Jones Lang LaSalle (JLL) Valuation in Focus After AI Upgrade to Prism Platform

If you have been watching Jones Lang LaSalle (JLL) lately, there is something new to consider in your investment checklist. The company just rolled out artificial intelligence capabilities for its Prism building operations platform, layering predictive intelligence and automation onto daily property management tasks. This move is a direct signal that JLL is doubling down on digital solutions in an industry where traditional methods have long reigned. That development might have implications for both growth and efficiency in the quarters ahead.

Zooming out, this tech investment fits into a broader pattern for Jones Lang LaSalle. JLL’s stock has jumped 14% over the past month and logged a strong 36% climb over the past three months, outpacing real estate peers during a year of change. Over the past year, the shares are up 18%, rebounding further from prior uncertainty and reflecting growing investor confidence in the firm’s strategy. Momentum has returned, helped by JLL’s drive to integrate advanced technology and sharpen its operational focus.

After this surge, are investors overlooking hidden value in JLL, or has the rapid adoption of tech-driven solutions already been factored into the stock’s recent rise?

Most Popular Narrative: 4.2% Undervalued

According to the community narrative, Jones Lang LaSalle is viewed as slightly undervalued by analysts. Their price target is about four percent higher than the company’s current trading price. This reflects optimism around strategic moves and future growth potential.

Accelerating client demand for integrated, sustainable, and energy-efficient real estate solutions is leading to strong activity in Project Management and Leasing. As tenants prioritize scarce high-quality assets, this positions JLL to capture higher advisory fees and margin growth.

Curious how JLL's future could look so bright? The market is abuzz about impending shifts in corporate outsourcing and game-changing technology adoption. Want to see what surprising profit and top-line growth figures are fueling bullish analyst forecasts? Stay tuned to unpack the full valuation backdrop and see what is driving confidence in this real estate leader.

Result: Fair Value of $316.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, possible slowdowns in transactional markets or shifts in office leasing demand could present challenges to JLL’s growth and test analysts’ current expectations.

Find out about the key risks to this Jones Lang LaSalle narrative.Another View: Discounted Cash Flow Perspective

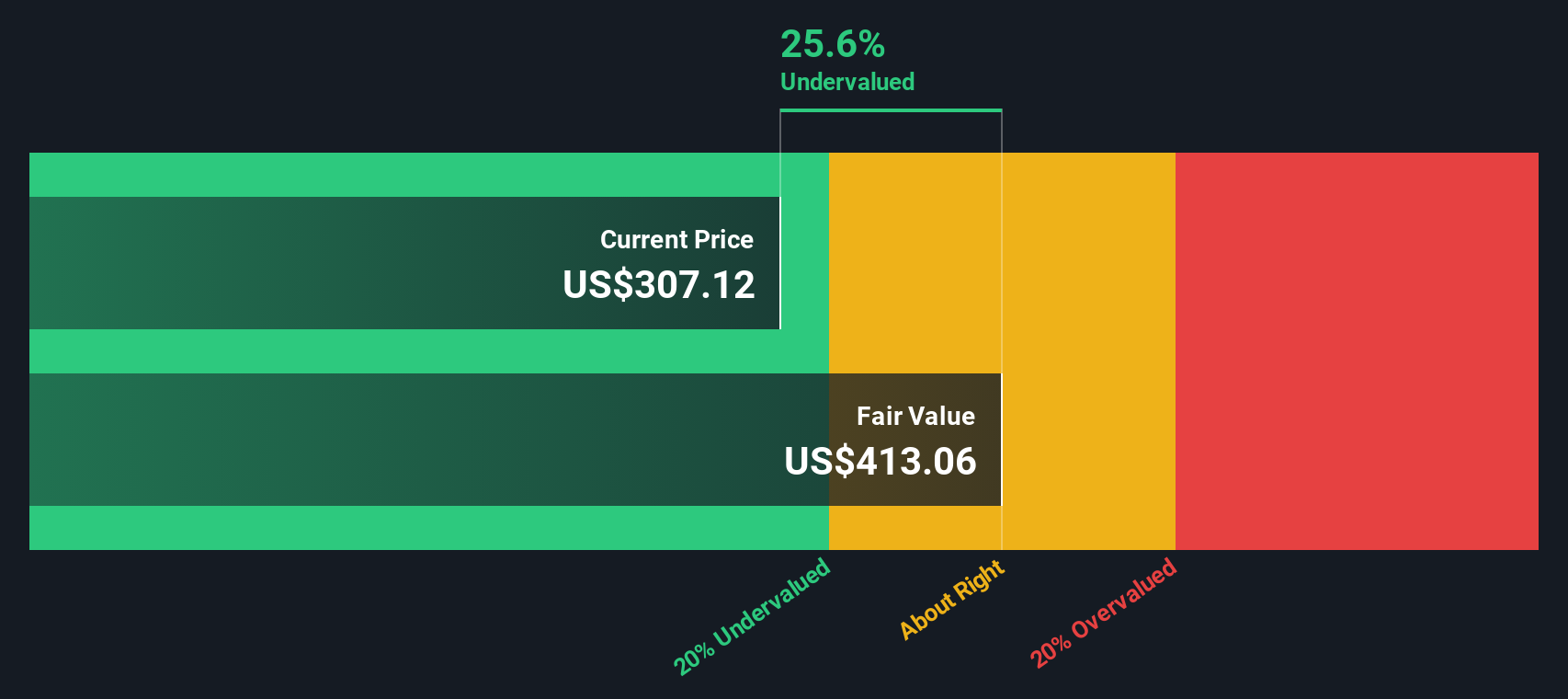

While analysts see a fair price based on profit growth and market assumptions, our DCF model suggests there could be even more value on the table. Could future cash flows paint a different picture than consensus estimates?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Jones Lang LaSalle Narrative

If you have your own take on these numbers or want a hands-on look at the data, it only takes a couple of minutes to craft your own narrative. Why not do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Jones Lang LaSalle.

Ready for More Smart Stock Ideas?

With markets moving fast, it pays to stay ahead of emerging opportunities. Get inspired and put your investing goals into action by tapping into unique stock ideas tailored to your interests. Make your next move count with one of these handpicked opportunities:

- Boost your income stream by tapping into dividend stocks with consistent yields over 3% using dividend stocks with yields > 3%.

- Jump into the future of medicine by spotting healthcare companies that are harnessing the power of artificial intelligence. Find those front-runners with healthcare AI stocks.

- Unlock hidden potential by scanning for undervalued stocks supported by healthy cash flows through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English