AeroVironment (AVAV) Partners With ISS to Unveil Next-Gen Vehicle Network Platform

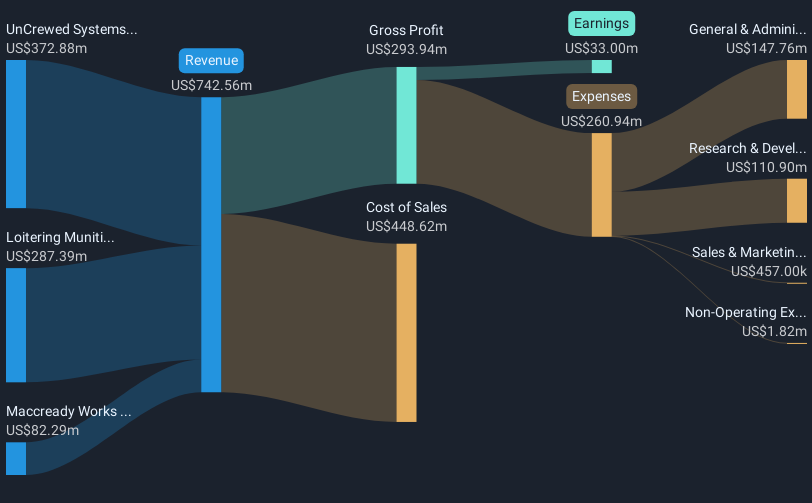

AeroVironment (AVAV) recently announced a significant technology partnership with INTEGRITY Security Services, enhancing their vehicle-to-everything platform. This development, coupled with the company's notable fourth-quarter earnings showing a robust revenue increase, appears aligned with the 39% rise in AeroVironment's share price over the last quarter. Additionally, the company's strategic corporate moves, such as the delivery of P550 systems to the U.S. Army and its addition to the S&P 400, have likely bolstered investor confidence. Despite a generally positive market environment, these key events distinctively highlight AeroVironment’s impressive performance relative to market trends.

The collaboration between AeroVironment and INTEGRITY Security Services could significantly strengthen AeroVironment's vehicle-to-everything platform and influence its growth trajectory, aligning well with its strategic expansion into new sectors. Over the last five years, AeroVironment's shareholders have witnessed a total return of 212.21%, reflecting the company's substantial progress despite market fluctuations. This growth contrasts with the past year's challenging results, where the US Aerospace & Defense industry outpaced AeroVironment with a 33.9% return.

AeroVironment's recent advances may positively influence revenue and earnings forecasts. As demand for unmanned and autonomous systems rises, the company's partnerships and product developments could drive revenue growth. Analysts forecast revenue to increase at a 22.3% annual rate, potentially supporting enhanced profitability. However, challenges such as integration and reliance on government contracts could affect future performance.

The recent share price of US$245.90 contrasts with an analyst price target of US$286.94, offering a potential price appreciation of 16.89%. This suggests room for investor optimism, assuming the company's growth drivers materialize. While AeroVironment trades at a higher valuation compared to the industry, the anticipated revenue growth and strategic partnerships could justify the premium in the long term. Investors should remain vigilant to risks such as government funding dependencies and integration challenges with BlueHalo.

Explore historical data to track AeroVironment's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English