Quanta Services (PWR) Declares US$0.10 Quarterly Dividend as Share Price Stays Flat

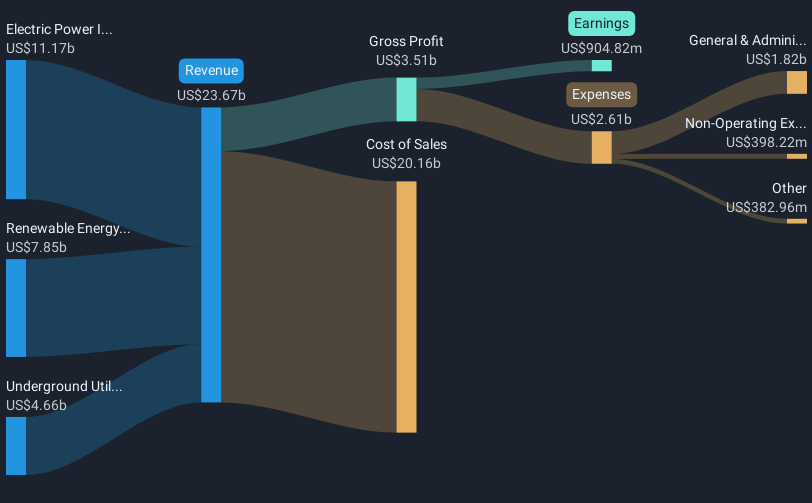

Quanta Services (PWR) has demonstrated its commitment to shareholder value by announcing a quarterly cash dividend, reaffirmed on August 28, 2025, against a backdrop of strong Q2 earnings reported on July 31, 2025. Over the last quarter, the company saw a 11.38% increase in its share price. This movement aligns with broader market trends, where major indexes also recorded gains amid robust earnings across various sectors. Meanwhile, Quanta's strategic debt financing moves further bolster its financial position, potentially enhancing investor confidence. Overall, these factors collectively contributed to Quanta's positive performance within a buoyant market.

We've spotted 1 risk for Quanta Services you should be aware of.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

The recent reaffirmation of Quanta Services' quarterly dividend amidst robust Q2 earnings underlines its ongoing commitment to enhancing shareholder value. This decision holds potential ripple effects on future revenue and earnings forecasts, as it signals robust financial health and instills investor confidence. The company's strategic debt financing could further strengthen its financial standing, potentially allowing for reinvestments that support continuous growth in key areas like grid modernization and renewables.

Over a period of five years, Quanta Services achieved a very large total return, including dividends, which provides a compelling context for its longer-term investment appeal. This performance significantly surpasses typical market returns, showcasing Quanta's substantial growth capabilities. Over the past year, however, the company's share price has been outperformed by the US Construction industry, which saw greater gains. This contrast may highlight short-term challenges or opportunities within the industry-specific context.

In the context of the share price at US$381.56, compared to the consensus price target of US$421.88, Quanta's current valuation may imply potential for future gains, although the discount is relatively modest. This reflects analyst confidence in its growth trajectory, backed by anticipated revenue and earnings expansion derived from robust demand in infrastructure solutions. Investors may want to closely monitor how these strategic directions impact Quanta’s financial outcomes and align with targets over the forthcoming periods.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English