Dana (DAN): Valuation Insights After Profit Growth Surprises in Q2 Earnings

Dana (DAN) just dropped its second quarter earnings. If you’re following this stock, you probably noticed the headlines about higher net income and a solid gain in earnings per share, even though overall sales dipped compared to last year. When a company posts a profit boost while revenue falls, it signals shifts beneath the surface, such as more efficient operations or tighter cost controls. For investors trying to read the tea leaves, these kinds of reports can suggest significant changes in the business that do not always show up in top-line numbers.

The recent announcement follows a strong run for Dana’s shares. The stock has climbed 76% year-to-date, and it is up 84% compared to a year ago, outpacing many in the sector. Momentum built steadily over the past month and quarter, suggesting that investors could be reacting not just to this profit turnaround but also anticipating more to come, especially given lingering questions around profitability and growth in a tougher market environment.

After such a run, investors are left to consider whether Dana is a bargain with more potential upside, or if the market has already priced in much of the improved outlook. That remains the key valuation question.

Most Popular Narrative: 16.4% Undervalued

According to the community narrative, Dana is currently undervalued by 16.4% based on a discounted cash flow approach that considers upcoming margin improvements, disciplined capital allocation, and exposure to electric vehicle megatrends.

"Dana's aggressive cost reduction and operational efficiency initiatives, such as the $310 million run-rate cost savings target by 2026, significant margin lift from stranded cost eliminations, and ongoing plant automation, should meaningfully increase net margins and profit sustainability over the next several years."

Ever wondered what ambitious engineering and financial targets power a double-digit undervaluation call? This narrative focuses on bold cost cuts, future-focused automation, and electrification wins. The numbers behind the forecast may surprise you. Dig deeper to see which projections make analysts this bullish on Dana.

Result: Fair Value of $23.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Dana's higher dependence on major OEMs and ambitious cost-saving targets introduce real risks. These factors could quickly dampen the bullish thesis if trends reverse.

Find out about the key risks to this Dana narrative.Another View: Market-Based Comparison

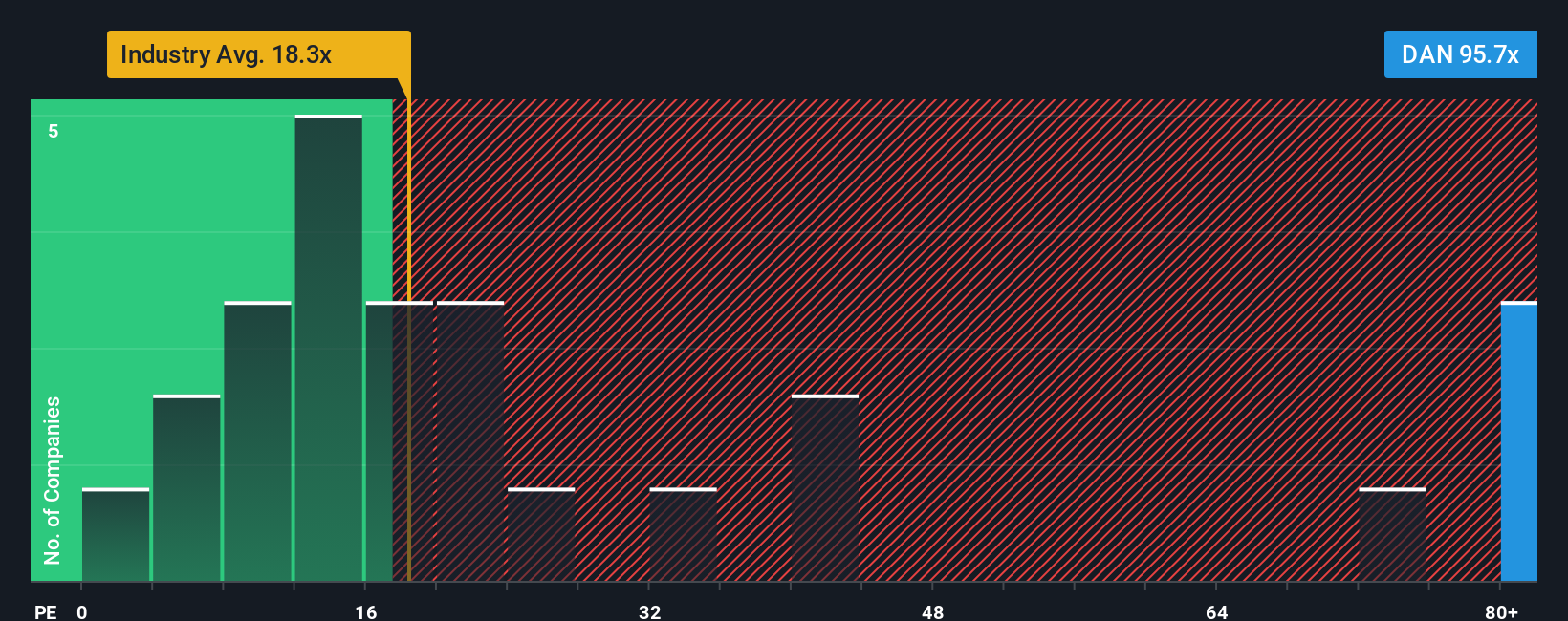

Our market comparison method, which looks at earnings multiples versus the industry, paints a very different picture. Unlike the discounted cash flow approach, this lens suggests Dana may not be as cheap as it first appears. Could the market be onto something the forecasts have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dana Narrative

If you see things differently, or want your own take on what the numbers say, you can shape a narrative to fit your own outlook in just a few minutes. So why not do it your way?

A great starting point for your Dana research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not let your next big opportunity slip by. Multiply your investing edge by searching beyond Dana to track truly promising companies that fit your strategy and spark your curiosity. Here are three powerful ways to channel your research into smarter moves:

- Supercharge your portfolio with steady income opportunities by checking out dividend stocks with yields > 3% that continue to deliver yields above 3%.

- Tap into healthcare’s innovation wave and spot major breakthroughs with healthcare AI stocks driving advances in artificial intelligence-powered medicine.

- Seize potential bargains most investors overlook by targeting undervalued stocks based on cash flows based on strong cash flows and attractive market entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English