Offerpad Stock Shoots Up 21% After Hours, While Inno Holdings And Opendoor Take A Breather

After soaring 136.36% on Monday, Offerpad Solutions Inc. (NYSE:OPAD), an iBuying platform, is showing no signs of slowing down, with the stock up another 20.6% after hours at the time of writing this.

The other “meme stock” surge of the day, Inno Holdings Inc. (NASDAQ:INHD), which makes steel-based construction technologies, among other things, is however, taking a breather following its 254.45% rally, with the stock down 10.32% after hours.

See Also: Baby Boomer Turned Meme Stock Trading Into a Thrilling Hobby, Calling It ‘Absolutely’ Gambling

On the other hand, the original iBuying platform, and the company that sparked this latest “meme stock” frenzy, Opendoor Technologies Inc. (NASDAQ:OPEN), is taking a breather from its 790% rally since late June, with the stock declining 9.38% during the day, but rising 0.88% after hours.

Rate Cut Hopes Spur Rally

The common theme across these three companies is a focus on housing and real estate, which investors hope will get a boost following Fed Chair Jerome Powell’s dovish comments and hints at a rate cut in September during his speech at Jackson Hole last week.

Offerpad Solutions and Opendoor, both similar businesses in the iBuying space, are set to benefit from the “unfreezing” of the housing market if the rate cuts are realized, resulting in higher sales activity in a market that has been weighed down by interest rates.

Inno Holdings, however, is more diversified, with subsidiaries in areas such as phone recycling, wholesaling, and more. It, however, has a building technologies business that is set to see tailwinds as interest rates come down.

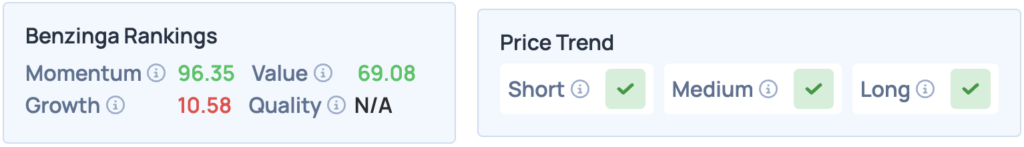

Opendoor shares were down 9.38% on Monday, closing at $4.54 per share, but are up 0.88% after hours. The stock scores high on Momentum and Value in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for more insights, and to see how it compares with Offerpad Solutions.

Read More:

Photo Courtesy: REDPIXEL.PL from Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English