Marten Transport (MRTN): Assessing Valuation Following Leadership Change and CEO Transition Announcement

If you’re keeping an eye on Marten Transport (MRTN), there’s a big change worth talking about. The company just announced that Timothy Kohl, longstanding CEO, plans to retire at the end of September. Stepping back in is Randolph Marten, the current Executive Chairman and someone with decades of experience inside the company, who will take up both Chairman and CEO titles starting in October. For investors, this kind of leadership transition, especially with a returning executive who has shaped much of Marten’s history, can raise real questions about direction and stability.

The market’s response to these announcements has been cautious so far. Marten Transport’s share price has drifted down around 28% over the past year and nearly 20% year-to-date, with declines stretching over the past several months. That’s despite the company affirming its dividend and reporting steady, if modest, annual growth in both revenue and net income. There is clear evidence that momentum has faded, but the return of a seasoned insider as CEO is now front and center for investors weighing what comes next.

After this leadership shakeup and the stock’s recent slide, the big question is whether Marten Transport is trading at a discount, or if the market is already looking ahead and pricing in everything that new-old leadership might bring.

Price-to-Earnings of 48.3x: Is it justified?

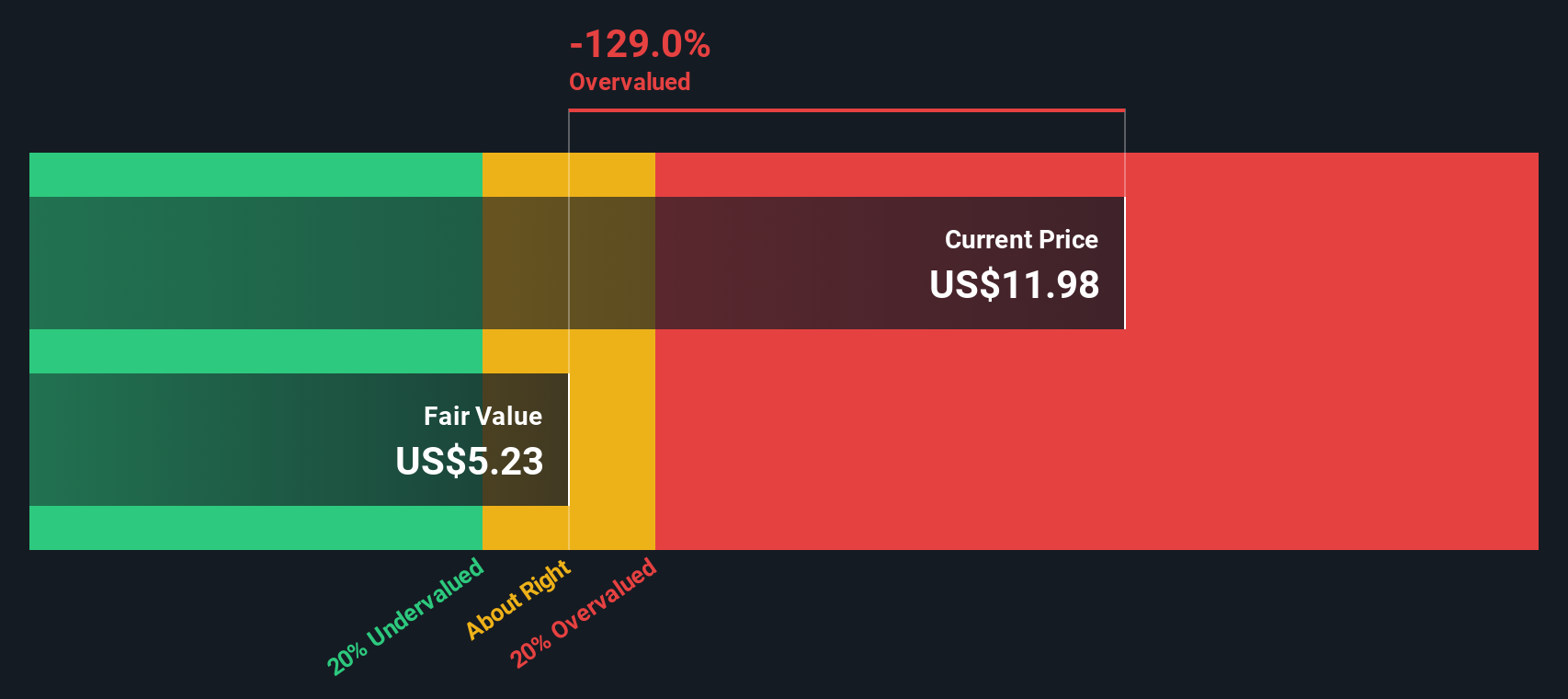

Marten Transport currently trades at a Price-to-Earnings (P/E) ratio of 48.3x, which is significantly higher than both the US Transportation industry average of 28x and the peer average of 18.5x. Compared to the estimated fair P/E ratio of 18.1x, the stock appears expensive.

The Price-to-Earnings ratio measures how much investors are willing to pay for each dollar of current earnings. In the transportation sector, this ratio is commonly used to judge whether a company’s profits justify its stock price, taking into account factors such as stability and expectations for future growth.

Based on current multiples, the market is pricing in high expectations for Marten’s future earnings, which are well above what is typical for its peers. This premium may be difficult to justify given recent profit declines and industry headwinds.

Result: Fair Value of $5.22 (OVERVALUED)

See our latest analysis for Marten Transport.However, persistent declines in share performance and high valuation may spark further volatility if revenue growth or leadership changes do not restore confidence.

Find out about the key risks to this Marten Transport narrative.Another View: What Does the SWS DCF Model Say?

While earnings multiples suggest Marten Transport is expensive, our DCF model paints a similar picture. This approach looks at expected future cash flows, rather than just profits, to gauge value. Does this strengthen the case, or is something missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Marten Transport Narrative

If you want to dig deeper or put your own spin on Marten Transport’s outlook, it takes just a few minutes to uncover your own story. So why not do it your way?

A great starting point for your Marten Transport research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great opportunities do not wait around, and neither should you. Expand your watchlist and strengthen your strategy by looking beyond Marten Transport. Here are three handpicked routes for your next smart investment move:

- Target steady income by tapping into dividend stocks with yields > 3%, which delivers reliable yields above 3% to help boost your portfolio’s cash flow.

- Uncover growth potential in tomorrow’s healthcare leaders by scanning healthcare AI stocks, where advanced AI meets medical innovation for fresh performance drivers.

- Get ahead of tech breakthroughs by reviewing quantum computing stocks, spotlighting companies accelerating the shift to quantum computing and reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English