Strong week for GCL New Energy Holdings (HKG:451) shareholders doesn't alleviate pain of five-year loss

It is doubtless a positive to see that the GCL New Energy Holdings Limited (HKG:451) share price has gained some 48% in the last three months. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 83% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

GCL New Energy Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years GCL New Energy Holdings saw its revenue shrink by 45% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 13% per year in that period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

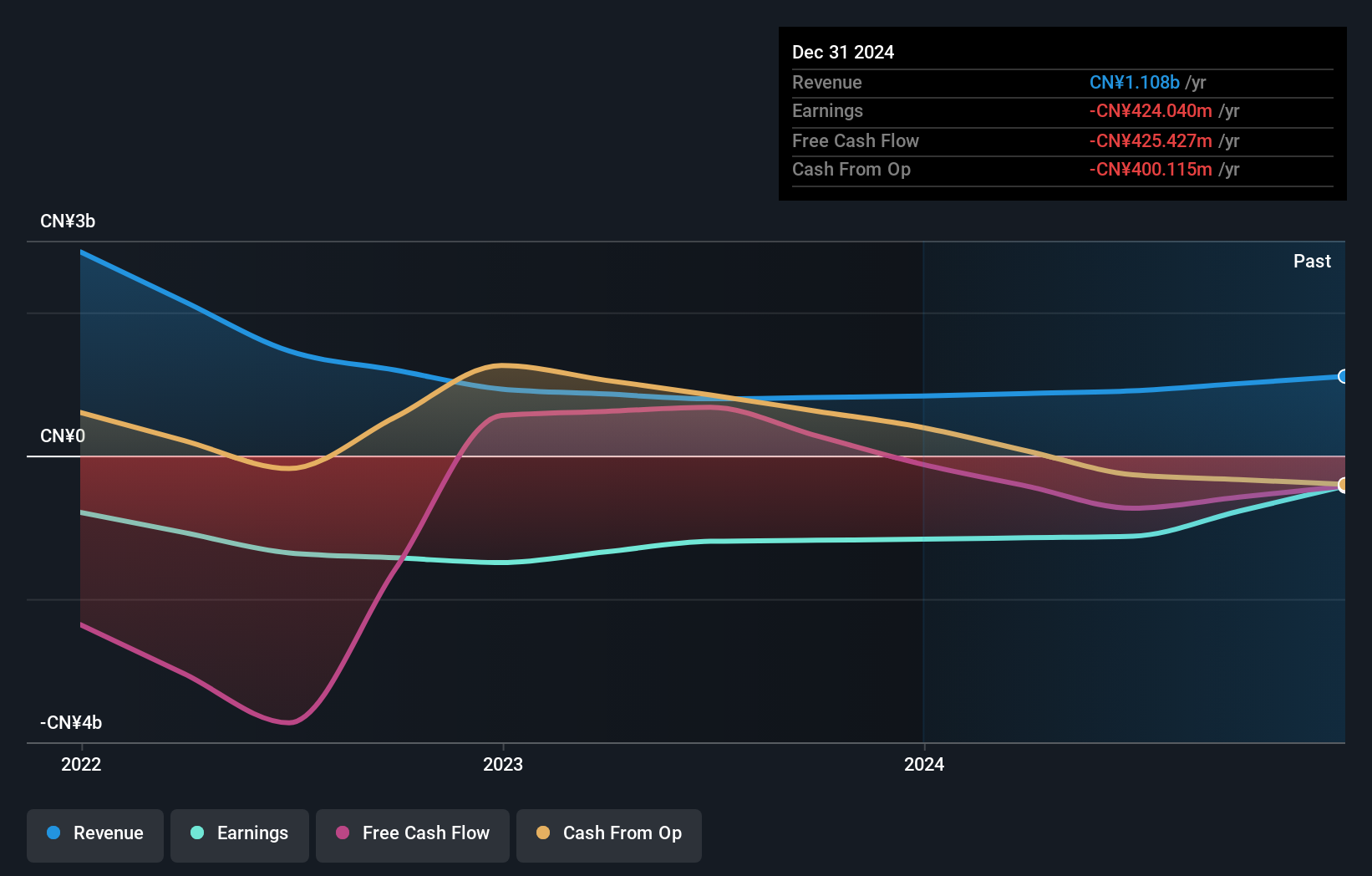

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on GCL New Energy Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

GCL New Energy Holdings' TSR for the year was broadly in line with the market average, at 45%. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 13% over the last five years. While 'turnarounds seldom turn' there are green shoots for GCL New Energy Holdings. It's always interesting to track share price performance over the longer term. But to understand GCL New Energy Holdings better, we need to consider many other factors. Even so, be aware that GCL New Energy Holdings is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English