This Opendoor Competitor Is Quietly Riding The 'Meme' Stock Frenzy: Momentum Spikes Amid Recent Rallies

Arizona-based iBuying platform, Offerpad Solutions Inc. (NYSE:OPAD), is rallying on the coattails of its biggest competitor, Opendoor Technologies Inc. (NASDAQ:OPEN), as the retail investor frenzy surrounding these stocks generates renewed interest in the segment.

OPAD is having a challenging session. View the charts here.

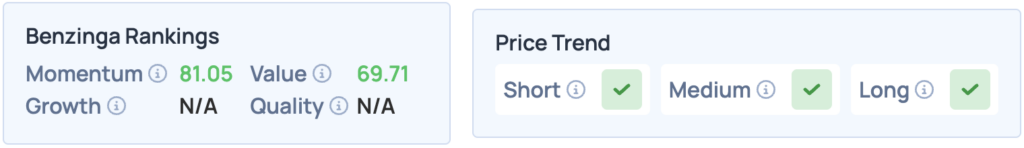

Momentum Score Spikes

Offerpaid’s Momentum score in Benzinga’s Edge Stock Rankings has witnessed a spike over the past 7 days, increasing 74.19 points, from 6.86 to 81.05, with a favorable price trend in the short, medium and long terms. Click here for more insights into the stock, and to see how it compares with Opendoor.

See Also: Opendoor (OPEN) Stock Surges On Rate Cut Hopes: What’s Going On?

Momentum scores in Benzinga rankings are determined based on the relative strength of a stock’s price movements and volatility, ranked as a percentile against other stocks.

Retail Frenzy And Rate Cut Optimism

Shares of Offerpad have surged over 310% over the past two months, with the bulk of this rally coming over the past two weeks.

This was in part fueled by the retail frenzy surrounding Opendoor, which has seen a similar 821% rally in recent months, with many observers and analysts calling it a “meme” stock resurgence. This has since spread to other similar real estate and property-focused platforms, with Offerpad emerging as a key candidate.

Besides this, Offerpad is also being boosted by hopes of a rate cut in September, followed by multiple rounds of easing through 2026. Leading investment banks, such as Morgan Stanley, Goldman Sachs and JPMorgan Chase, have all forecasted the same in recent weeks.

One of Opendoor’s vocal supporters, Anthony Pompliano, referred to the rate cuts as a significant tailwind for the company, and of course, the housing market itself. “Interest rate cuts are big for OPEN. Powell can unfreeze the housing market,” he posted on X last week.

Shares of Offerpad were up 2.47% on Tuesday, closing at $3.73, but are down 0.67% pre-market, at the time of writing this.

Read More:

Photo Courtesy: Garun .Prdt on Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English