New Oriental (NYSE:EDU) Valuation Update Following Expanded Collaboration With East Buy and Scope Growth

New Oriental Education & Technology Group (NYSE:EDU) has renewed its Framework Agreement with East Buy Holding Limited. This update is more than a routine contract extension; it sets new annual limits and expands the partnership’s scope to include everything from private label agricultural products and food to livestreaming e-commerce materials. Both companies are signaling expectations of rising demand and a push for smarter, broader product offerings. For investors, the move serves as a reminder that New Oriental is actively fostering business momentum through collaborative growth channels while maintaining a strong focus on competitive pricing.

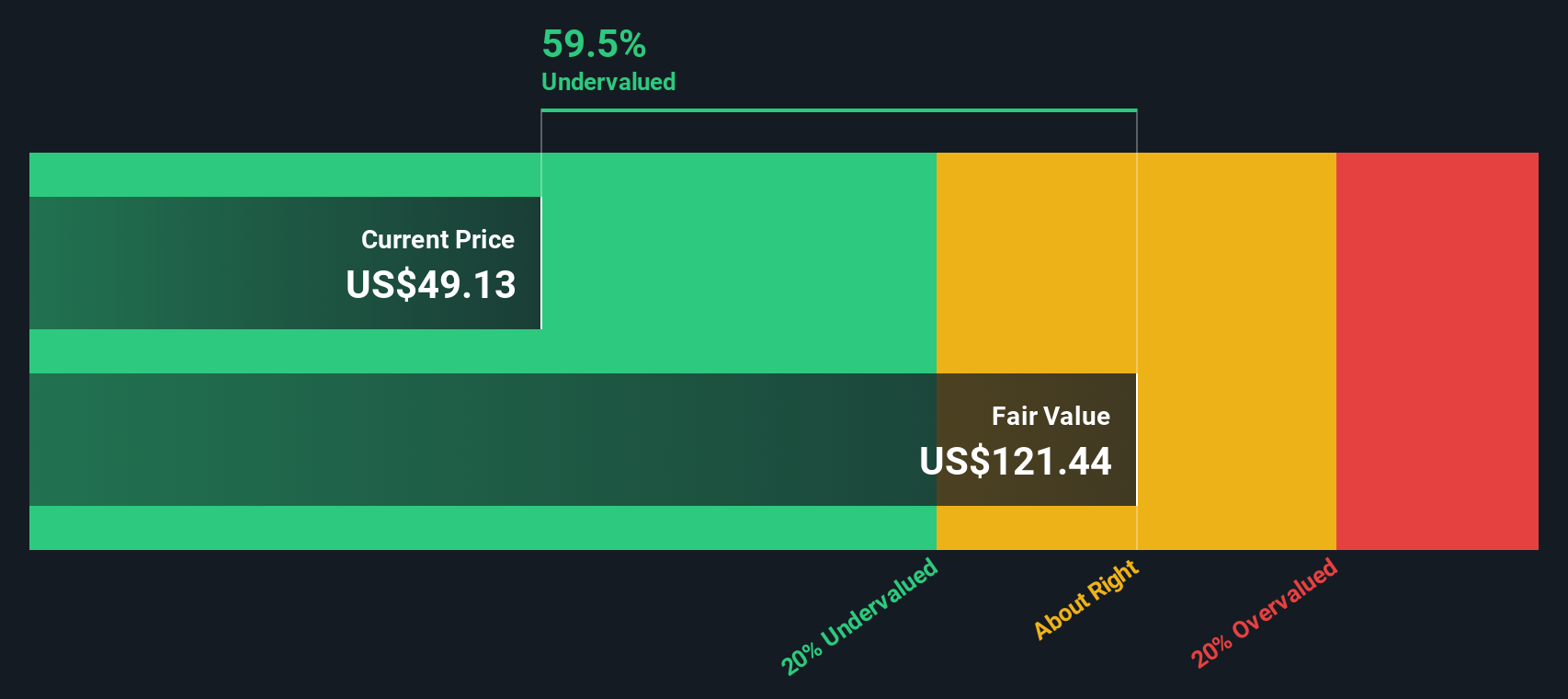

Looking at the bigger picture, New Oriental’s share price presents a complicated story. The stock has climbed about 2% over the past month and 1% in the past three months, indicating some renewed attention. However, on a year-to-date basis, it is down 23%. Extending the timeframe, the one-year total return is also negative. Despite the recent momentum, long-term holders have experienced volatility. Interestingly, the stock remains up nearly 70% over three years, even after some challenging periods. The Framework Agreement renewal brings a new narrative to the stock as it seeks direction.

The question remains: Is this business update the catalyst for a turnaround, or has the market already factored in all the growth New Oriental may deliver from this point?

Most Popular Narrative: 17.3% Undervalued

Based on the most popular narrative, New Oriental Education & Technology Group is considered undervalued by 17.3%. This assessment uses a discount rate of 7.84% and projects substantial future growth and improved profitability along with ongoing capital returns.

"Continued investment and rollout of omnichannel online-merge-offline (OMO) and AI-driven systems are enabling operating leverage, cost reductions, and higher efficiency in delivery. This is already resulting in improved operating margins (410bps year-over-year in core business), supporting future earnings growth through both topline expansion and margin expansion."

Want to unlock the quantitative engine driving this valuation? One major financial lever, a more optimistic outlook for future profits, and a surprising development in how margins might change. Explore how the narrative’s formula works and how analysts believe these factors could affect the stock’s potential.

Result: Fair Value of $57.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, intensified competition and ongoing regulatory changes could disrupt New Oriental’s growth trajectory and present challenges to its path toward sustained margin improvements. Find out about the key risks to this New Oriental Education & Technology Group narrative.Another View: The SWS DCF Model

While the popular narrative points to New Oriental being undervalued, the SWS DCF model arrives at a similar conclusion by projecting fair value through future cash flows and discounting them to the present. The question is whether this second approach adds weight to the existing case or uncovers blind spots in current assumptions.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own New Oriental Education & Technology Group Narrative

If you have a different take or want to investigate the figures for yourself, you can assemble your own perspective in just a few minutes. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding New Oriental Education & Technology Group.

Ready for More Opportunities?

Top investors rarely settle for just one great idea. Open the door to new potential wins with Simply Wall Street’s screener tools, each designed to match your style and financial goals. Make your next move with confidence and avoid missing out on tomorrow’s top performers by checking out these opportunities:

- Pinpoint exceptional income streams and secure your portfolio’s future by targeting steady dividend stocks with yields > 3%.

- Tap into the explosive potential of the industry’s most talked about trend with a handpicked selection of AI penny stocks that can shape tomorrow’s market.

- Spot under the radar value plays that could be overlooked by others by focusing on undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English