Golar LNG (NasdaqGS:GLNG): Examining Valuation as Rising Costs and Economic Headwinds Shift Broker Outlook

If you’re watching Golar LNG (NasdaqGS:GLNG), it’s hard to miss the shift in sentiment recently. The company just reported that rising operating expenses and tough economic conditions, like shifting trade policies and tariffs, are beginning to weigh on performance. These headwinds have triggered some sharp downward revisions to earnings forecasts, and broker confidence in the near-term storyline is clearly not what it was earlier in the year.

This comes at a time when the stock’s momentum has been anything but dull. Golar LNG is up almost 39% over the past year, outpacing energy sector peers and showing double-digit returns over the past month and quarter. Still, the recent turbulence, combined with last week’s earnings and dividend update, has the market rethinking the risk and growth potential here.

After a strong run but with mounting uncertainty, is Golar LNG trading at a discount that’s too good to pass up, or have markets already priced in the shifts ahead?

Most Popular Narrative: 11.6% Undervalued

According to community narrative, Golar LNG is viewed as undervalued by 11.6%, with analyst consensus suggesting strong future prospects if current growth trends materialize.

"The company has secured long-term (20-year) charters for its existing FLNG units, providing $17 billion in contracted EBITDA backlog and 20 years of cash flow visibility. This is expected to drive a significant (4x) increase in EBITDA and contracted free cash flow by 2028, indicating the market may be undervaluing its forward earnings stability and revenue growth."

Curious about the bullish case? The heart of this narrative is an aggressive roadmap for earnings, ambitious profitability forecasts, and a future valuation multiple that is rarely seen in energy stocks. Want to see which bold growth figures are fueling this price target? Uncover the surprising quantitative assumptions powering this undervaluation call.

Result: Fair Value of $50.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in global LNG demand or delays in signing new project charters could quickly undercut these optimistic long-term forecasts.

Find out about the key risks to this Golar LNG narrative.Another View: Cash Flow Paints a Different Picture

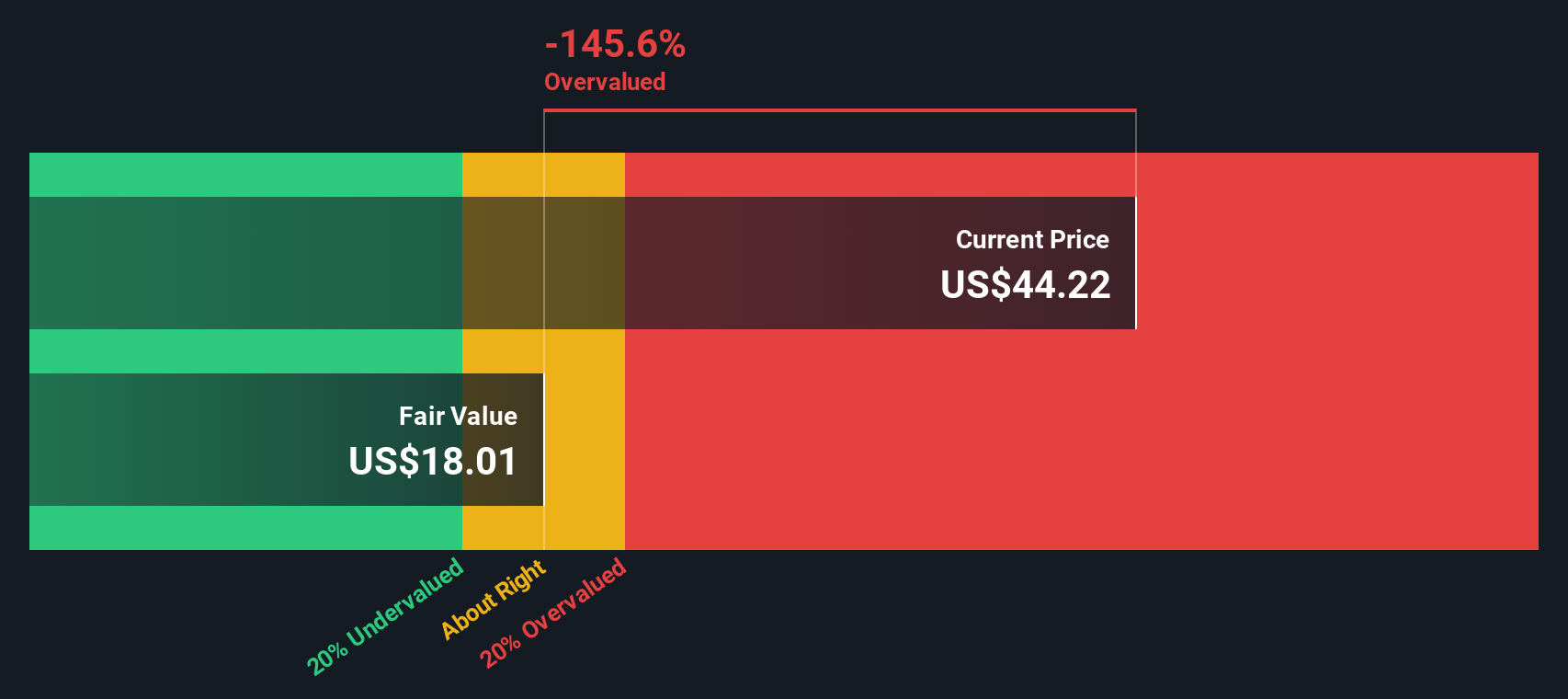

Looking at Golar LNG through the lens of our DCF model instead of price targets presents a different perspective. This approach actually suggests the stock is overvalued, providing a clear counterpoint to analyst optimism. Which lens will prove more accurate as events unfold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Golar LNG Narrative

If you see things differently, or would rather dive into the details yourself, you can shape your own view on the data in just a few minutes. do it your way.

A great starting point for your Golar LNG research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Stop settling for the obvious choices. Savvy investors are always a step ahead because they know where to look for the next opportunity. Boost your edge right now by accessing hand-picked lineups across different sectors and strategies. Waiting too long could mean missing out.

- Target high yields and put your cash to work with stocks screened for dividend stocks with yields > 3%, delivering income consistently above 3%.

- Fast-track your search for emerging tech leaders by exploring companies at the forefront of innovation through AI penny stocks.

- Focus on resilient value by uncovering stocks recognized for strong fundamentals and attractive pricing with our handpicked selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English