3 Dividend Stocks With Up To 4.7% Yield For Your Portfolio

As the S&P 500 reaches record highs, driven by anticipation around major earnings reports such as Nvidia's, investors are closely monitoring market dynamics and policy shifts that could impact their portfolios. In this environment of heightened market activity, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to balance risk with reward.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.26% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.48% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.84% | ★★★★★★ |

| Ennis (EBF) | 5.40% | ★★★★★★ |

| Dillard's (DDS) | 4.74% | ★★★★★★ |

| DHT Holdings (DHT) | 8.22% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.27% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.53% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.47% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.25% | ★★★★★☆ |

Click here to see the full list of 123 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

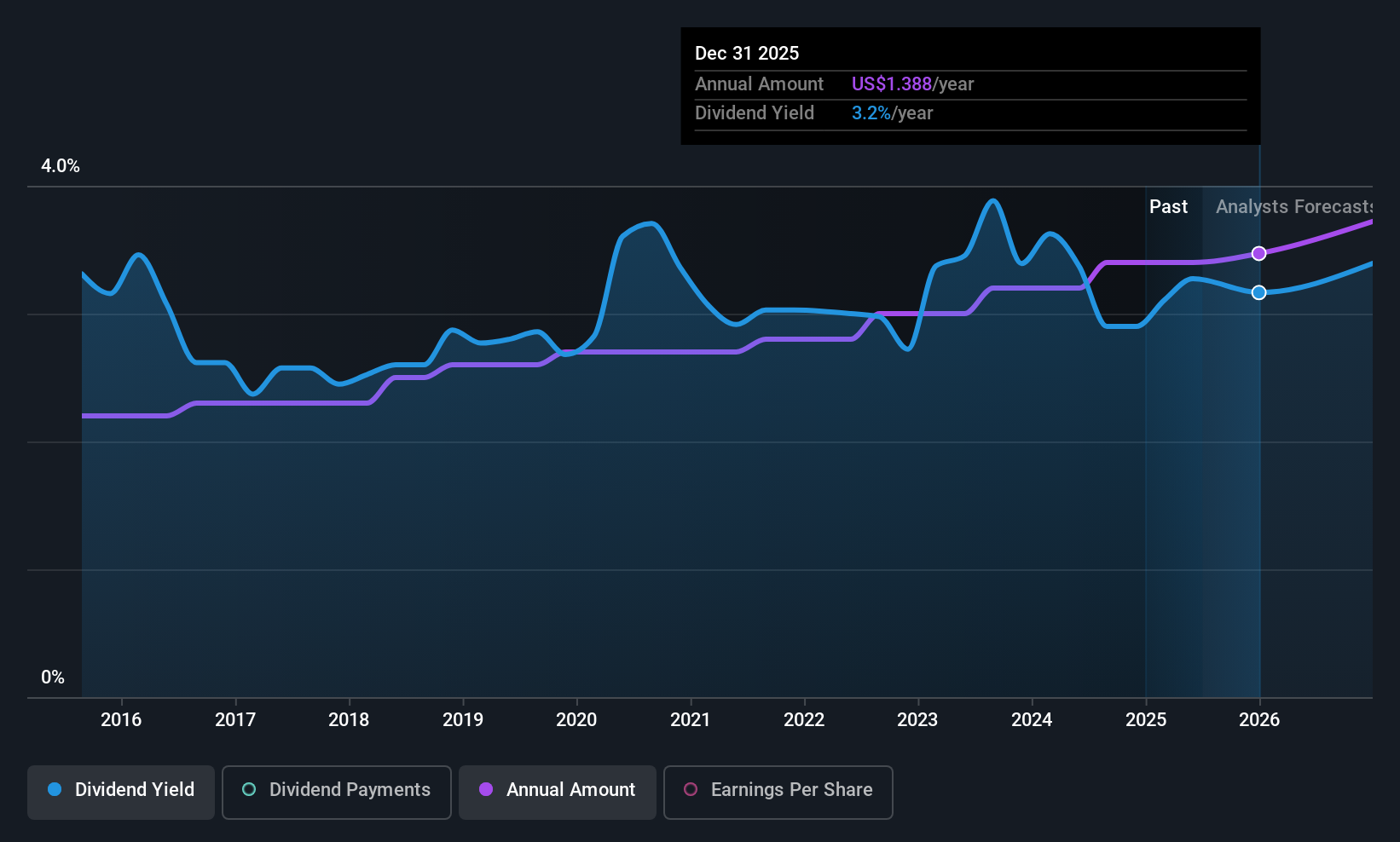

NBT Bancorp (NBTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NBT Bancorp Inc. is a financial holding company offering commercial banking, retail banking, and wealth management services with a market cap of $2.35 billion.

Operations: NBT Bancorp Inc. generates its revenue through diverse segments including commercial banking, retail banking, and wealth management services.

