How VSE's (VSEC) Strong Results and Insider Ownership Could Shape Its Investment Narrative

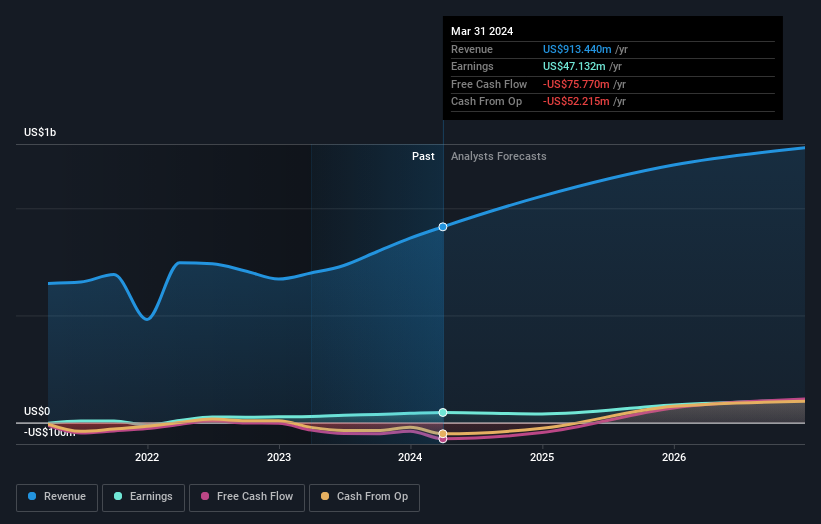

- VSE (NASDAQ:VSEC) recently reported impressive financial results, with annual earnings per share growth of 14% over three years and a 52% increase in revenue to US$1.3 billion, reflecting operational momentum and insider investment of approximately US$79 million.

- With CEO compensation below industry averages and significant insider ownership, the company shows signs of strong governance and management alignment with shareholder interests.

- We'll explore how solid insider alignment and governance can influence VSE's investment outlook following these operational results.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

VSE Investment Narrative Recap

Shareholders in VSE need to believe the company's focus on aviation aftermarket expansion and disciplined management alignment can continue to drive growth, despite a less diversified business mix. The latest solid earnings and revenue surge are positive, but the biggest immediate catalyst, successful integration of recent acquisitions, remains, while exposure to aviation sector cyclicality remains a key risk; neither appears to be materially altered by these results.

Among recent announcements, the May refinancing of VSE's Term Loan A and revolving credit facility stands out, as greater financial flexibility supports the company’s runway for integrating TCI and Kellstrom, further strengthening the case for near-term execution as a driver of value. Yet, as with many acquisition-heavy growth stories, maintaining margin and cash flow discipline is critical, particularly following a period of rapid expansion.

In contrast, investors should be mindful of the company’s heightened vulnerability to aviation cyclicality and what that could mean for...

Read the full narrative on VSE (it's free!)

VSE's narrative projects $1.6 billion in revenue and $139.2 million in earnings by 2028. This requires 7.4% yearly revenue growth and a $75.4 million earnings increase from $63.8 million today.

Uncover how VSE's forecasts yield a $169.58 fair value, in line with its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community for VSE range from US$169.58 to US$184.79 per share. While these private views reflect differing optimism, broader analyst consensus points to rapid earnings growth as both an opportunity and a pressure test for the company’s recent strategy.

Explore 2 other fair value estimates on VSE - why the stock might be worth as much as 11% more than the current price!

Build Your Own VSE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VSE research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free VSE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VSE's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English