Should Icahn Enterprises’ (IEP) $500 Million Debt Refinancing Prompt a Closer Look From Investors?

- On August 19, 2025, Icahn Enterprises L.P. and Icahn Enterprises Finance Corp. closed the sale of an additional US$500 million in 10.000% Senior Secured Notes due 2029, using the proceeds to partially redeem existing 6.250% Senior Notes due 2026.

- This refinancing transaction alters the company's debt structure and interest expense profile, which is a key focus for both equity and credit analysts.

- With a significant refinancing move impacting its capital structure, we explore how this development shapes Icahn Enterprises' investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is Icahn Enterprises' Investment Narrative?

For Icahn Enterprises, the big picture centers on whether investors believe in a turnaround story for a business that has struggled with consistent profitability and revenue growth. The recent US$500 million refinancing, shifting debt from 6.250 percent notes due 2026 to higher-cost 10 percent secured notes due 2029, reflects an urgent focus on managing upcoming maturities, but it also raises the company's interest expense at a time when its earnings remain under pressure and dividends are not well covered by cash flows. Previously, concerns focused on ongoing losses, weak short-term catalysts, and legal risks. Now, with this refinancing, the immediate risk of a near-term cash crunch eases, but the cost of capital rises and net losses remain a critical hurdle. Price action since the news suggests the impact may be modest, so the core risks around balance sheet strength and earnings sustainability persist. However, for those who see value in Icahn Enterprises’ assets and hope for operational improvement, this refinancing may appear as a step toward stability.

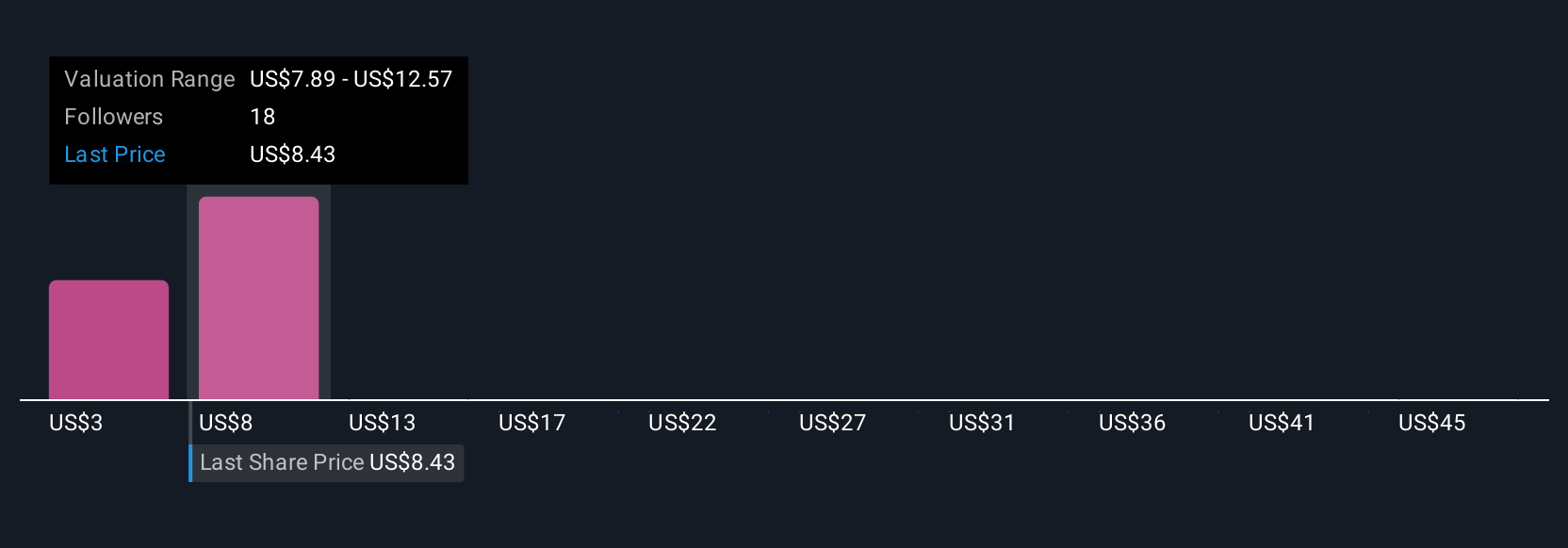

But the rising interest burden could put further pressure on dividend safety, a detail investors should not ignore. Icahn Enterprises' shares are on the way up, but they could be overextended by 9%. Uncover the fair value now.Exploring Other Perspectives

Explore 7 other fair value estimates on Icahn Enterprises - why the stock might be worth less than half the current price!

Build Your Own Icahn Enterprises Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Icahn Enterprises research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Icahn Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Icahn Enterprises' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English