A Fresh Look at Coeur Mining’s (CDE) Valuation After Surprising Cash Flow and Debt Repayment

If you have been watching Coeur Mining (NYSE:CDE), the company just gave investors something extra to think about. Coeur Mining reported a second quarter free cash flow of $146 million, which handily exceeded expectations, and delivered earnings per share of $0.20, beating forecasts. Just as importantly, management expanded the company’s cash reserves and paid off its revolving credit facility in full. These moves send a strong message about disciplined financial management and are a signal that the company’s operational performance is translating into real financial gains.

This splash of good news has not gone unnoticed by the markets. Over the past month, Coeur Mining’s stock climbed 37%, and it is up 105% over the past year. That is a marked shift in momentum compared to its more modest five-year return. The combination of outperformance on free cash flow, higher earnings, and a cleaner balance sheet has prompted renewed interest in the stock and could suggest that investors see more upside or at least reduced risk going forward.

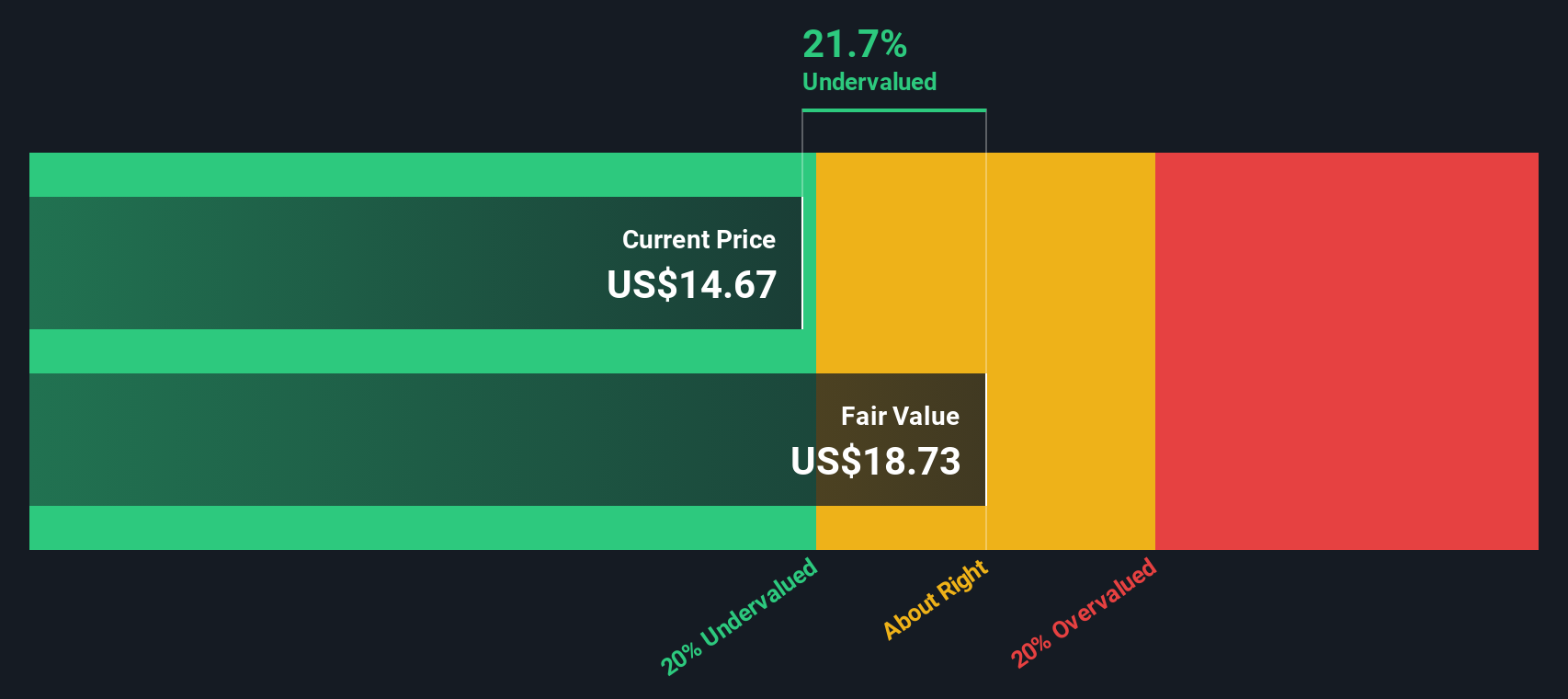

The big question now is whether Coeur Mining’s recent runup still leaves more room for growth, or if the market has already incorporated these positive developments.

Most Popular Narrative: 3% Undervalued

According to community narrative, Coeur Mining is currently trading modestly below its estimated fair value, with analysts projecting room for upside based on strong projected profit and margin growth. The narrative hinges on expectations of continued sector tailwinds, operational improvements, and disciplined management driving robust future earnings.

The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production. This is positioning Coeur for robust revenue and earnings growth in the near to medium term. Strengthened operational efficiencies, reflected in declining cost applicable to sales per ounce and process improvements at key mines, are improving operating leverage and could further support margin expansion and cash generation.

What is powering this valuation narrative? There are some dramatic financial projections, bold margin expectations, and a numerical growth roadmap at its foundation. Want to know the three factors that analysts argue could move the price even higher? The full narrative holds the answers. Find out exactly what is behind Coeur’s fair value call.

Result: Fair Value of $12.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory challenges and potential production delays could undermine analyst optimism. These factors may also make future earnings less predictable for Coeur Mining.

Find out about the key risks to this Coeur Mining narrative.Another View

Looking at things from a different angle, our DCF model suggests a deeper undervaluation compared to the first approach. Could this indicate that the market is overlooking certain factors, or are the future growth expectations too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coeur Mining Narrative

If you think there is more to the story or want to analyze the numbers in your own way, you can build your own company narrative in just a few minutes. Do it your way.

A great starting point for your Coeur Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your investing horizons and stay ahead of the curve by checking out a few standout opportunities powered by the Simply Wall Street Screener. This opens the door to focused research that highlights unique strengths and untapped potential you might otherwise miss out on.

- Accelerate your search for market gems by uncovering penny stocks with strong financials with solid financial foundations and hidden growth prospects.

- Supercharge your portfolio with healthcare AI stocks that are bringing artificial intelligence breakthroughs into medical advancements and reshaping patient outcomes.

- Boost your income focus with dividend stocks with yields > 3% that consistently deliver strong yields and put financial stability at the forefront.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English