ExxonMobil's Structural Cost Savings Drive Market Leadership

Exxon Mobil Corporation XOM has set the industry standard for aggressive, long-term structural cost discipline, cementing its competitive edge as the energy landscape undergoes rapid change. In the second quarter of 2025, XOM confirmed cumulative structural cost savings of $13.5 billion since 2019, with clear execution on operational efficiencies, workforce streamlining, and digital transformation. The company is now targeting $18 billion in total structural savings by 2030. This relentless focus allows ExxonMobil to sustain high levels of investment, deliver robust shareholder distributions, and remain resilient — even amid periods of lower commodity prices.

BP & TTE Accelerate Cost Reductions Too

Like XOM, BP plc BP and TotalEnergies TTE are doubling down on multi-year cost transformation strategies.

Cost reductions are a pillar of BP’s turnaround. As of the first half of 2025, BP delivered $0.9 billion in fresh structural cost savings, bringing its cumulative total since 2023 to $1.7 billion. The company is on pace to reach its target of $4-$5 billion cuts by 2027-end. BP’s second-quarter report emphasized a tighter grip on spending, a holistic review of the business, and digitally driven process efficiencies — all strategic levers to improve profitability and strengthen investor confidence.

TotalEnergies' latest results highlighted ongoing “strict cost discipline” and recurring operational improvements across all business segments. Even as benchmark oil prices dropped 10%, TTE managed to keep cash flow nearly steady, attributing this to efficiency measures, supply-chain optimization and asset replacement strategies. TTE does not disclose a cumulative cost-out figure, but persistent quarterly cost controls are credited with supporting earnings resilience and funding growth.

XOM’s Price Performance, Valuation & Estimates

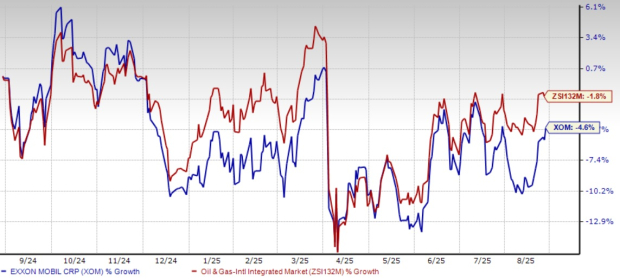

Shares of XOM have declined 4.6% over the past year against 1.8% decline of the industry.

Image Source: Zacks Investment Research

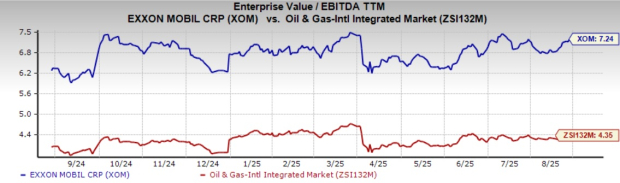

From a valuation standpoint, XOM trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 7.24X. This is above the broader industry average of 4.35X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for XOM’s 2025 earnings has been revised upward over the past 30 days.

Image Source: Zacks Investment Research

ExxonMobil stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

TotalEnergies SE Sponsored ADR (TTE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English