As Canada Goose Goes on Sale, Should You Buy, Sell, or Hold GOOS Stock Here?

Canada Goose (GOOS) shares surged over 16% on Wednesday following reports that controlling shareholder Bain Capital is exploring a sale that could take the luxury outerwear company private. Multiple bidders are circling the winter apparel maker, offering approximately $1.35 billion based on 8x trailing EBITDA.

Private equity firms Boyu Capital and Advent International have submitted verbal offers, while other interested parties include China's Bosideng International and a consortium of Anta Sports Products with FountainVest Capital.

The takeover interest comes despite Canada Goose's mixed recent performance. It posted a larger-than-expected quarterly loss in July, with operating losses widening to $158.7 million from $96.9 million year-over-year (YoY), despite revenue growing 20% to $107.8 million. Higher costs from retail expansion and promotional campaigns pressured profitability.

However, Canada Goose has been diversifying beyond its winter-focused roots, launching year-round products including sunglasses, sweaters, and footwear to extend its selling season. The company also benefits from tariff exemptions, as 75% of its products are manufactured domestically under the U.S.-Mexico-Canada Agreement (USMCA).

Is Canada Goose Stock a Good Buy Right Now?

In fiscal Q1 2026, Canada Goose reported revenue of $108 million, a 22% YoY increase, driven by impressive direct-to-consumer performance with 15% comparable sales growth, marking seven consecutive months of positive comps.

CEO Dani Reiss emphasized the importance of expanding product offerings for year-round relevance, with apparel becoming the fastest-growing category. New styles like the Emerson T-shirt topped bestseller lists, while the bold Spring-Summer campaign successfully challenged perceptions that Canada Goose is only a winter brand. The Snow Goose collaboration with designer Haider Ackermann generated significant brand heat and cultural relevance.

Operationally, Canada Goose shows improving fundamentals. Inventory declined 9% YoY, marking the seventh consecutive quarter of reductions, while inventory turnover improved to 0.9x from 0.8x. Net debt decreased to $542 million from $766 million, reflecting stronger cash generation and tighter inventory management.

Regional performance was robust, with North America and APAC both posting 27% revenue growth. China delivered strong results through enhanced e-commerce capabilities, including the success of Douyin livestreaming. Even EMEA's slight decline reflected planned wholesale timing rather than operational weakness.

The company's tariff protection remains intact, with 75% of products manufactured in Canada under USMCA exemptions. Management invested heavily in marketing and store operations, resulting in improved conversion rates across all regions.

While takeover interest creates near-term volatility, Canada Goose's underlying business transformation appears sustainable, suggesting it has successfully evolved beyond seasonal dependency into a year-round luxury lifestyle brand with strong growth prospects.

For investors, the situation presents a classic takeover scenario. With shares trading around the reported bid levels and Bain holding off for potentially higher offers, current shareholders face limited upside unless a bidding war emerges.

The 41% year-to-date (YTD) gain already reflects much of the premium, making this a hold-or-sell situation rather than a compelling buy opportunity.

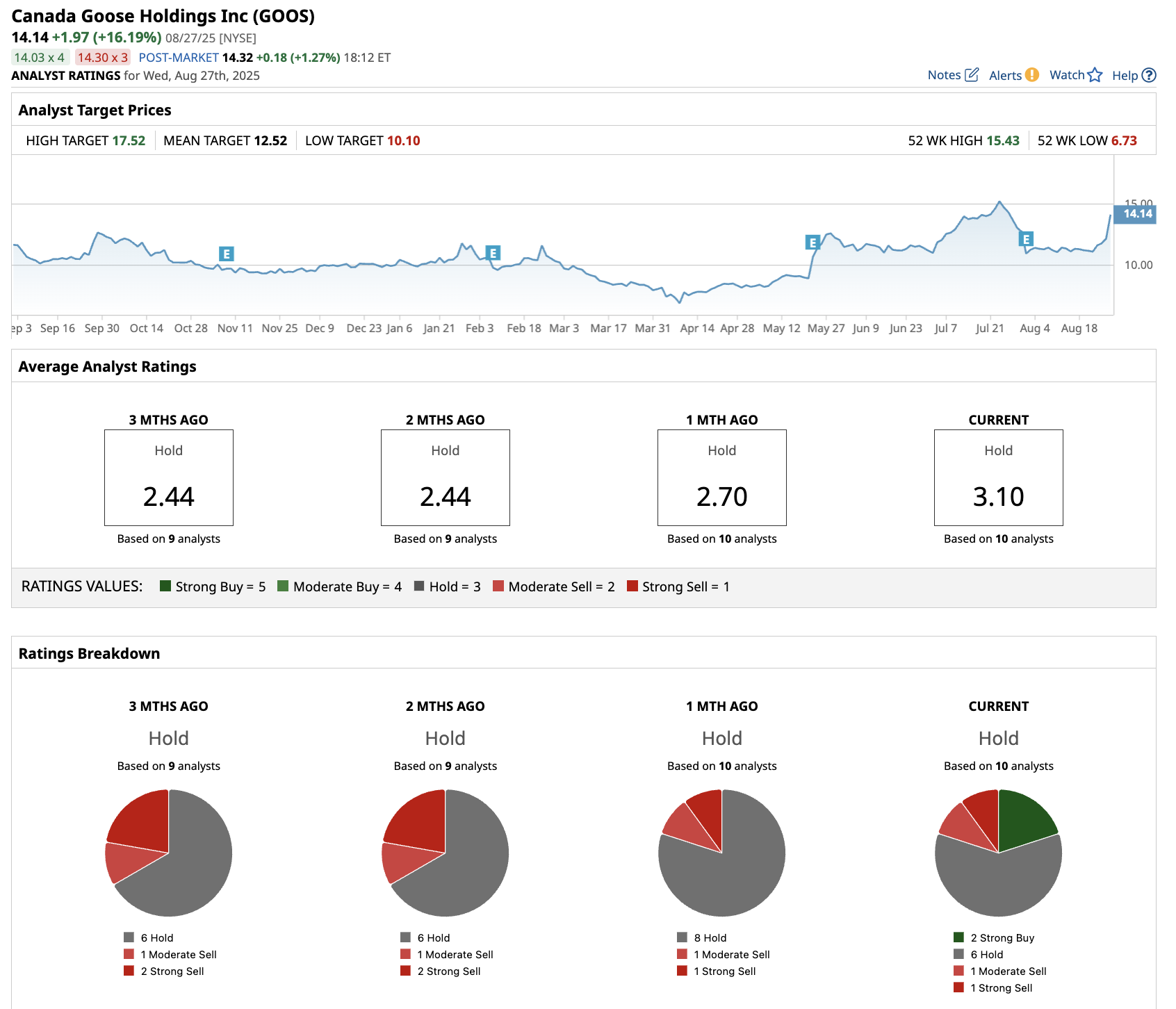

What Is the Target Price for GOOS Stock?

Analysts tracking GOOS stock forecast revenue to increase from $1.35 billion in fiscal 2025 (ended in March) to $1.49 billion in fiscal 2027. However, in this period, its free cash flow is forecast to narrow from $275 million to $84.4 million.

Out of the 10 analysts covering GOOS stock, two recommend “Strong Buy,” six recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average Canada Goose stock price target is $12.52, which is below the current price of $14.14.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English