Celanese (CE): Evaluating Current Valuation After RBC Analyst Downgrade and Demand Concerns

Most Popular Narrative: 11.5% Undervalued

According to the community narrative, Celanese shares are considered undervalued by 11.5% relative to their fair value, based on analysts' consensus. This valuation is grounded in forward-looking assumptions about the company’s earnings potential, margins, and top-line growth over the next several years.

Celanese’s investments in green chemistry and downstream product diversification position it to capture share as demand accelerates for sustainable materials. This trend is driven by both tightening environmental regulation and increased consumer focus on circular solutions, which supports long-term top-line and margin expansion.

Curious what bold forecasts make Wall Street think Celanese is worth more than the market currently believes? There is a surprising blend of projected profit turnaround and future earnings multiples that challenge market pessimism. Interested in the numbers fueling this upside? The full narrative reveals the critical variables that drive this valuation.

Result: Fair Value of $54.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent overcapacity and unpredictable demand could continue to pressure Celanese’s volumes and margins. These factors may potentially limit near-term earnings recovery despite cost cuts.

Find out about the key risks to this Celanese narrative.Another View: Discounted Cash Flow Perspective

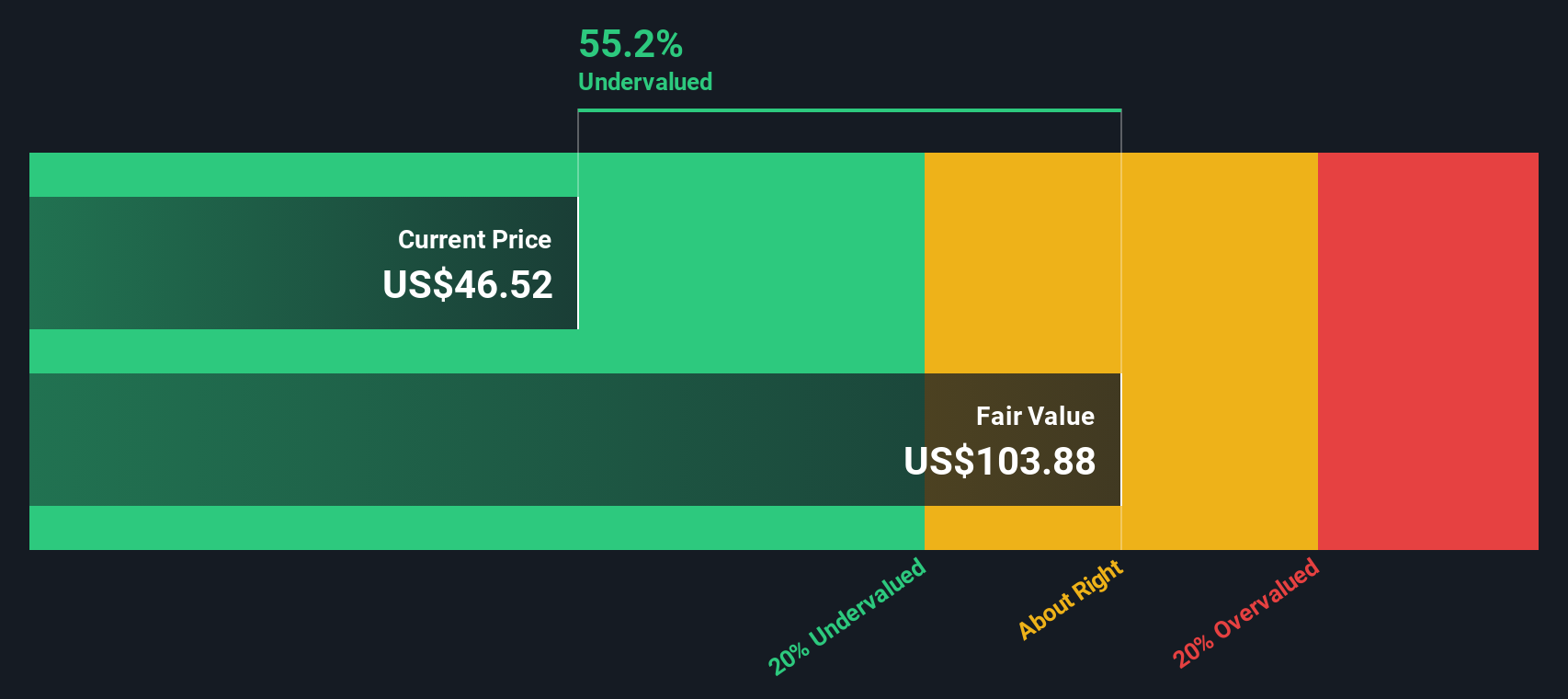

While the market compares Celanese’s share price to company earnings, our DCF model offers a different lens. It currently signals that the shares are trading well below intrinsic value, supporting the undervalued narrative. However, does it capture all the risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Celanese Narrative

If you want to see the underlying data for yourself or think your perspective could change the story, you can put together a personalized narrative in just a few minutes: do it your way.

A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investing instincts by zeroing in on opportunities that others might overlook. Leverage unique insights from Simply Wall Street to pinpoint companies that are outperforming, innovating, or offering attractive yields. Here are three powerful ideas you can act on right now:

- Tap into high-potential growth by exploring this list of AI penny stocks. Artificial intelligence is reshaping business models and creating new winners across industries.

- Capture steady income with reliability as you review dividend stocks with yields > 3%, which features companies consistently delivering dividends above 3% for rewarding long-term returns.

- Uncover value plays that could be flying under the radar with our handpicked collection of undervalued stocks based on cash flows, which highlights stocks priced below their underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English