MINISO Group Holding (MNSO) Announces Share Buyback of Over 6.9 Million Shares

MINISO Group Holding (MNSO) experienced a 47.86% price increase last quarter, amidst several impactful corporate developments. The announcement of a semi-annual dividend increase and a proactive share buyback of over 6.9 million shares underscored the company's commitment to returning value to shareholders. These actions were coupled with the expansion into the European market, exemplified by the opening of a flagship store in Amsterdam. While the company's net income saw a decline, these shareholder-friendly measures likely added weight to MINISO's robust price move. Meanwhile, broader market trends showed slight gains as investors evaluated potential interest rate cuts.

MINISO Group Holding has 1 risk we think you should know about.

The recent surge in MINISO Group Holding's share price, bolstered by dividend increases and a share buyback, aligns well with the company's narrative of fostering sustained growth through global expansion and strategic partnerships. These shareholder-friendly measures may reinforce investor confidence, despite the company's current challenges with earnings declines. The expansion into the European market, overlayed with their overseas growth strategy, could significantly impact future revenue and margins, suggesting potential upward revisions if execution is successful.

Over a three-year period, MINISO's total return, including share price movements and dividends, recorded a large increase of 321.99%. Moreover, in the past year, MINISO outperformed the US Multiline Retail industry return of 31.2%, signaling strong relative performance. This success highlights investor acknowledgment of the company's proactive actions and international expansion as key drivers of value.

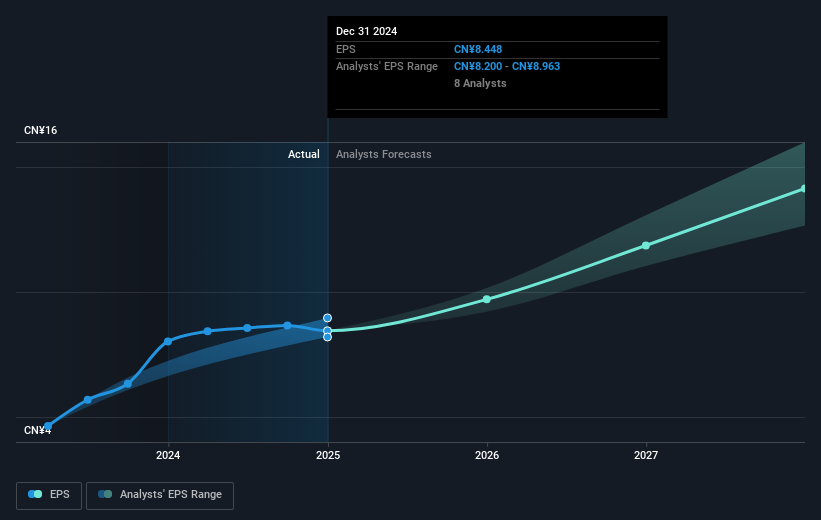

Analysts' revenue and earnings forecasts may see potential adjustments following recent developments, as expansion efforts could elevate both top-line and bottom-line figures, contingent on cost efficiencies and margin improvements. With a current share price of $25.61, the stock is nearing analysts' price target of $26.40, indicating limited short-term upside potential unless further positive catalysts emerge. Investors must consider these projections carefully as they evaluate the company's trajectory.

Understand MINISO Group Holding's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English