Opendoor (OPEN) Stock Surge Continues As Rate Cut Hopes Fuel Real Estate Rally

Shares of Opendoor Technologies Inc (NASDAQ:OPEN) shares are surging again Tuesday, contributing to a 48% gain over the past five trading sessions. The move higher comes amidst a broader rally in the real estate sector, fueled by optimistic signals from the Federal Reserve.

What To Know: The primary catalyst for the bullish momentum was Federal Reserve Chair Jerome Powell’s address last week at the Jackson Hole economic symposium. Powell’s indication that the central bank may be prepared to “adjust our policy stance” and consider interest rate cuts has invigorated investors.

Lower interest rates are a significant boon for the housing market, as they translate into more affordable mortgages for potential buyers, directly benefiting Opendoor’s iBuying business model.

For Opendoor, this favorable macroeconomic environment has amplified its recent impressive performance, which includes a 114% surge over the past month.

Adding to the positive sentiment, Opendoor’s interim CEO, Shrisha Radhakrishna, has recently articulated a vision for the company’s future centered on an AI-driven, multi-product model.

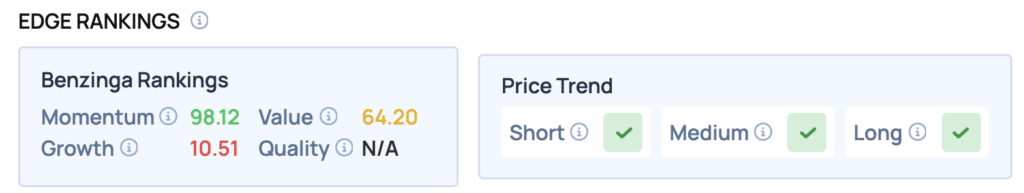

Price Action: According to data from Benzinga Pro, OPEN shares are trading higher by 2.83% to $4.66 Tuesday. The stock has a 52-week high of $5.87 and a 52-week low of $0.51.

Read Also: Opendoor Stock Rallies As Rate Cuts Could ‘Unfreeze’ Housing Market

How To Buy OPEN Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Opendoor Technologies’ case, it is in the Real Estate sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English