Will McGogney’s New Role Signal a Strategic Shift for Criteo (CRTO)’s Growth Ambitions?

- Criteo recently promoted Connor McGogney to Chief Strategy Officer, following his impactful tenure as Chief Business Development Officer where he led key global partnerships and acquisitions, including the purchase of Iponweb.

- This leadership move highlights Criteo’s continued emphasis on advancing its platform capabilities and long-term growth through both partnership development and AI-driven initiatives.

- We'll explore how McGogney's appointment to Chief Strategy Officer could shape Criteo's strategic focus and growth ambitions ahead.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Criteo Investment Narrative Recap

To be a shareholder in Criteo, you need to believe in its ability to drive long-term growth by scaling its AI-powered commerce and retail media offerings, even as major tech competitors exert pressure and the pace of large client spending remains uneven. The appointment of Connor McGogney as Chief Strategy Officer signals a firm commitment to identifying new growth channels and optimizing platform capabilities, but it does not immediately resolve the ongoing risk of stagnant top-line growth and client concentration, which remain key near-term concerns.

One of the most relevant recent announcements is Criteo’s expanded global partnership with dentsu to improve commerce and performance media campaigns. This move aligns closely with management’s focus on deepening partner relationships to broaden market reach, an area where McGogney has a proven background, and is central to countering both client concentration challenges and competitive threats as the company’s AI-driven solutions evolve.

Conversely, investors should keep in mind the persistent uncertainty around monetizing AI agent-based advertising, as the commercial model for these offerings is still...

Read the full narrative on Criteo (it's free!)

Criteo's narrative projects $1.0 billion in revenue and $147.8 million in earnings by 2028. This implies a -19.2% yearly revenue decline and a $11.3 million increase in earnings from the current $136.5 million.

Uncover how Criteo's forecasts yield a $38.17 fair value, a 57% upside to its current price.

Exploring Other Perspectives

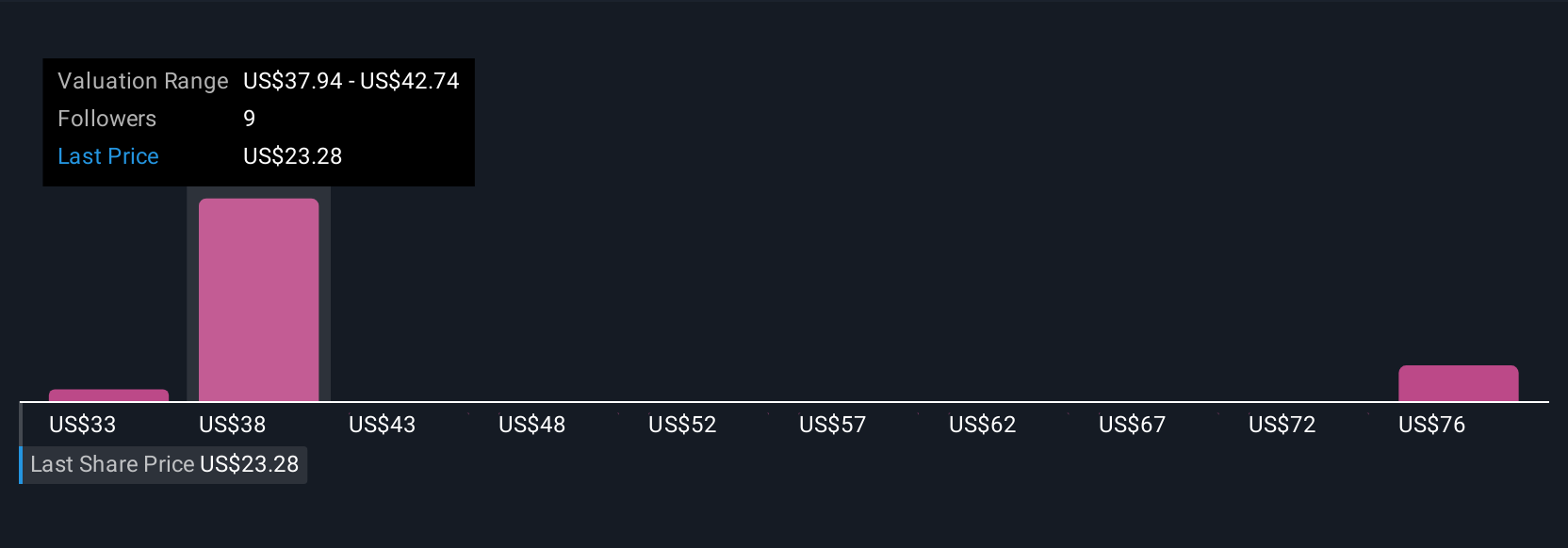

Simply Wall St Community members posted three fair value estimates for Criteo between US$33.14 and US$96.74. As you review these valuations, remember the risk of revenue visibility tied to AI monetization could have material consequences for the company’s future performance. Explore different viewpoints to inform your own opinion.

Explore 3 other fair value estimates on Criteo - why the stock might be worth just $33.14!

Build Your Own Criteo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Criteo research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Criteo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Criteo's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English