Amid Trump's Fresh Tariff Threats, These 2 Furnishing Stocks Look Set For A Breakout: Growth Metrics Soar Over The Past Week

Two leading furniture stocks look all set for a breakout, with big spikes in their Growth metrics in Benzinga’s Edge Stock Rankings over the past week. This comes amid mounting tensions surrounding fresh trade and tariff-related uncertainties for the sector.

Two Furnishing Stocks With Big ‘Growth’ Spikes

Benzinga assigns Growth scores to a stock based on the pace of expansion in its earnings and revenues historically, relative to others. It is worth noting that in addition to historic trends, the score also takes into account the stock and the company’s recent performance.

See Also: Cramer Blasts Trump’s Furniture Tariffs: ‘Ship Has Sailed’ For The American Sofa

Over the past week, two furniture stocks have witnessed a big jump in their Benzinga Edge Growth scores, while the industry itself is now under the cloud of further escalation in trade and tariff-related issues.

Late last week, President Donald Trump launched a national security investigation into furniture imports, while saying, “Furniture coming from other Countries into the United States will be Tariffed at a Rate yet to be determined,” rattling the stocks of most furniture manufacturers and retailers.

1. Ethan Allen Interiors Inc.

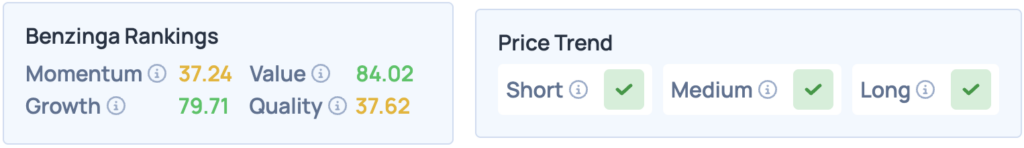

A leading American manufacturer and retailer of home furnishings, Ethan Allen Interiors Inc. (NYSE:ETD) saw its Growth score jump from 36.73 to 79.71, up by an impressive 42.98 points within the span of a week.

This can be attributed to the company’s strong fourth-quarter performance, where it beat consensus estimates at the top and bottom lines, while announcing a special dividend of $0.25 per share. The stock is up 7.61% year-to-date, after mounting a recovery from its “Liberation Day” lows.

According to Benzinga’s Edge Stock Rankings, the stock scores well on Growth and Value, while having a favorable price trend in the short, medium and long terms. Click here for deeper insights into the company, its peers and competitors.

2. Flexsteel Industries Inc.

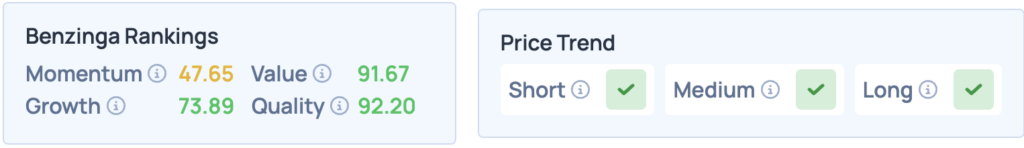

A furniture-maker known for its recliners, Flexsteel Industries Inc. (NASDAQ:FLXS) has seen its Growth score spike 37.68 points, from 36.21 to 73.89, within a week.

The company released its fourth-quarter earnings this month, beating analyst consensus estimates at the top and bottom lines, despite tariff pressures and inflationary concerns taking a toll on its consumers. The stock spiked following the results, and is currently up 24.41% over the past one month, but is down 14.21% year-to-date.

The stock scores high on Growth, Quality and Value in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, and to see how it compares with Ethan Allen, and other peers and competitors.

Read More:

Photo courtesy: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English