IMAX (IMAX): Valuation in Focus After Earnings Surge and Exclusive "Narnia" Release Deal

Investors have been buzzing about IMAX (NYSE:IMAX) following its quarterly earnings report, which revealed net income more than doubled compared to the previous year. This was partly due to box office wins like “Sinners” and “F1.” That momentum was quickly followed by confirmation that Greta Gerwig’s take on The Chronicles of Narnia will premiere exclusively in IMAX theaters for two weeks before heading to Netflix. This arrangement reinforces IMAX’s special relationship with top filmmakers and gives the company a rare window of exclusivity with a highly anticipated family film.

These back-to-back developments come amid a period of growth for IMAX’s core business. The stock has climbed 23% over the past year and notched a 7% gain year-to-date, even as it eased slightly in the past month. Its rapid gains have outpaced many in the exhibition space, supported by robust revenue and net income growth. Headlines about expanding partnerships, such as new theater builds and enhanced screen experiences, have continued to highlight that IMAX’s premium format is resonating with both studios and audiences.

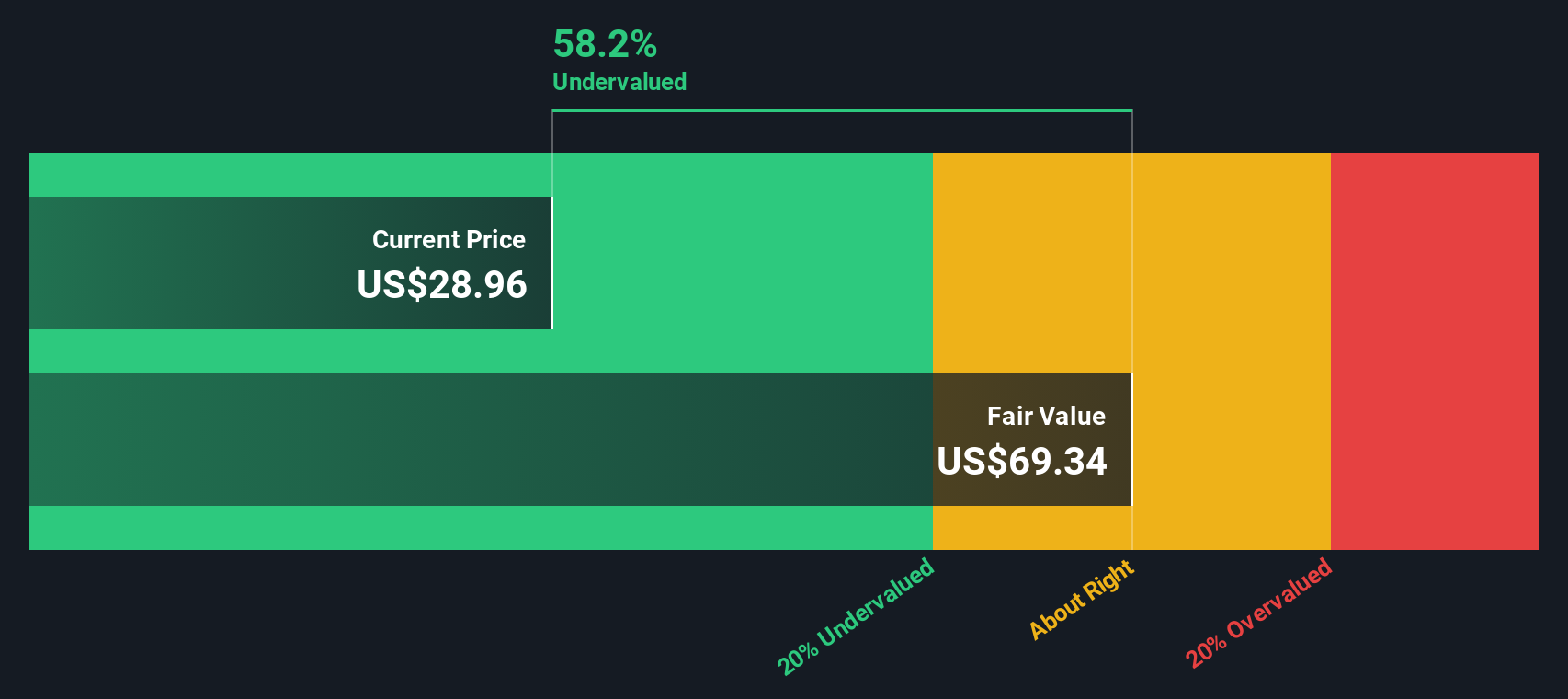

With earnings momentum and high-profile film releases driving attention, the question is whether IMAX still represents a value, or if expectations for future growth are already fully reflected in its share price.

Most Popular Narrative: 17.6% Undervalued

According to community narrative, IMAX is currently considered undervalued, with its fair value calculated to be meaningfully higher than the current share price. This valuation is based on strong growth expectations, improving margins, and a bullish outlook on new installations and premium partnerships.

Rapid acceleration of new system installations, along with a replenishing and geographically diverse backlog driven by consumer demand for premium, differentiated out-of-home entertainment, positions IMAX for continued growth in both top-line revenue and recurring cash flows as its global footprint expands, particularly in high-per-screen-average markets such as North America, Japan, and Australia.

Interested in exploring what’s driving this double-digit undervaluation? This narrative suggests IMAX could achieve a profit surge and margin expansion that may surprise even industry insiders. What are the underlying factors in earnings and revenue growth reflected in these forecasts? Scroll down to discover which assumptions could potentially transform today’s discount into tomorrow’s premium.

Result: Fair Value of $32.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts toward home entertainment or a pause in blockbuster film output could challenge IMAX’s projected growth and put pressure on future earnings momentum.

Find out about the key risks to this IMAX narrative.Another View: DCF Model Offers a Different Perspective

Looking at IMAX from the angle of our DCF model, the outlook tells a somewhat different story than the approach based on earnings multiples. This method also points to an undervalued stock. However, does the long-term cash flow view really line up with market sentiment?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IMAX Narrative

You can always dig deeper into the numbers and form your own outlook. If the current story does not align with your view, or if you prefer to build things from scratch, you can assemble your own in just a few minutes. So why not do it your way?

A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investment journey further by tapping into fresh opportunities that other investors might miss. The Simply Wall Street Screener can help you zero in on themes and stocks aligned with your ambitions. Uncover companies making waves with strong momentum, attractive value, and transformational potential right now:

- Cash in on consistent income by targeting shares with yields above 3%. See which dividend powerhouses could boost your returns through dividend stocks with yields > 3%.

- Accelerate your portfolio’s growth by spotting AI innovators transforming healthcare. Break new ground and access top-performing medical technology stocks via healthcare AI stocks.

- Seize low prices on stocks that show solid future cash flows and tap into overlooked bargains with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English