Insider-Favored Growth Companies To Watch In August 2025

As the S&P 500 reaches record highs, buoyed by investor optimism and anticipation around major tech earnings like Nvidia's, the U.S. market continues to demonstrate resilience amidst evolving economic policies. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, aligning well with current market enthusiasm for robust corporate performance.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Prairie Operating (PROP) | 31.1% | 86.3% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| Hippo Holdings (HIPO) | 14.1% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63% |

| Credo Technology Group Holding (CRDO) | 11.5% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.2% |

| Astera Labs (ALAB) | 12.3% | 37.1% |

We'll examine a selection from our screener results.

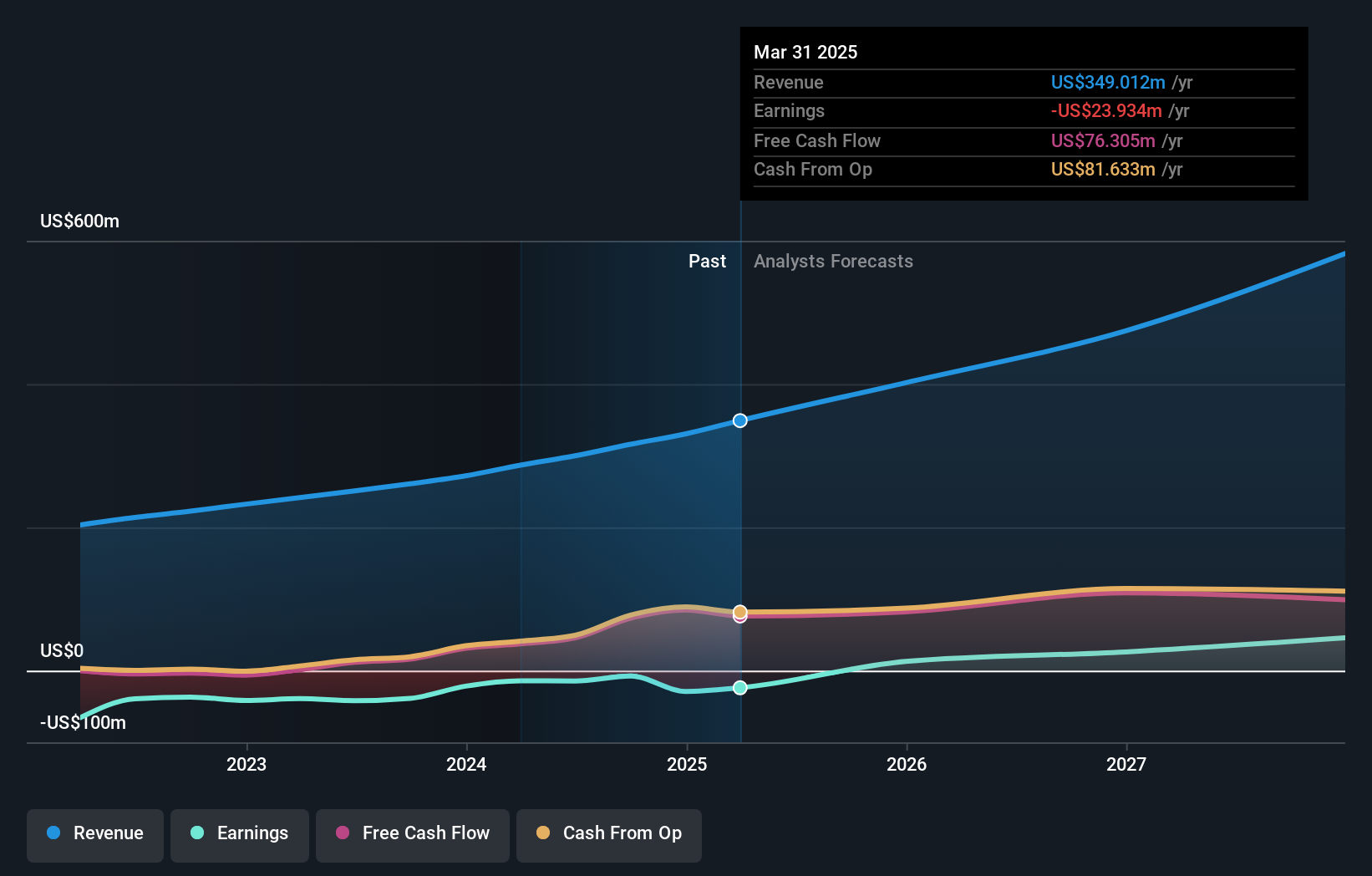

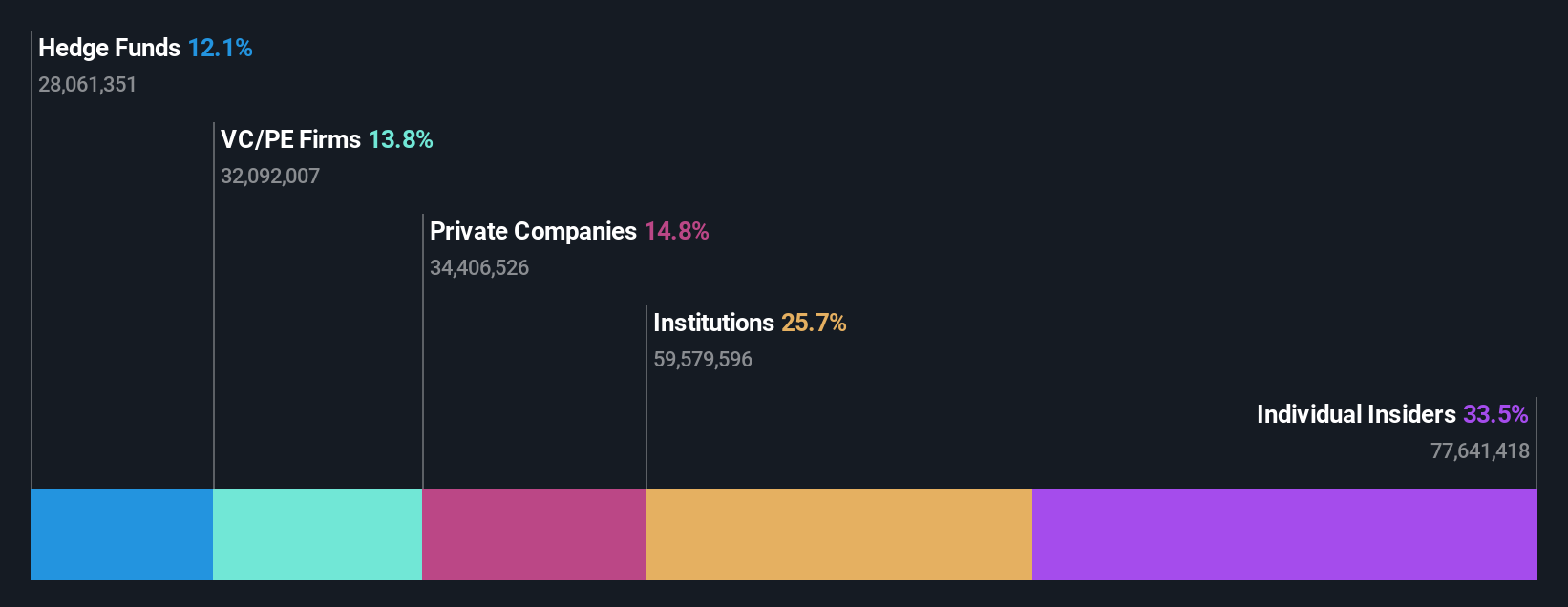

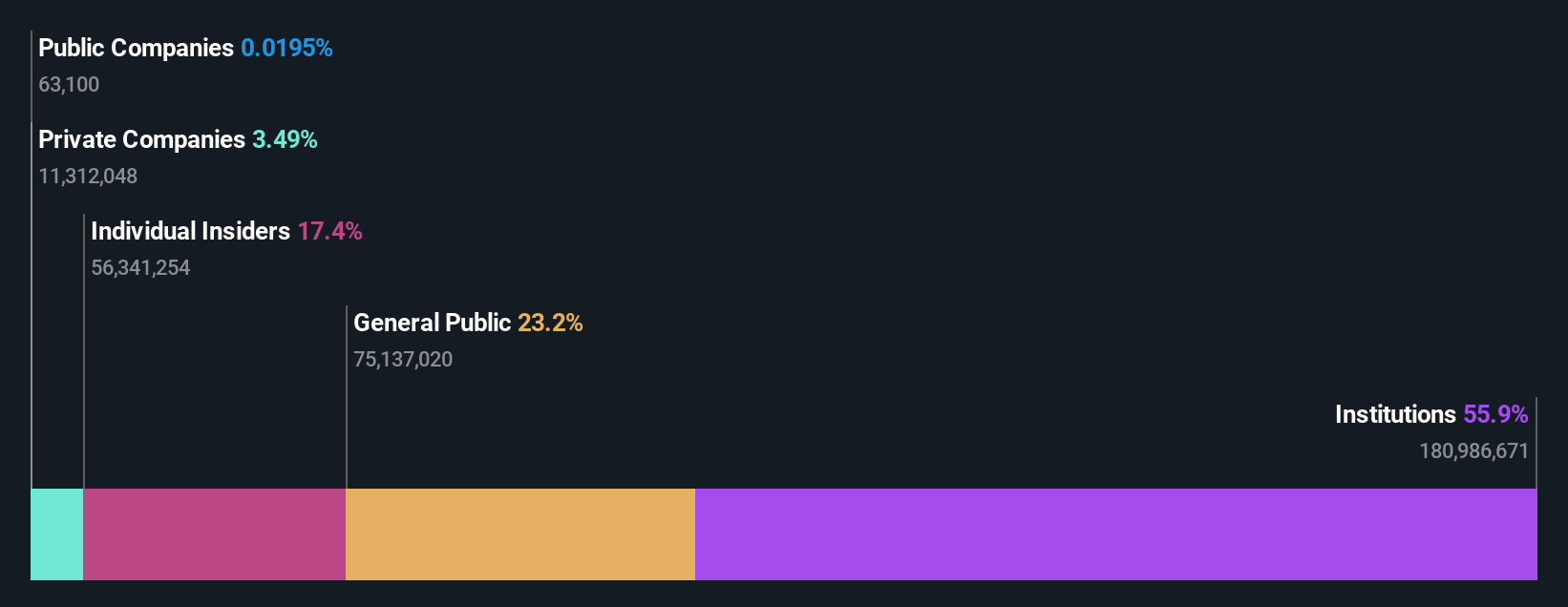

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $3.35 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating $373.07 million.

Insider Ownership: 33%

Earnings Growth Forecast: 86.8% p.a.