Dividend Yield: 3.3%

NBT Bancorp recently announced an 8.8% increase in its quarterly dividend to US$0.37 per share, marking the thirteenth consecutive year of annual increases, highlighting its commitment to returning value to shareholders. Despite a decline in net income for Q2 2025 compared to the previous year, net interest income showed improvement. The company's dividend yield is lower than top-tier US dividend payers but remains reliable and stable over the past decade with a low payout ratio of 49%.

- Unlock comprehensive insights into our analysis of NBT Bancorp stock in this dividend report.

- Our comprehensive valuation report raises the possibility that NBT Bancorp is priced higher than what may be justified by its financials.

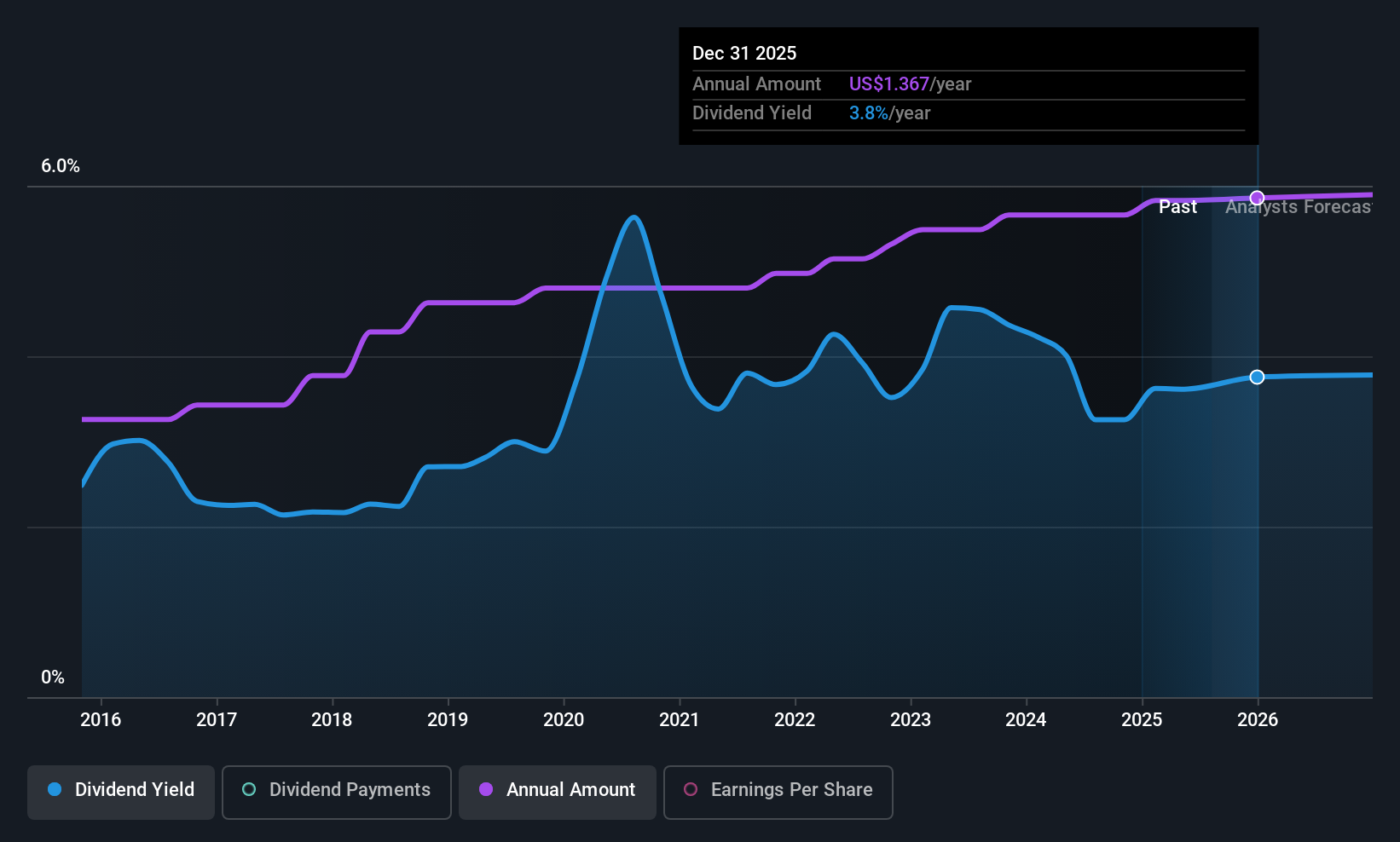

S&T Bancorp (STBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S&T Bancorp, Inc. is the bank holding company for S&T Bank, offering retail and commercial banking products and services to consumers, commercial entities, and small businesses in Pennsylvania and Ohio, with a market cap of approximately $1.51 billion.

Operations: S&T Bancorp, Inc. generates revenue primarily through its Community Banking segment, which accounts for $388.49 million.

Dividend Yield: 3.4%

S&T Bancorp's recent dividend increase to $0.34 per share reflects a 3.03% rise, maintaining a reliable and stable dividend history over the past decade. Despite lower net income for Q2 2025 compared to the previous year, dividends remain well-covered by earnings due to a low payout ratio of 19.9%. The current yield of 3.41% is below top-tier US dividend payers but offers consistent growth and stability in its payouts.

