Qifu Technology (NasdaqGS:QFIN): Evaluating Valuation After Strong Earnings, Dividend Hike, and Major Buyback Completion

If you have been watching Qfin Holdings (NasdaqGS:QFIN) lately, you know the stock has been anything but quiet. The company just checked off three boxes favored by investors: a sizable share buyback completed, a meaningful bump in dividends, and another period of strong earnings growth. After reporting second-quarter results that showed revenue and net income rising compared to last year, Qfin’s management reinforced its commitment by both returning cash to shareholders and signaling long-term confidence with these actions.

This streak comes at an interesting time for the stock. While returns over the past year have been up by 27%, the trends have not all moved in one direction. Shares are still down about 11% over the past month and off 26% in the past three months, reflecting occasional swings in sentiment. However, looking at a broader timeline shows a company that has posted gains of over 120% in three years and nearly doubled over five years. This pattern suggests that momentum has often reappeared when the business delivers results.

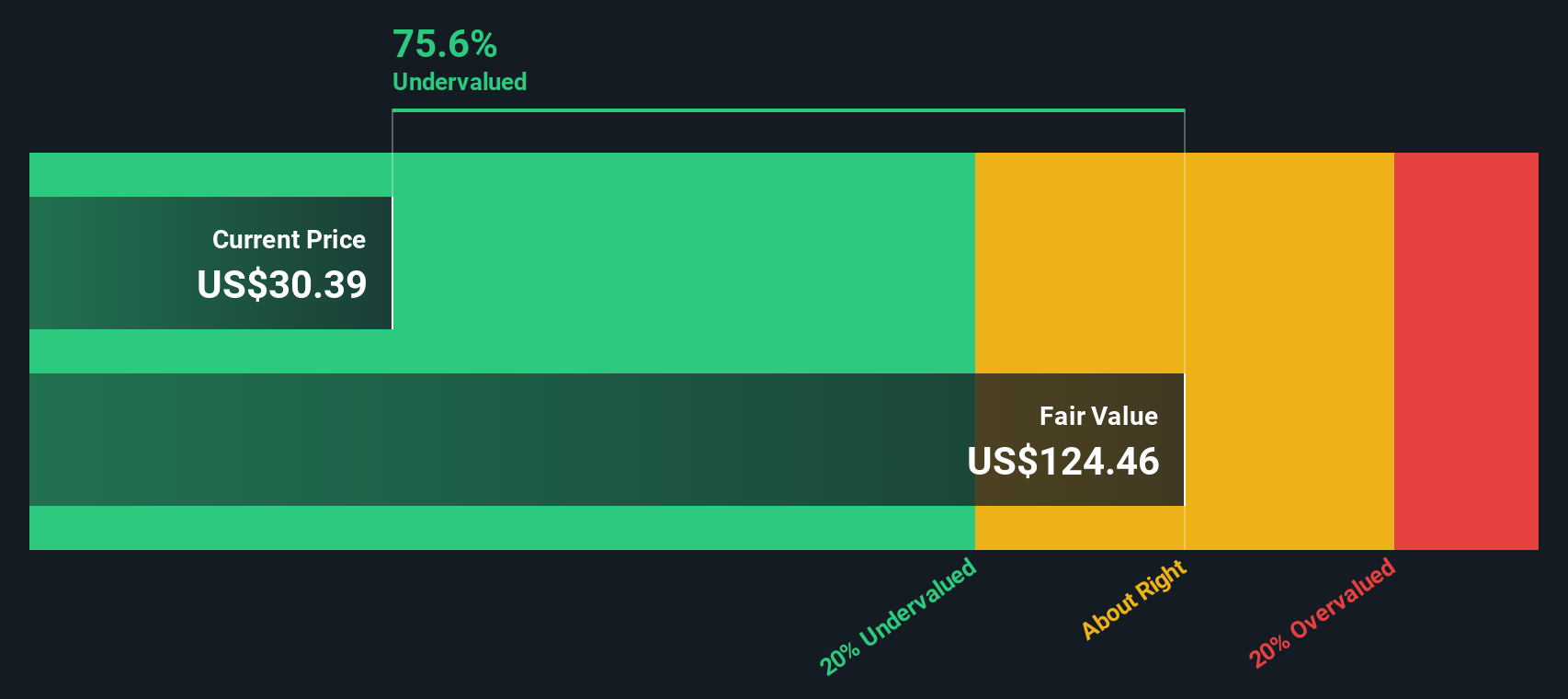

With Qfin Holdings combining buybacks and a higher dividend on top of solid earnings, the key question is whether the market is underestimating future growth at this point or if the current price already reflects all the potential upside.

Most Popular Narrative: 37.7% Undervalued

According to community narrative, Qfin Holdings is currently seen as significantly undervalued relative to its fair value estimate. The forward-looking narrative draws on analyst consensus for both the company’s projected earnings growth and its discount rate assumptions.

Qfin's ongoing integration of advanced AI and large language models into its risk assessment and user profiling systems is already reducing default rates (for example, FPD 7-day down 5%, improved model KS scores) and improving operational efficiency. This should protect and gradually enhance net margins in the medium and long term.

Want to uncover the bold vision fueling these valuation estimates? The real story hinges on ambitious growth targets and a future profit multiple that challenges sector norms. Wonder what key numbers make up this undervaluation case? The deeper details reveal some surprising assumptions about revenue, margins, and market expansion that might flip your view on Qfin's upside potential.

Result: Fair Value of $50.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased regulatory scrutiny or persistently weak consumer credit demand in China could quickly undermine the bullish narrative regarding Qfin's future growth.

Find out about the key risks to this Qfin Holdings narrative.Another View: Discounted Cash Flow Perspective

Our SWS DCF model tells a similar story, suggesting that Qfin Holdings is materially undervalued based on projected future cash flows. However, it is worth questioning whether long-term assumptions can fully capture the shifting realities facing this business.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Qfin Holdings Narrative

If you see it differently or want to test your own assumptions, you are free to dig into the data and develop your own perspective. You can do it your way in under three minutes.

A great starting point for your Qfin Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Sticking with just one company means you might miss chances elsewhere. You can explore exceptional opportunities across different sectors by using the Simply Wall Street Screener. Here are three effective strategies you can use right now to identify standout stocks and potential market leaders:

- Discover trusted sources of income and strengthen your portfolio with companies offering dividend stocks with yields > 3%.

- Access innovation by supporting firms leading advancements in healthcare with strong momentum in healthcare AI stocks.

- Find value by focusing on businesses currently overlooked by the market through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English