AvePoint, a growth company with substantial insider ownership, is navigating a dynamic market landscape. Despite recent insider selling, the company's revenue is expected to grow faster than the US market at 17.3% annually. Recent earnings reports showed significant improvement, with net income rising to US$2.7 million from a previous loss. The revamped Global Partner Program aims to enhance partner engagement and profitability by focusing on data security and governance solutions in an expanding IT services market surpassing US$600 billion.

- Click to explore a detailed breakdown of our findings in AvePoint's earnings growth report.

- In light of our recent valuation report, it seems possible that AvePoint is trading beyond its estimated value.

Frontier Group Holdings (ULCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market cap of $1.11 billion.

Operations: The company's revenue is primarily derived from providing air transportation services for passengers, totaling $3.78 billion.

Insider Ownership: 32.8%

Earnings Growth Forecast: 97.4% p.a.

Frontier Group Holdings is experiencing growth challenges despite being added to multiple Russell indices, which may enhance its market visibility. The company reported a net loss of US$70 million in Q2 2025, contrasting with a previous net income of US$31 million. Forecasts indicate revenue growth at 9.5% annually, slightly above the US market average, and profitability is expected within three years. Insider transactions show more buying than selling recently but not in substantial volumes.

- Navigate through the intricacies of Frontier Group Holdings with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Frontier Group Holdings shares in the market.

On Holding (ONON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: On Holding AG is involved in the development and distribution of sports products globally, with a market cap of $14.75 billion.

Operations: The company generates revenue primarily from its athletic footwear segment, which amounts to CHF 2.72 billion.

Insider Ownership: 17.2%

Earnings Growth Forecast: 34.7% p.a.

On Holding is experiencing robust growth, with earnings projected to rise significantly at 34.7% annually, outpacing the US market. Despite a recent net loss of CHF 40.9 million in Q2 2025, sales surged to CHF 749.2 million from CHF 567.7 million year-over-year. The company raised its earnings guidance for 2025 and expects net sales to reach at least CHF 2.91 billion. Inclusion in multiple Russell indices could enhance its visibility among investors.

- Unlock comprehensive insights into our analysis of On Holding stock in this growth report.

- Our valuation report here indicates On Holding may be overvalued.

Where To Now?

- Investigate our full lineup of 197 Fast Growing US Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English