RKLB or AVAV: Which Stock Stands Out in the Space Race Now?

With space becoming more congested, the United States has been investing heftily in satellite operations and communications, missile warning systems and space-based ISR to strengthen resilience and maintain the nation’s dominance in future conflicts. As a result, stocks like Rocket Lab USA, Inc. RKLB and AeroVironment, Inc. AVAV, with their deep involvement in the space industry, are drawing heightened investor attention.

Rocket Lab focuses on small satellite launches, spacecraft components and space systems that support both government and commercial missions. On the other hand, AeroVironment, more commonly known for its unmanned aerial vehicles, offers a full suite of space-qualified hardware trusted to fly in geosynchronous, medium and low Earth orbits as well as Cislunar orbits.

With rapidly growing demand for space-based services, a large portion of which is coming from commercial companies these days, both RKLB and AVAV are well-positioned to benefit. Now, let’s take a closer look to determine which of these stocks is a stronger contender in the space economy.

Key Takeaways for RKLB

Recent Achievements: Among Rocket Lab’s achievements worth mentioning include the launch of its 70th Electron mission for a confidential commercial customer this month. The company also completed the acquisition of GEOST, strengthening its position in providing next-generation electro-optical and infrared sensor systems faster.

Rocket Lab also reached an integration milestone for the U.S. Space Force’s Victus Haze mission, thereby demonstrating its capability to deliver responsive space operations, from payload preparation to launch.

The company also announced plans to boost its U.S. investments to expand semiconductor manufacturing capacity and enhance supply-chain security for space-grade solar cells and electro-optical sensors used in national security space missions.

Financial Stability: Rocket Lab ended the second quarter with a cash and cash equivalent of $688 million. Its current debt was $17 million, while its long-term debt totaled $415 million. This indicates that the company maintains a strong solvency position, giving it the ability to keep investing in expanding its manufacturing capacity for integrated spacecraft systems as well as advanced semiconductor and electro-optical technologies.

Challenges to Note: Rocket Lab’s high-cost structure, driven by continued investments in new technologies such as the Neutron launch vehicle, Electron reusability programs and the expansion of its space systems portfolio, often leads to higher expenses, putting pressure on its profitability.

The space industry also requires long development timelines. Programs like Neutron could take longer than anticipated to become fully operational, which may delay revenue generation for RKLB and weigh on its growth outlook.

Key Takeaways for AVAV

Recent Achievements: Among recent achievements secured by AeroVironment worth noticeable are the delivery of its Group 2 P550 small Unmanned Aircraft Systems to the U.S. Army under the Long-Range Reconnaissance program this month. The delivery included multiple P550 systems, along with training support to ensure rapid integration into Transformation in Contact brigades and other designated units.

AVAV also announced a strategic partnership with Sierra Nevada Corp. to develop the next generation of integrated, open-architecture air and missile defense systems in support of the Golden Dome for America program.

In July, AeroVironment revealed “Skyfall,” a mission concept developed with NASA’s Jet Propulsion Laboratory for next-generation Mars Helicopters. This initiative aims to support future human landing missions on Mars through autonomous aerial exploration, with a potential launch target of 2028.

Financial Stability: AeroVironment ended the fiscal fourth quarter of 2025 with cash and equivalents of $41 million. Its long-term debt stood at $30 million, with no notable current maturities. This reflects a strong financial position, enabling AeroVironment to continue expanding its unmanned aerial systems portfolio, enhancing its defense solutions and advancing cutting-edge autonomous technologies that support both military and commercial applications.

Challenges to Note: Aerospace-defense industry headwinds like labor shortage continue to pose a risk for stocks like AeroVironment. Such labor shortages can slow production and delay contract deliveries. A limited workforce also makes it difficult for the company to expand operations in line with rising demand.

The company is also dealing with supply-chain constraints, as access to certain components remains challenging. These issues could disrupt manufacturing schedules, raise costs and limit AeroVironment’s ability to deliver systems on time.

