Cisco Rides AI Boom With $2B Orders: Can It Sustain the Growth Curve?

Cisco Systems CSCO is riding high on the AI infrastructure boom, with AI-related orders crossing $2 billion in fiscal 2025 — twice its initial $1 billion target. In the fourth quarter alone, orders topped $800 million, up from $600 million in the prior quarter, positioning it as a key beneficiary of the accelerating demand for high-performance networking solutions to power artificial intelligence workloads.

The momentum reflects booming demand for high-performance, scalable networking to power massive AI workloads. Cisco’s Ethernet-based solutions, advanced switching platforms and Silicon One networking gear have become critical for hyperscalers, neocloud providers and sovereign cloud clients. Its collaboration with NVIDIA, integrating Nexus switches with Spectrum-X architecture and advancing Secure AI Factory solutions, further strengthens Cisco’s leadership in the long run. Deals in the Middle East with HUMAIN, G42, and Stargate UAE are moving forward and should scale up in the second half of fiscal 2026.

Cisco’s integration of Splunk and its strategic shift toward higher-margin software and subscription offerings now account for 54% of revenues through annual recurring revenues, providing predictable income streams and improved margins. This move reduces reliance on cyclical hardware sales while aligning with the industry trend toward as-a-service models, positioning the company to capture long-term AI growth opportunities.

Cisco’s diversified portfolio, strong hyperscaler relationships and expanding presence with emerging cloud clients provide a solid foundation for sustained growth. The company projects first-quarter fiscal 2026 revenues of $14.65-$14.85 billion and full-year revenues of $59-$60 billion, reflecting confidence in the continuation of its AI-driven momentum and setting the stage for next-generation infrastructure leadership.

Cisco Faces Fierce Rivals in the AI-Infrastructure Race

Arista Networks ANET is rapidly outpacing Cisco in AI infrastructure with 800 Gbps Etherlink platforms, ultra-low latency and advanced features built for hyperscaler clusters. Arista Networks leverages its Linux-based EOS and CloudVision software to deliver superior programmability and real-time workload visibility, strengthening its leadership in AI networking. With AI revenues projected at $750 million in 2025, gross margins above 64%, $8.3 billion in cash, and a $1.5 billion buyback program, Arista Networks underscores both financial strength and competitive superiority over Cisco in next-gen data centers.

Dell Technologies DELL is intensifying competition with Cisco through its “AI Factory” initiative, delivering pre-integrated systems that simplify deployment and speed AI adoption. DELL shipped $1.8 billion in AI servers in the first quarter of fiscal 2026 and commands a $14.4 billion backlog, highlighting stronger enterprise traction. Leveraging its $100 billion hardware scale and supply-chain dominance, DELL demonstrates procurement strength that positions it as a formidable rival to Cisco in the AI-infrastructure race.

CSCO’s Price Performance, Valuation & Estimates

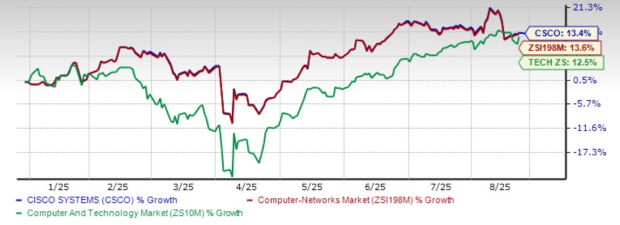

Shares of Cisco have gained 13.4% year to date, outpacing the Zacks Computer and Technology sector’s return of 12.5%, though slightly trailing the Zacks Computer – Networking industry’s growth of 13.6%.

CSCO’s YTD Price Performance

Image Source: Zacks Investment Research

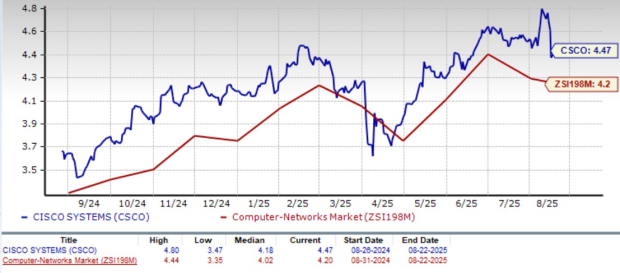

From a valuation standpoint, CSCO appears overvalued, trading at a forward 12-month price-to-sales ratio of 4.47, which is higher than the industry’s 4.2X. Cisco carries a Value Score of D.

CSCO’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for CSCO’s fiscal 2026 earnings is pegged at $4.02 per share, up by a penny over the past 30 days and implying year-over-year growth of 5.51%.

Image Source: Zacks Investment Research

CSCO stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English