Tilray Stock Continues To Rally After Hours: Here's Why Its Moving

Pharmaceuticals and cannabis lifestyle company, Tilray Brands Inc. (NASDAQ:TLRY), rallied 20.87% on Monday and is now showing no signs of slowing down, with another 4.32% gain after hours, as broad-based tailwinds begin to align in the company’s favor.

Research Note And Schedule III Decision

The key catalyst for the rally was Jefferies analyst Kaumil Gajrawala reiterating a “Buy” rating on the stock, while raising the price target from $1.50 per share to $2, representing an upside of 43.88% from current levels.

See Also: How Is The Market Feeling About Tilray Brands?

This comes amid growing reports of marijuana being rescheduled to Schedule III of the Controlled Substances Act by the end of this year. President Donald Trump is expected to finalize the move over the next couple of weeks and is seen as a major catalyst for the industry.

Stock Closes Above $1 For The Ninth Day

The stock is up 98.57% over the past month, up from a 52-week low of $0.32 per share. Just two weeks ago, the company was considering a reverse split to stay compliant with the Nasdaq’s per-share price rule of maintaining a minimum bid price above $1.

However, since its recent rally, the stock has maintained its bid price above $1 for 9 straight days, and is now just 1 day short of regaining compliance.

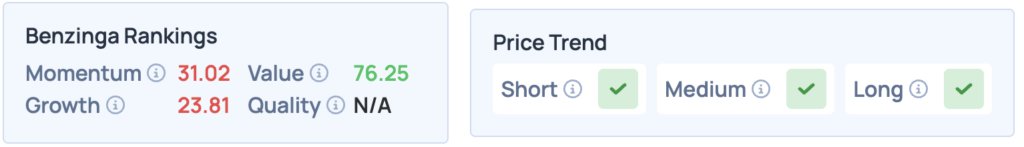

Shares of Tilray Brands were up 20.87% on Monday, closing at $1.39 per share, and are up another 4.32% after hours. The stock scores poorly on Momentum and Growth, but does well on Value, according to Benzinga’s Edge Stock Rankings. It also has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Photo: Viewimage / Shutterstock

Read More:

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English