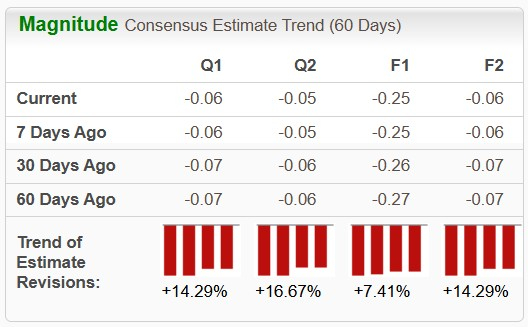

How do EPS Estimates Compare for RKLB & AVAV?

The Zacks Consensus Estimate for RKLB’s 2025 loss is pegged at 25 cents per share, indicating year-over-year improvement. The consensus estimate for revenues is pinned at $587.4 million, implying growth of 34.7%. The company’s near-term EPS estimates have improved over the past 60 days.

Image Source: Zacks Investment Research

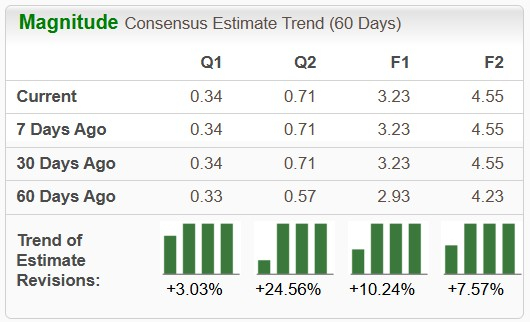

For AVAV, the Zacks Consensus Estimate for 2025 earnings per share (EPS) is pegged at $3.23, indicating a decline of 1.5% from the prior-year quarter. Its consensus estimate for revenues is pinned at $2 billion, implying growth of 144.3%. The company’s near-term EPS estimates have improved over the past 60 days.

Image Source: Zacks Investment Research

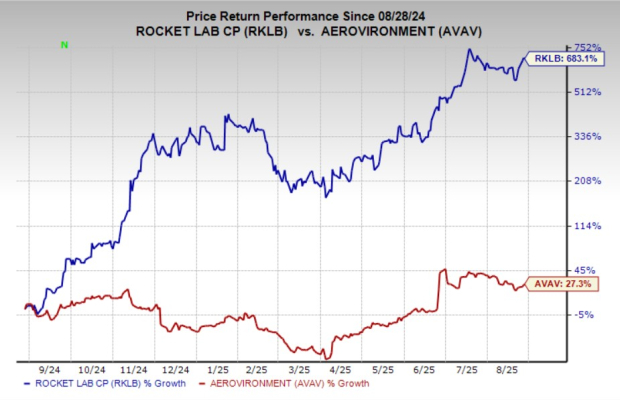

Stock Price Performance: RKLB vs. AVAV

RKLB has outperformed AVAV over the past year. Shares of RKLB have gained 683.1% compared with AVAV’s growth of 27.3%.

Image Source: Zacks Investment Research

AVAV’s Valuation More Attractive Than RKLB

RKLB trades at a forward 12-month Price/Sales (P/S F12M) multiple of 30.09X compared with AVAV’s 5.84X, making the latter relatively more attractive from a valuation perspective.

Image Source: Zacks Investment Research

Conclusion

Both Rocket Lab and AeroVironment are gaining momentum from the surge in space and defense investments.

Rocket Lab has delivered eye-catching stock performance, surging more than 683.1% in the past year, but its lofty valuation raises questions about sustainability. AeroVironment, by contrast, combines a diversified defense and space hardware portfolio with steady earnings and a far more reasonable valuation of 5.8x forward sales.

Thus, for investors looking beyond short-term rallies, AVAV offers a stronger balance of stability, growth potential and value in the space race.

Rocket Lab currently carries a Zacks Rank #3 (Hold), while AeroVironment sports a Zacks Rank #1 (Strong Buy).

You can see the full list of today’s Zacks Rank #1 stocks here.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

See "2nd Wave" AI stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AeroVironment, Inc. (AVAV): Free Stock Analysis Report

Rocket Lab Corporation (RKLB): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English