Scholar Rock (SRRK) Valuation: Assessing Share Price After Pivotal Apitegromab Results and FDA Priority Review

If you are watching Scholar Rock Holding (SRRK), this week’s news probably caught your eye. Shares surged 14% right after the company published positive Phase 3 SAPPHIRE trial results for its SMA therapy, apitegromab, in The Lancet Neurology. The data shows real motor function improvements in children and adults with spinal muscular atrophy, which is a significant development for families and clinicians seeking new options. Just as important, the FDA has now accepted the company’s Biologics License Application under priority review, putting possible approval within reach and fueling discussion about what could be next for Scholar Rock’s pipeline.

This is not the first major headline for Scholar Rock in recent months, but it stands out as one of the most impactful. After a rocky start to the year, with the stock down nearly 20% year-to-date, it is now up 17% over the past three months and has doubled in value over the past twelve months. This reflects growing confidence around its late-stage programs. Despite a widening net loss in the second quarter, investors appear more focused on long-term growth potential than on short-term operating expenses, with momentum increasing as key regulatory dates approach.

With fresh data and potential FDA approval on the horizon, some investors are considering whether Scholar Rock is now priced for success, or if additional upside could emerge as markets adjust to newly unfolding growth prospects.

Price-to-Book Ratio of 14.6x: Is it justified?

Scholar Rock Holding is currently trading at a price-to-book ratio of 14.6x, which is significantly higher than the US Biotechs industry average of 2.2x. This suggests the market is assigning a premium to the company compared to most of its domestic peers.

The price-to-book (P/B) ratio compares a company’s market value to its book value and is often used to assess biotech firms that have yet to become profitable. A high P/B ratio may reflect high investor confidence in future prospects, intellectual property, or upcoming catalysts.

While the elevated multiple indicates optimism about Scholar Rock’s future, it also raises questions about whether expectations for revenue growth or new product success are too aggressive given the lack of current profitability. Investors should consider if the premium is justified by the company's long-term potential or if more modest valuations are warranted at this stage.

Result: Fair Value of $35.49 (OVERVALUED)

See our latest analysis for Scholar Rock Holding.However, any regulatory setbacks or weaker-than-expected commercial uptake could quickly challenge the optimism that is currently priced into Scholar Rock’s valuation.

Find out about the key risks to this Scholar Rock Holding narrative.Another View: Discounted Cash Flow Tells a Different Story

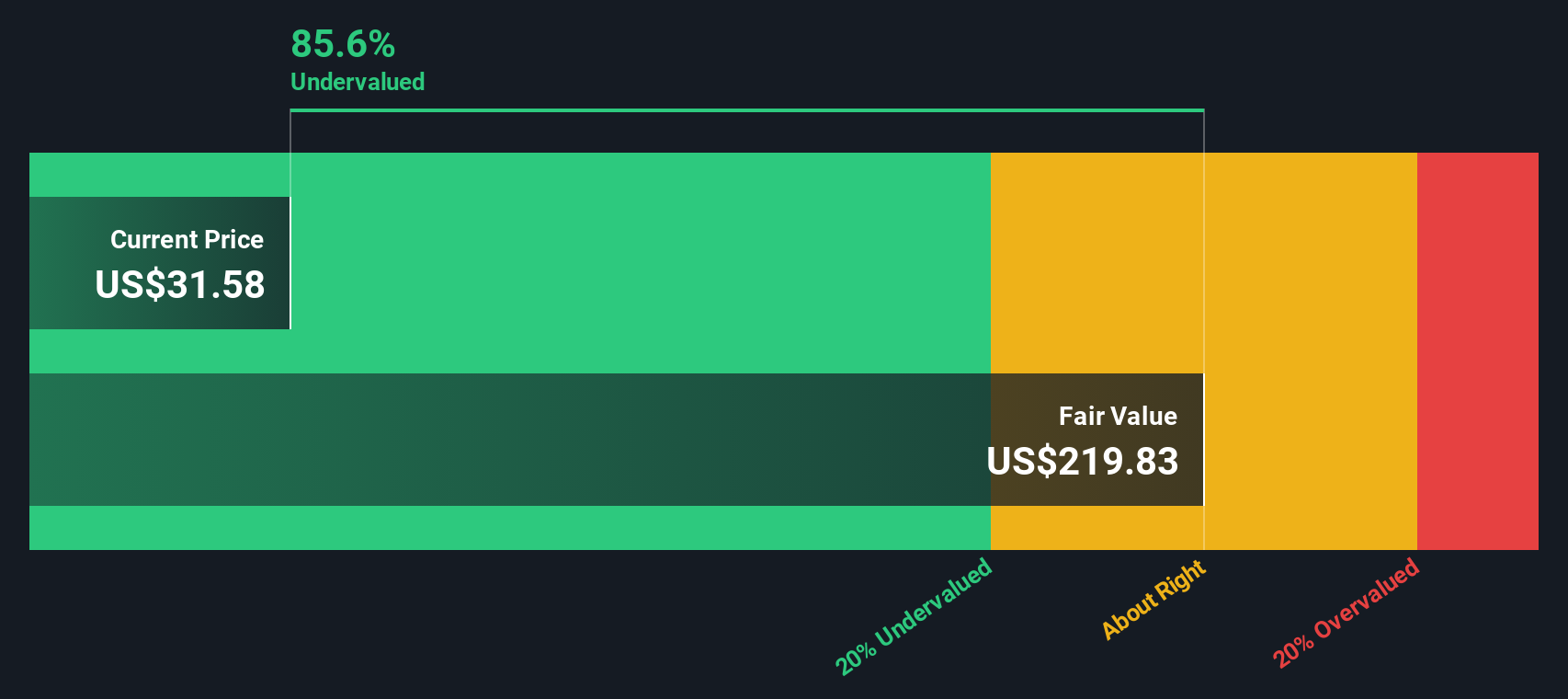

Looking at valuation through the SWS DCF model offers a very different perspective. While the market price seems steep using traditional metrics, this method suggests the shares might actually be undervalued. This could indicate overlooked potential.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Scholar Rock Holding Narrative

If you want to dig deeper or think a different story should be told, you can craft your own take on Scholar Rock’s outlook in just a few minutes. do it your way.

A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not wait on the sidelines. Uncover exciting opportunities across the market using these intelligent tools equipped to match your strategy. Each idea is carefully curated so you will not miss out on tomorrow’s winners. Start now and give your portfolio an edge.

- Boost your passive income by targeting companies that consistently deliver strong yields through stable and generous payouts with dividend stocks with yields > 3%.

- Unlock future growth potential in healthcare by accessing a collection of trailblazing firms harnessing AI to redefine the medical landscape through healthcare AI stocks.

- Stay ahead of trends by pinpointing undervalued businesses set to benefit from robust cash flows with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English