- Click to explore a detailed breakdown of our findings in S&T Bancorp's dividend report.

- Our expertly prepared valuation report S&T Bancorp implies its share price may be lower than expected.

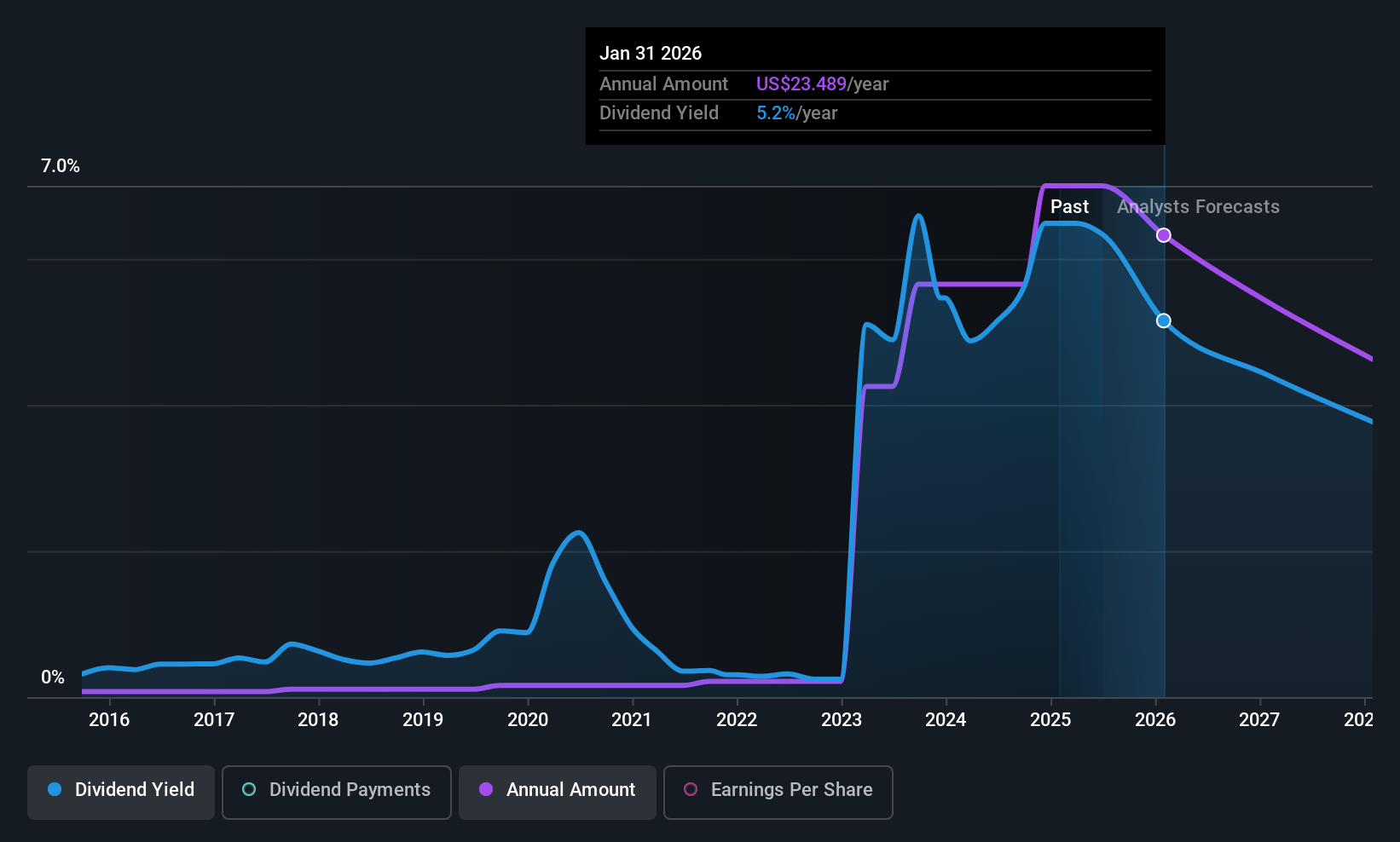

Dillard's (DDS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. operates retail department stores across the southeastern, southwestern, and midwestern United States with a market cap of approximately $8.20 billion.

Operations: Dillard's, Inc. generates revenue through its Retail Operations segment, which accounts for $6.32 billion.

Dividend Yield: 4.7%

Dillard's recently declared a cash dividend of $0.30 per share, maintaining a stable and attractive dividend yield of 4.74%, which ranks in the top 25% among US market payers. The company's dividends are well-covered by earnings with a low payout ratio of 2.8% and supported by cash flows at a reasonable cash payout ratio of 52.7%. Despite slight declines in net income, Dillard’s continues to demonstrate reliable dividend growth over the past decade.

- Get an in-depth perspective on Dillard's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Dillard's is trading behind its estimated value.

Next Steps

- Explore the 123 names from our Top US Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English