Viasat Options Activity Surged Wednesday, but These 2 Trades With 143-Day DTEs Look More Attractive

Viasat (VSAT) had a busy day in the options market on Wednesday. Its options volume on the day was 109,914, 11 times its 30-day average. At the same time, its Jan. 16/2026 $35 call had the highest Vol/OI (volume-to-open-interest) ratio at 343.19, more than double that of the second-highest.

I don’t know the last time the provider of global communications solutions had a Vol/OI ratio over 100,000. I went back 24 months, and the second-highest daily volume was 39,655, on Aug. 6. Eight of Viasat’s 10 highest daily volumes for options have come in 2025.

Not surprisingly, Viasat’s shares are up 281% in 2025. Options volumes perk up when stocks make big moves in either direction. Unfortunately, for shareholders holding VSAT since August 2023, they’re back to breakeven despite this year’s big move.

In fiscal 2022 (March year-end), Viasat had retained earnings of $233.5 million on its balance sheet. By fiscal 2025, the surplus had turned to a deficit of $325.5 million. If not for the sale of assets from its Link-16 Tactical Data Links business (the Link-16 TDL Business) for nearly $2 billion in cash, its deficit would be considerably higher.

The lack of profitability explains the poor performance of its stock before 2025. While it’s tempting to bet on Viasat options, I’ve identified three alternatives that expire in 143 days that make better long-term investments.

Duolingo (DUOL)

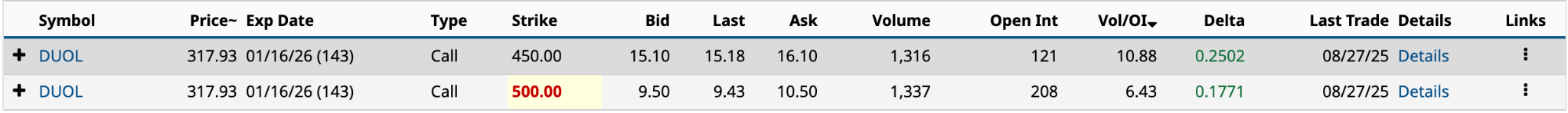

Duolingo (DUOL) had two unusually active options yesterday, expiring on Jan. 16/2026.

The $450 call has a profit probability of 15.99% and the $500 call’s profit probability is 11.27%. Both have a low probability of trading at or above breakeven. To do so would require gains of 46.6% and 60.2%, respectively, over the next 143 days. That isn’t happening.

However, consider two things before discarding my suggestion.

First, Duolingo is operating at a highly efficient level. Despite losing 42% since hitting a 52-week high of $544.93 on May 14, the company continues to grow its top and bottom lines.

On Aug. 6, it reported second-quarter revenues of $252.3 million, nearly 5% higher than Wall Street expectations, with $0.91, 33 cents higher than the consensus. More importantly, it raised its guidance for 2025. On the top line, it now expects annual revenue of $1.015 billion, up from $991.5 million previously.

On the bottom line, it expects adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) of $291.8 million at the midpoint of its guidance, representing a 52% increase from $191.9 million a year earlier.

It continues to grow both its monthly active users and paid subscribers. As long as it continues to do that, it will be fine.

Secondly, the share price only has to appreciate by $65.35 (20.2%) to double your money for the $450 call and $59.29 (18.6%) for the $500 call. The expected move, up or down, between now and Jan. 16 is 26.34%. It’s more than doable.

With a leverage ratio of between 95% and 97%, it presents a reasonable risk-reward proposition.

Tractor Supply (TSCO)

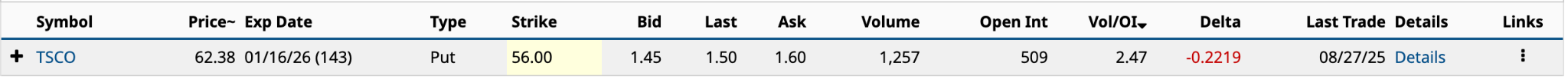

The rural lifestyle specialty retailer had one unusually active option yesterday. Although its Vol/OI ratio was nothing to write home about at 2.47, it’s a business I continue to like in the retail space.

I can’t remember the first time I wrote about the Tennessee-based business. It’s probably more than a decade ago.

I first noticed Tractor Supply (TSCO) because there was a retailer in Ontario where I used to live called TSC Stores. It had an identical logo, but only operated in Canada. TSC Stores was the Canadian operations of Tractor Supply until 1979, when its U.S. parent spun it off. TSC stores were acquired by Peavey Industries in 2017 and fully rebranded to Peavey Mart in 2021. Peavey Industries filed for creditor protection in January. But I digress.

What attracted me to Tractor Supply was its niche focus on customers who were neither full-time, large-scale farmers nor city slickers, but rather those individuals who like to spend their weekends and after-work hours tending to their acreage.

It delivered a breadth of products that you couldn’t get all in one place, providing convenience at reasonable prices. From what I can see on Reddit, some of that has disappeared. Living in Canada, I can’t physically confirm this, but it’s interesting to note.

Despite the headwinds facing Tractor Supply, its stock hit an all-time high of $63.99 on July 1. Its shares are up 16.4% year-to-date and 110.5% over the past five years, 30% higher than the S&P 500.

Analysts are mixed about its stock. There are 31 covering TSCO. Of those, 16 rate it a Buy (3.94 out of 5), with a target price of $63.28, which is slightly higher than its current share price. According to S&P Global Market Intelligence, Tractor Supply is expected to earn $2.10 a share in 2025 and $2.24 in 2026. It trades at x times the 2026 estimate. It trades at 27.6 times the 2026 estimate. That’s at the high end over the past decade.

While I definitely see some valuation concerns, Tractor Supply continues to dominate in this niche category. It will continue to do so until Walmart (WMT) or Home Depot (HD) decides that they want it instead.

Meanwhile, the Jan. 16/2026 $56 put from yesterday is a good way for options investors who like the stock to generate income while waiting for a better entry point.

The bid price of $1.45 is an annualized return of 6.9% [($1.45 bid price / $56 strike price - $1.45) * 365 / 143]. It’s not a huge income given the 143-day DTE, but the share price has to fall to $54.55 before you’re out of pocket. The odds of its share price trading above $54.55 by expiration are about 76%. That’s relatively high.

At worst, you buy $100 worth of TSCO stock at $54.55. The expected move between now and January, up or down, is 11.06%, indicating that the share price will still be higher than the breakeven point.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English