INO Stock Soars as FDA Backs Rolling BLA for Rare Lung Disease Drug

Shares of Inovio Pharmaceuticals INO jumped 20.6% on Wednesday after the FDA agreed to the company’s rolling submission timeline for the biologics license application (BLA) seeking approval for INO-3107 in adult patients with recurrent respiratory papillomatosis (RRP). Inovio expects to finalize the submission in the coming months and plans to seek priority review, aiming for the FDA’s acceptance of the filing by the end of 2025.

A filing accepted under the regulatory body’s Priority Review pathway reduces the review period to six months from the standard 10 months. This status is awarded to marketing applications for medicines intended to treat serious conditions and that, if approved, would offer a substantial improvement in safety, effectiveness, prevention, or diagnosis of such conditions. Commercial preparations are currently underway for a potential 2026 launch of INO-3107, pending FDA approval.

A rare disease, RRP causes benign tumors (called papillomas) to grow in the respiratory tract, most commonly in the larynx (voice box). It is caused by two types of human papillomavirus (HPV) – HPV 6 and HPV 11. INO-3107 is Inovio’s investigational DNA medicine candidate designed to elicit a targeted T cell response against HPV-6 and HPV-11. It is designed to target and cure the infection to potentially prevent or slow down the growth of new papillomas. The candidate enjoys the breakthrough therapy and orphan drug designations in the United States for the RRP indication.

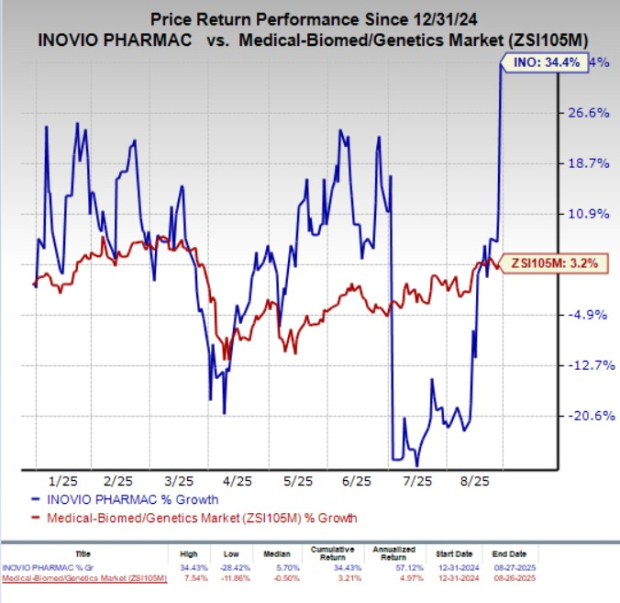

Year to date, Inovio shares soared 34.4% compared with the industry’s 3.2% growth.

Image Source: Zacks Investment Research

Basis for INO’s RRP Drug Rolling BLA Submission

Inovio’s plans for the BLA filing seeking the approval of INO-3107 are supported by data from its completed phase I/II study evaluating the candidate’s safety, tolerability, immunogenicity and efficacy in patients with HPV-6 and/or HPV-11-related RRP. The study met its efficacy endpoint. Based on the encouraging results from the early to mid-stage RRP study, the FDA had earlier advised Inovio against a pivotal phase III study for INO-3107 to treat RRP, stating that the completed study has the potential to support a BLA filing under the accelerated approval program.

Inovio, however, is also gearing up to initiate a confirmatory study of INO-3107 for RRP, which will enroll 100 patients across the United States.

Other Players in the RRP Space

Earlier this month, Precigen, Inc. PGEN secured the FDA approval for Papzimeos (zopapogene imadenovec-drba) for the treatment of adults with RRP. The drug, developed using Precigen’s proprietary AdenoVerse platform, is a non-replicating adenoviral vector immunotherapy engineered to address the primary drivers of RRP. The gene therapy is administered through four subcutaneous injections given over 12 weeks. Like Inovio’s INO-3107, Papzimeos also enjoys the FDA’s breakthrough therapy and orphan drug designation for the RRP indication.

In December 2024, Precigen completed submission of the rolling BLA for Papzimeos to treat RRP, under the FDA’s accelerated approval pathway. In mid-August, the FDA granted full approval to the gene therapy based on the data from a pivotal phase I/II study that evaluated Papzimeos for the treatment of adult patients with RRP. The study met its primary safety and pre-specified primary efficacy endpoints. A full approval means that Precigen will not have to conduct a confirmatory study of Papzimeos for the RRP indication.

INO’s Zacks Rank & Other Stocks to Consider

Inovio currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the biotech sector are CorMedix CRMD and Kiniksa Pharmaceuticals KNSA, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s earnings per share have increased from 93 cents to $1.22 for 2025. During the same time, earnings per share estimates for 2026 have increased from $1.64 to $2.12. Year to date, shares of CRMD have surged 74.6%.

CorMedix’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 34.85%.

In the past 60 days, estimates for Kiniksa Pharmaceuticals’ 2025 earnings per share have increased from 74 cents to $1.03. Earnings per share estimates for 2026 have increased from $1.19 to $1.60 during the same period. KNSA stock has surged 70.4% year to date.

Kiniksa Pharmaceuticals’ earnings beat estimates in two of the trailing four reported quarters and missed on the remaining two occasions, delivering an average negative surprise of 330.56%.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Inovio Pharmaceuticals, Inc. (INO): Free Stock Analysis Report

CorMedix Inc (CRMD): Free Stock Analysis Report

Kiniksa Pharmaceuticals International, plc (KNSA): Free Stock Analysis Report

Precigen, Inc. (PGEN): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English