Papa John's (PZZA) Valuation in Focus After Launch of Garlic 5-Cheese Crust Pizza

Most Popular Narrative: 10.5% Undervalued

According to community narrative, Papa John's International is viewed as undervalued by roughly 10.5%, with analysts using a discount rate of 10.2% to estimate its fair value.

The success of loyalty and digital engagement efforts, reflected in a rapidly growing rewards membership base (an increase of 2.7 million since November 2024), higher app conversions, accelerated repeat purchases, and improved brand health metrics, indicates Papa John's is well positioned to benefit from the long-term industry trend toward digital marketing, customer engagement, and tech-enabled scale. This ultimately supports stronger revenue and earnings over time.

Ready to see why analysts give Papa John's a double-digit discount to its so-called fair value? The formula is anything but typical. Bold expectations for future digital-driven growth, evolving customer behavior, and margin trends are all factored into this number. The real recipe for the price target may surprise you.

Result: Fair Value of $51.7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.Still, successful technology investment or faster-than-expected gains from supply chain savings could shift Papa John’s outlook and challenge the prevailing cautious view.

Find out about the key risks to this Papa John's International narrative.Another View: SWS DCF Model Tells a Different Story

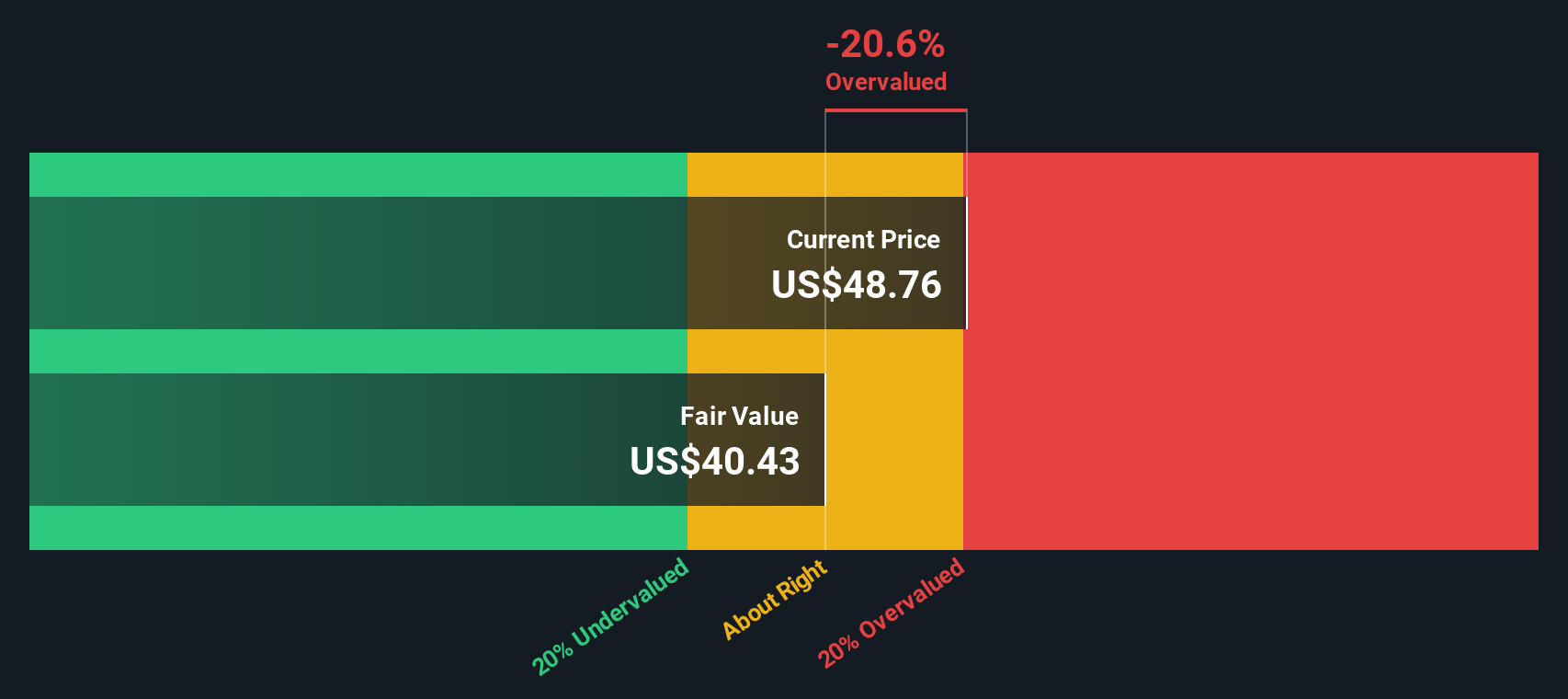

While many see value in Papa John's based on analyst targets, our DCF model presents a more cautious outlook. The model suggests the shares may actually be overvalued if future cash flows fall short of current optimism. Should this more conservative forecast be given greater consideration?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Papa John's International Narrative

If you have a different take or want to dig into the numbers yourself, it’s quick and easy to create your own analysis in just a few minutes. do it your way.

A great starting point for your Papa John's International research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Broaden your horizons and find your next standout opportunity by using powerful strategies from the Simply Wall Street Screener. Act now to spot companies on the move, capitalize on emerging trends, and secure your edge before others catch on. Here are some timely ideas you will not want to miss:

- Supercharge your portfolio with steady income when you check out companies offering dividend stocks with yields > 3% that help keep your returns on track, even in uncertain markets.

- Ride the wave of healthcare innovation and see what’s next by scanning for promising healthcare AI stocks transforming patient outcomes and medical breakthroughs through artificial intelligence.

- Tap into hidden value by zeroing in on undervalued stocks based on cash flows poised for growth based on their strong underlying cash flows. Find tomorrow’s leaders that others may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English