to benefit from the healthcare industry's accelerated shift toward technology adoption and data-driven, value-based care. This supports lower medical costs and higher medical margins, with positive implications for both revenue growth and net margins.

Is Clover really poised for a game-changing rebound? The math behind this outlook is quite bold. It hinges on aggressive expansion, much higher profits, and a leap in valuation multiples. Want to see exactly what fuels these ambitious price targets? Unpack the narrative's underlying numbers—they just might surprise you.

Result: Fair Value of $3.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including rising medical costs and ongoing net losses. These factors could challenge Clover Health's profitability and stall the anticipated turnaround.

Find out about the key risks to this Clover Health Investments narrative.Another View: What Does Our DCF Model Say?

Looking beyond analyst price targets, the SWS DCF model points to a similar story. This suggests the company remains undervalued. Still, DCF relies on different assumptions than those used by analysts. Which picture gives you more confidence?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clover Health Investments Narrative

You might have a different perspective, or want to dig into the data yourself. If so, crafting your own take is quick and straightforward. In just a few minutes, you can do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Clover Health Investments.

Looking for More Smart Investing Ideas?

You owe it to yourself to seek out fresh opportunities beyond your current watchlist. The market moves fast, but with the right tools, you can spot hidden gems and stay ahead of the crowd. Use these hand-picked ideas, designed to help you find that next standout winner before everyone else.

- Strengthen your portfolio by targeting stocks that offer consistent income with dividend stocks with yields > 3%, and tap into companies yielding above 3%.

- Accelerate your returns by scanning for AI penny stocks, which features dynamic businesses driving innovation in artificial intelligence.

- Ride powerful trends by searching for undervalued stocks based on cash flows, so you can pinpoint stocks trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English