Exploring Axos Financial’s (AX) Valuation After Fed Rate Cut Hopes Spark Sector Rally

If you have been watching Axos Financial (AX) lately, you probably noticed the stock popping higher after some dovish comments out of the Federal Reserve. Fed Chair Jerome Powell’s suggestion that the central bank could start considering interest rate cuts took a lot of pressure off financial names, especially regional banks. That kind of policy shift has immediate implications for banks’ funding costs and lending margins, so it is no surprise Axos jumped alongside its peers when the announcement hit.

This latest surge emphasizes what has been a strong year for Axos Financial. The stock has climbed over 31% in the past 12 months and is up an impressive 27% in the past 3 months. It is worth noting this momentum is not coming from thin air, as Axos’s own annual report pointed to growing net income, strategic loan acquisitions, and ongoing share repurchases. As broader market risk perceptions ebb, Axos appears to benefit both from favorable sector winds and the company’s own initiatives.

The question now is whether all this excitement is already priced in, or if there is still a window for investors to get in before markets fully price Axos’s future growth. Is there more room to run, or is caution justified?

Most Popular Narrative: 8.7% Undervalued

According to community narrative, Axos Financial is currently trading at a discount to its estimated fair value. The bullish case rests on forward-looking projections for revenue growth, operating efficiency, and digital innovation, all supported by a moderate discount rate.

Axos is positioned to benefit from the increasing consumer shift toward digital and mobile banking platforms. This supports ongoing expansion of its digital deposit base and enables strong account and loan growth at lower operating costs, which can have a positive impact on both revenue and net margins. The bank's technology investments in artificial intelligence are expected to accelerate product development and drive operating efficiencies. This may allow for improved cost control as the business scales, leading to enhanced operating leverage and potential earnings growth.

Want to know what’s driving this surprising discount? Axos’s narrative centers on tech-fueled banking growth, higher margins, and a finely tuned earnings engine. The key lies in the numbers, including growth rates and profitability assumptions that may not typically be expected from a regional bank. Delve deeper to discover the forecasts and future profit metrics that set this target apart.

Result: Fair Value of $99.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent pricing pressure or a downturn in credit quality could create challenges for Axos's profit margins and threaten the current growth story.

Find out about the key risks to this Axos Financial narrative.Another View: SWS DCF Model vs. Market Metrics

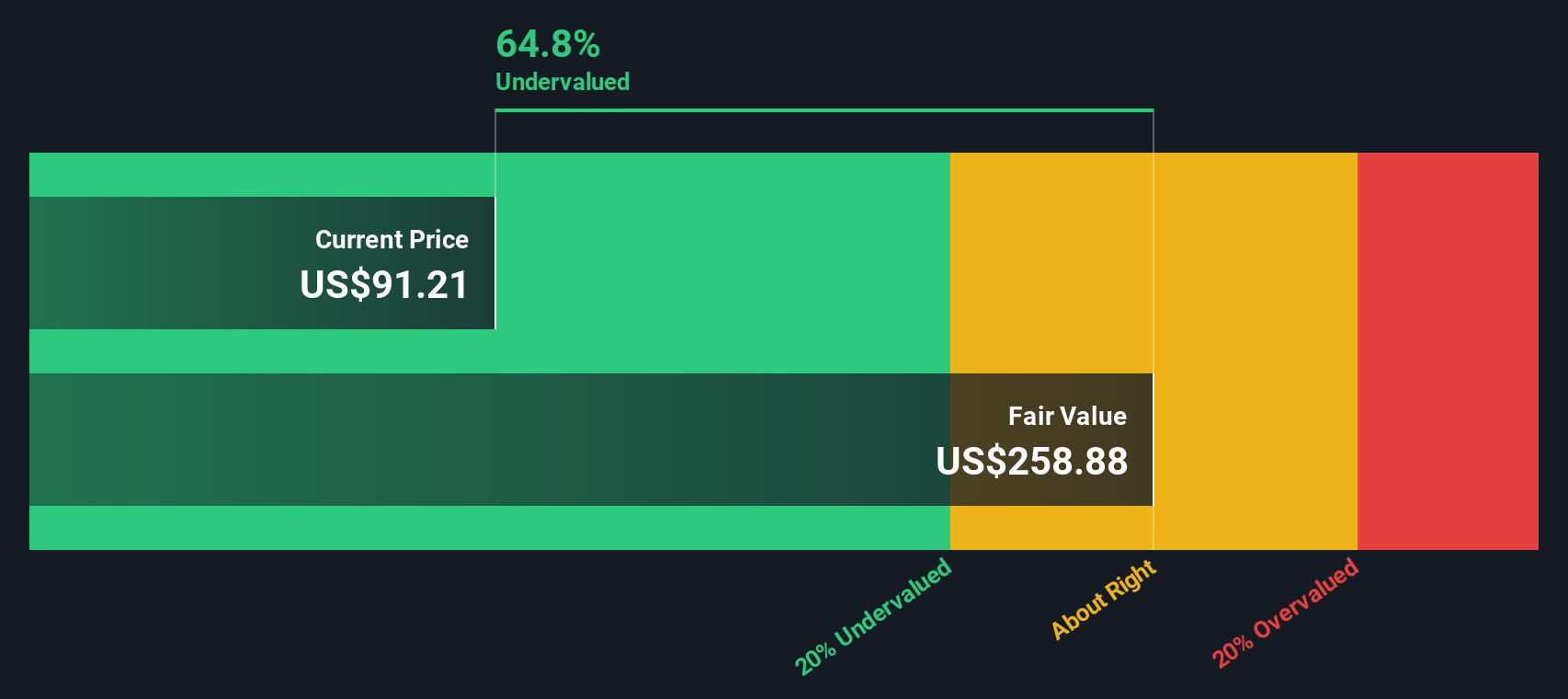

While some investors look to market ratios for quick assessments, our DCF model tells a different story for Axos Financial. This method suggests the company remains well below its estimated intrinsic value and challenges the signals from traditional market pricing. Which approach will better reflect reality as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Axos Financial Narrative

If you want a hands-on approach, the tools here let you dive into the figures and shape your own Axos Financial story in just a few minutes, so you can do it your way.

A great starting point for your Axos Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Position yourself ahead of the market by searching for tomorrow’s winners today. Use these curated ideas to expand your portfolio across the fastest-moving trends and hidden gems that others might overlook. Act now to uncover new ways to grow your wealth and stay a step ahead.

- Tap into next-level healthcare by checking out the growing world of artificial intelligence in medicine with healthcare AI stocks.

- Start earning more income by focusing on companies delivering robust dividends above 3% with dividend stocks with yields > 3%.

- Take advantage of undervalued opportunities based on real cash flow analysis by seeing which stocks stand out using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English