Assessing Toast (TOST) Valuation After Robust Q2 Growth, Strong Margins, and International Expansion

If you’re keeping an eye on Toast (TOST), there’s a fresh reason to take another look this week. The company’s latest Q2 earnings report sparked strong interest as Toast unveiled a 25% jump in revenue year over year, with improved net margins. This may indicate that its growth story is entering a new phase. The addition of 148,000 locations and the rollout of new AI-driven products like ToastIQ seem to be making an impact, and the company’s entry into Australia signals an appetite for global expansion that is difficult to ignore.

Earlier momentum in Toast’s share price has been building throughout 2024, with the stock now up 77% over the past year and more than doubling over the past three years. Recent market reaction appears to reflect renewed confidence in Toast’s ability to deliver on international growth and technology innovation. There have been brief declines, such as the 10% pullback last month, but its rebound from that drop has been swift, suggesting continued interest among investors after key milestones and product announcements.

Now comes the critical question: is Toast finally undervalued, or is the market simply factoring in all of its future growth and innovation already?

Most Popular Narrative: 12.8% Undervalued

According to community narrative, Toast is presently considered undervalued. The narrative outlines a compelling case for the company's future, building on integrated digital payments, automation, and a platform designed for expanding recurring revenue streams and operational efficiency.

The rapid adoption of integrated digital payment and ordering solutions, including mobile and contactless experiences, continues to expand Toast's addressable market. This positions the company to capture increased transaction volume and higher recurring fintech and software revenues as restaurants upgrade from legacy systems. Long-term challenges with labor shortages and wage pressures in hospitality drive restaurants to seek automation and operational efficiency, increasing demand for Toast's AI-driven tools (such as ToastIQ and Sous Chef) and productivity-enhancing hardware (Toast Go 3). These factors may support sustained revenue growth and improve net margins.

Curious about the bold assumptions powering this outlook? This fair value assessment relies on dramatic revenue expansion and margin gains that are usually associated with fast-growing market disruptors. Want to know exactly what the narrative projects, and how aggressive these financial targets really are? The answer may surprise you.

Result: Fair Value of $50.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing margin pressure from rising sales costs and lingering hardware challenges could undermine Toast’s growth trajectory if these issues are not managed carefully.

Find out about the key risks to this Toast narrative.Another View: Looking Through a Different Lens

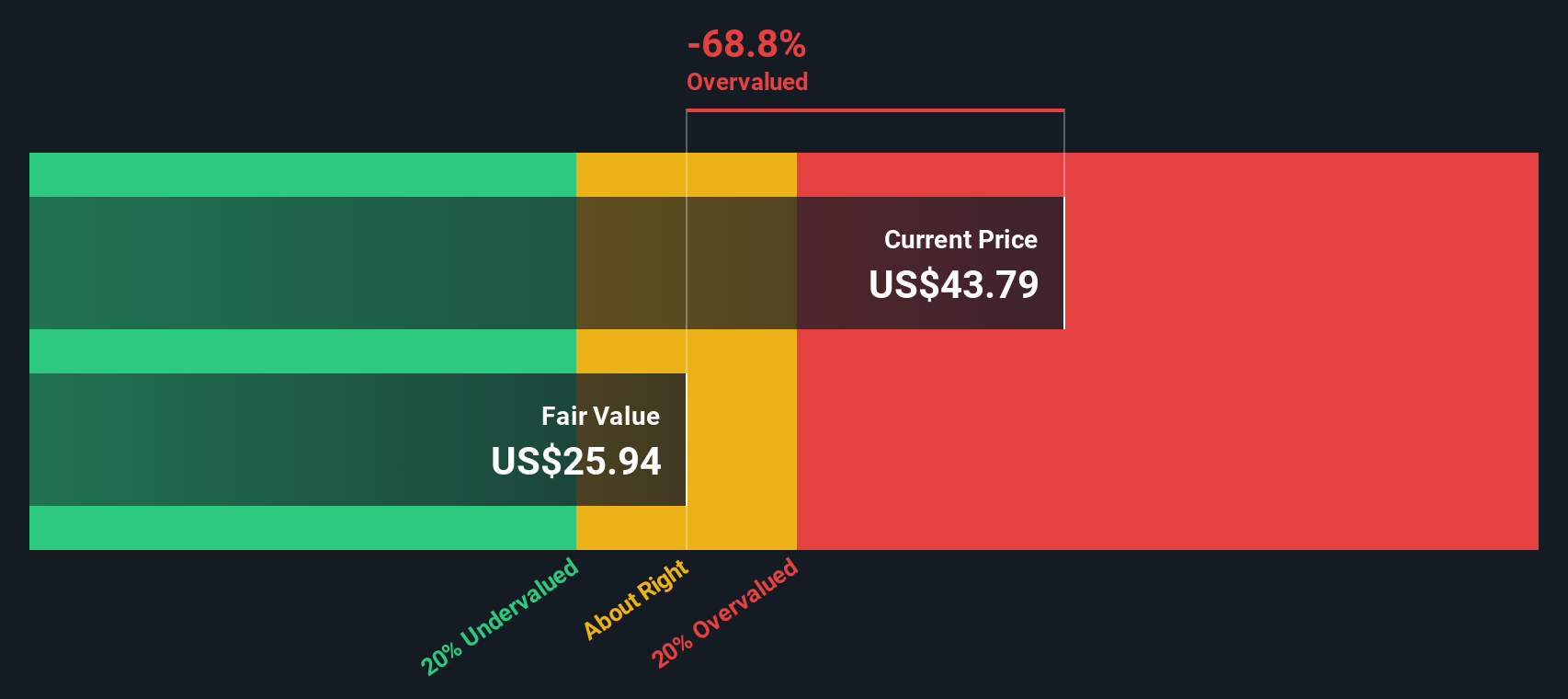

The SWS DCF model tells a different story compared to the community’s outlook, suggesting Toast could actually be overvalued rather than undervalued. Could this come down to more cautious growth assumptions? Or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toast Narrative

If the analysis above doesn't quite match your view, you can always explore the details and craft your own version in just a few minutes. Do it your way.

A great starting point for your Toast research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on unique opportunities across fast-growing sectors and themes. Use the Simply Wall Street Screener to uncover stocks with strong fundamentals, promising trends, and the potential to outperform. Take action now and expand your portfolio with these standout themes:

- Boost your income potential by targeting reliable companies offering higher yields with dividend stocks with yields > 3%.

- Spot undervalued gems primed for growth using undervalued stocks based on cash flows to filter opportunities based on real cash flow strength.

- Get ahead in healthcare innovation by searching for trailblazers revolutionizing medicine through artificial intelligence with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English