Ciena (CIEN) Is Up 7.0% After Record 1.6 Tbps Single-Wavelength Fibre Transmission in South Africa

- Earlier this week, DFA announced a world-first achievement in fibre capacity, successfully transmitting 1.6 Tbps over a single wavelength using Ciena's WaveRouter and WaveLogic 6 Extreme solutions on a 40 km stretch of their high-capacity network in South Africa.

- This breakthrough enhances network scalability and efficiency by integrating multiple high-speed services into a single router, highlighting Ciena's innovative position in optical and routing technology.

- We'll examine how this major milestone in single-wavelength capacity could reinforce Ciena's competitive edge and future market positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Ciena Investment Narrative Recap

To believe in Ciena as a shareholder, you need to have confidence that the company's optical innovations will keep it at the forefront of high-speed connectivity and position it as a go-to partner for cloud and service providers globally. The recent DFA news demonstrates Ciena's technical leadership, reinforcing the company's competitive edge and supporting positive demand from cloud and AI traffic. However, it does not materially change the critical short-term catalyst, which remains sustained order growth from major cloud clients, nor does it reduce the risks tied to revenue concentration or sudden shifts in client investment patterns.

Among recent announcements, the news of BR.Digital deploying Ciena's WaveLogic 6 Extreme technology to achieve 1.1 Tbps over 800 km stands out. Like the DFA breakthrough, it shows Ciena's ongoing ability to deliver record-setting optical performance, supporting the catalyst of rising demand for ultra-high-capacity, efficient optical solutions, the same demand underpinning Ciena's cloud and AI-driven revenue expansion.

In contrast, while technical breakthroughs support the growth story, investors should also be aware of...

Read the full narrative on Ciena (it's free!)

Ciena's outlook forecasts $5.7 billion in revenue and $463.9 million in earnings by 2028. This projection is based on an annual revenue growth rate of 10.4% and an increase in earnings of $359.1 million from the current $104.8 million.

Uncover how Ciena's forecasts yield a $87.50 fair value, a 6% downside to its current price.

Exploring Other Perspectives

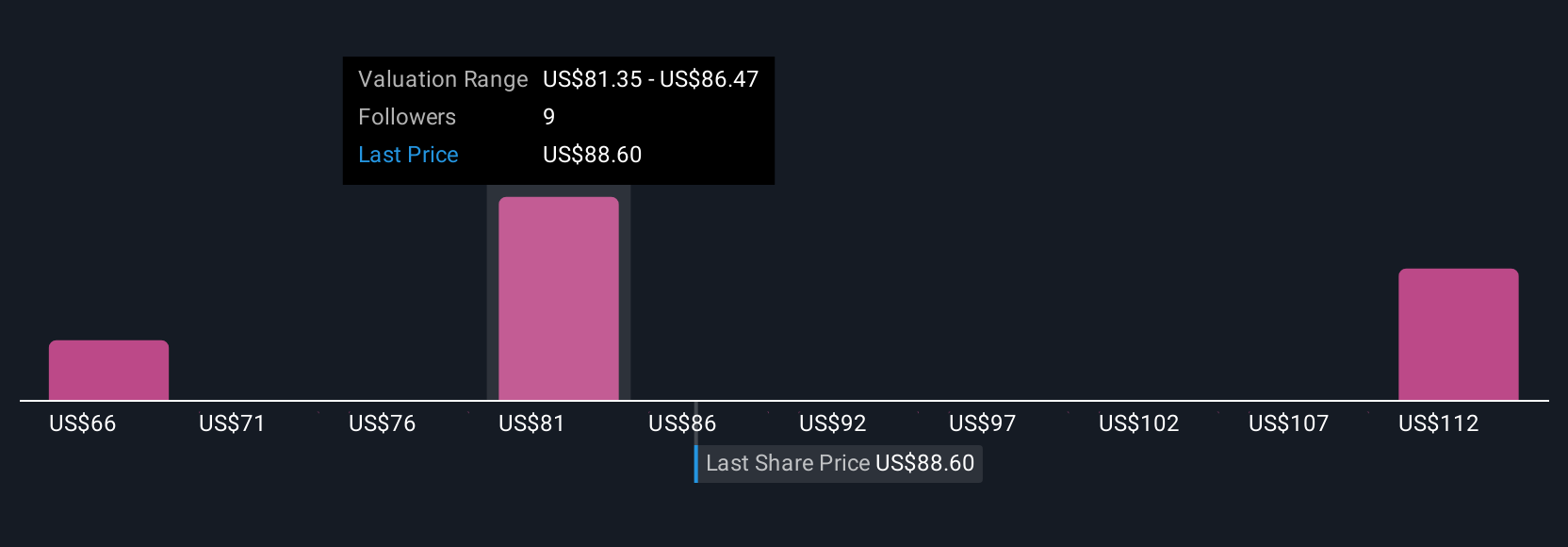

Five Simply Wall St Community fair value estimates for Ciena range widely from US$66 to US$107.90 per share. While many see growth from rising cloud and AI traffic, the risk of concentrated revenue from top clients still shapes the debate on future potential.

Explore 5 other fair value estimates on Ciena - why the stock might be worth 29% less than the current price!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English