GoPro Stock Cools Off After Options-Fueled 30% Rally, Company Launches AI Content Initiative

Shares of GoPro (GPRO) are pulling back on Tuesday, following a 30% surge on Monday that was driven by heavy trading and significant options activity. Here’s what investors need to know.

What To Know: Monday’s rally was highlighted by a large block trade in the options market, specifically a sweep of 30,000 April $2 call options, according to data from Benzinga Pro.

This aggressive bullish bet signaled strong speculative interest and helped propel the stock higher Monday on heavy trading volume. Such moves often attract momentum traders, further amplifying the price increase.

Despite the stock's retreat today, GoPro provided a positive fundamental update. On Tuesday morning, the company announced that its subscribers have opted-in more than 125,000 hours of video content for a new AI Training Licensing Program.

This initiative aims to create a new revenue stream by licensing GoPro’s vast library of user-generated, real-world video content to companies for training AI models. GoPro will share 50% of the licensing revenue with the content creators.

This strategic move comes after the company earlier in August reported a challenging second quarter, with revenues down 18% year-over-year.

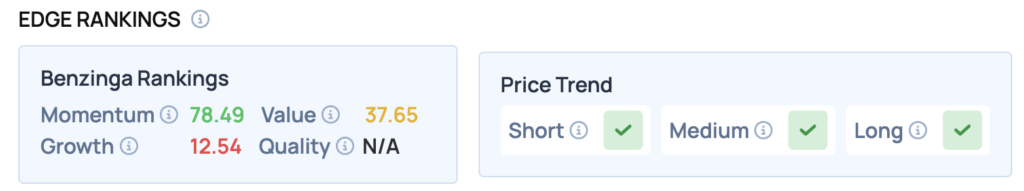

Price Action: According to data from Benzinga Pro, GPRO shares are flat Tuesday morning. The stock has a 52-week high of $2.37 and a 52-week low of $0.40.

Read Also: Palantir Bears Get Cramer’s Blunt Warning: ‘Karp Knows All’

How To Buy GPRO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in GoPro’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English