Can Ongoing Debt Reduction Boost the Prospects of Occidental Stock?

Occidental Petroleum Corporation OXY has made notable progress in reducing its debt load, a priority since the 2019 Anadarko acquisition. Leveraging robust free cash flow and proceeds from asset sales, the company has repaid significant near and medium-term maturities, improving its financial health. Over the past 13 months alone, Occidental has reduced debt by $7.5 billion, cutting annual interest expenses by $410 million. This disciplined deleveraging not only enhances balance sheet strength but also bolsters financial flexibility.

A leaner capital structure allows Occidental to better withstand commodity price swings while redirecting more capital toward high-return projects. The ongoing debt reduction also builds investors’ confidence, making the company more appealing in both equity and debt markets. Lower borrowing costs directly support profitability and cash flow, which ultimately benefit its shareholders through stronger returns.

Management continues to reinforce this strategy with targeted divestitures, including an announced $950 million sale of non-core assets following the first quarter of 2025. Proceeds will further reduce obligations, lowering capital servicing costs and strengthening Occidental’s long-term financial foundation.

With the debt profile improving, Occidental is well-positioned to pursue growth opportunities across its core Permian Basin operations, expand in chemicals and midstream, and invest in low-carbon initiatives such as carbon capture. This ongoing financial discipline supports resilience, competitive strength and the potential for enhanced shareholder value over the coming years.

Debt Reduction Boosting Financial Flexibility

For oil and gas companies, debt reduction enhances financial flexibility, lowers interest expenses and strengthens balance sheets. This allows them to better navigate commodity price volatility, reinvest in high-return projects and improve shareholder returns, while positioning for sustainable long-term growth and competitiveness.

BP Plc. BP and ConocoPhillips COP have reaped clear benefits from reducing debt, lowering interest expenses and strengthening cash flow stability. With leaner balance sheets, both companies enhanced resilience to price fluctuations, expanded capital allocation toward growth projects and improved shareholder value through dividends and buybacks, reinforcing long-term financial sustainability.

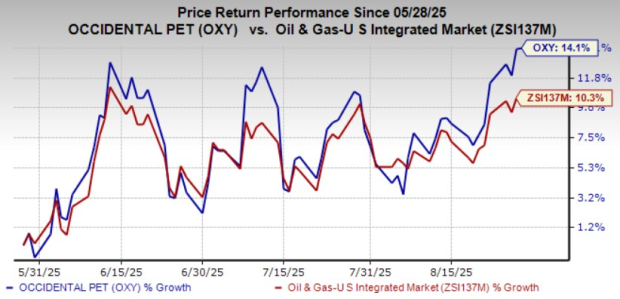

OXY’s Price Performance

Occidental’s shares have gained 14.1% in the past three months against the Zacks Oil and Gas-Integrated-United States industry’s rally of 10.3%.

Image Source: Zacks Investment Research

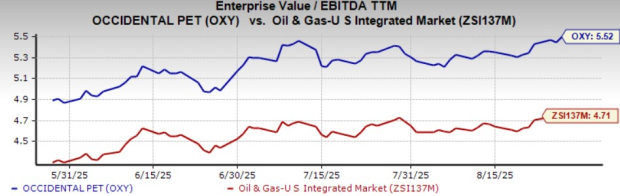

OXY’s Shares Are Trading at a Premium

Occidental’s shares are currently expensive on a relative basis, with its current trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA TTM) being 5.52X compared with the industry average of 4.71X.

Image Source: Zacks Investment Research

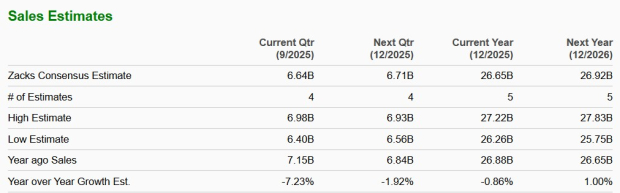

Mixed Sales Estimate Movement

The Zacks Consensus Estimate for Occidental’s 2025 sales estimate indicates a year-over-year decline of 0.86%, while the 2026 estimate implies an increase of 1%.

Image Source: Zacks Investment Research

OXY’s Zacks Rank

Occidental currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Occidental Petroleum Corporation (OXY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English